Factoring Agreement Sample Format In Orange

Description

Form popularity

FAQ

