Factoring Agreement Draft Withdrawal In Pennsylvania

Description

Form popularity

FAQ

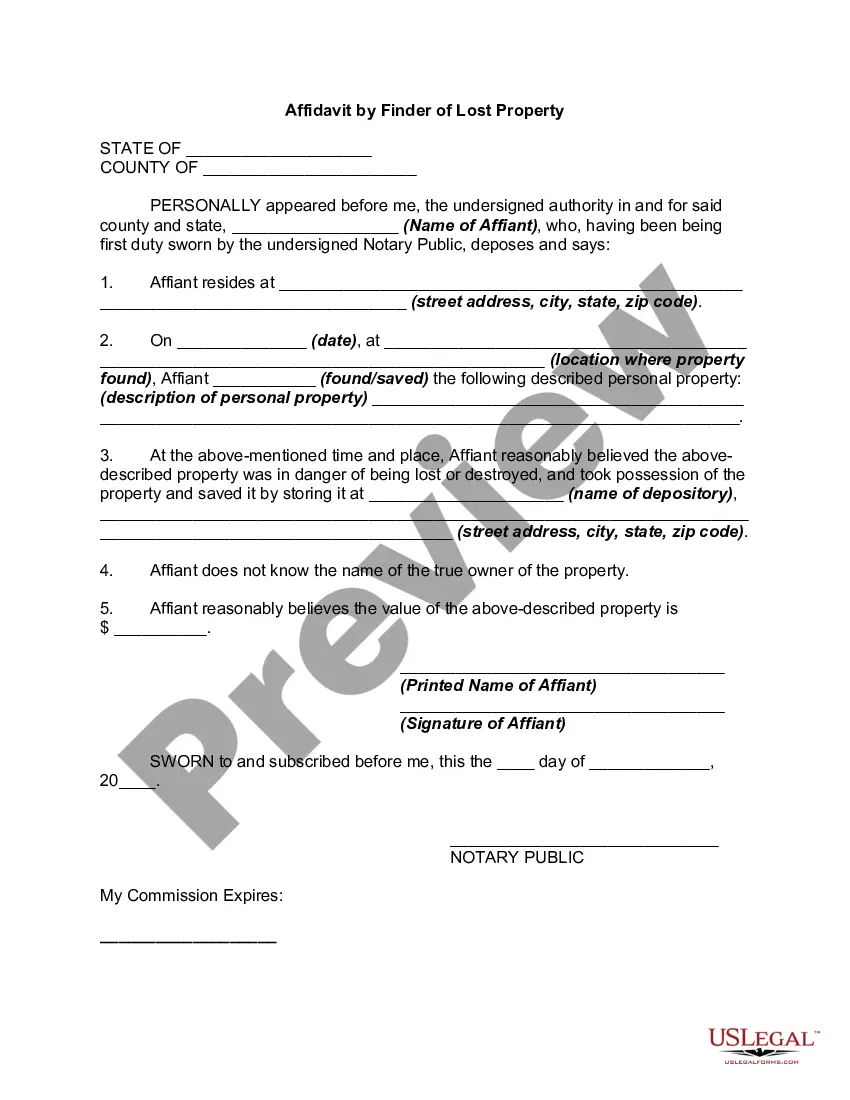

--A fictitious name registration under this chapter may be cancelled, or a party to such a registration may withdraw therefrom, by filing in the department an application for cancellation of fictitious name registration or an application for withdrawal from fictitious name registration, as the case may be, which shall ...

Once you have decided to switch freight factoring companies, you'll need to provide written notice to your current freight factoring company about your intention to terminate the agreement. The required notice period is most commonly 60 days, but some companies require more.

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

To cancel a foreign LLC, just submit form L-109, Certificate of Cancellation to the New Jersey Division of Revenue. To withdraw a foreign corporation, file form C-124P, Certificate of Withdrawal with the Division of Revenue.

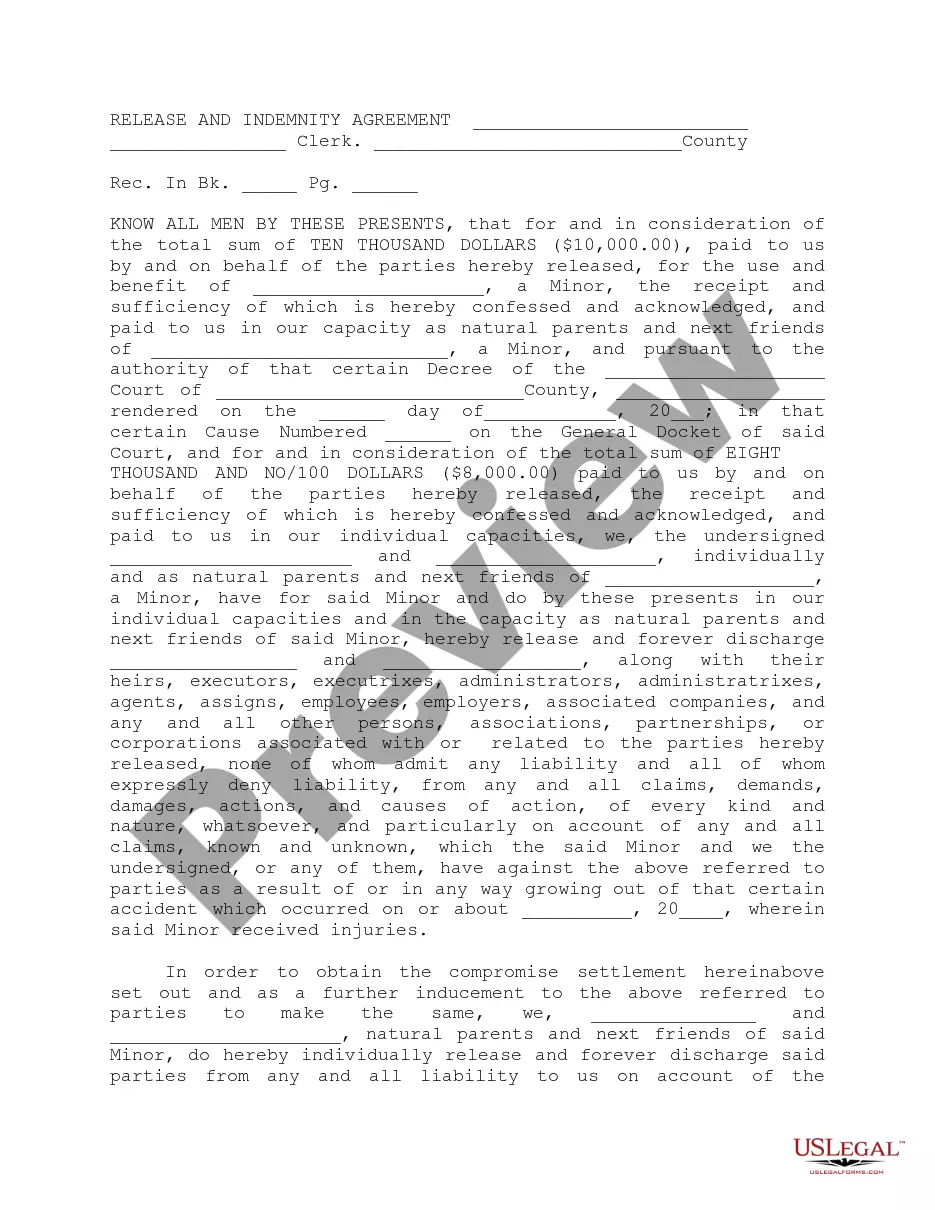

The factoring agreement will also include representations that each factored account is bona fide and represents indebtedness incurred by the customer for goods actually sold and delivered to the customer; that there are no setoffs, offsets, or counterclaims against the account; that the account does not represent a ...

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

This will help you understand your rights and options. Contact the factoring company. Talk to the factoring company directly and explain the situation. Ask them why the release hasn't been issued yet and when you can expect it. Be polite and professional, but be firm in your request. Get everything in writing.

Security Interests and Remedies. The factoring agreement will provide that if an event of default has occurred, then the factor will have the right to foreclose upon and sell the assets in which it has a security interest and apply the proceeds of the sale to the obligations your company owes to the factor.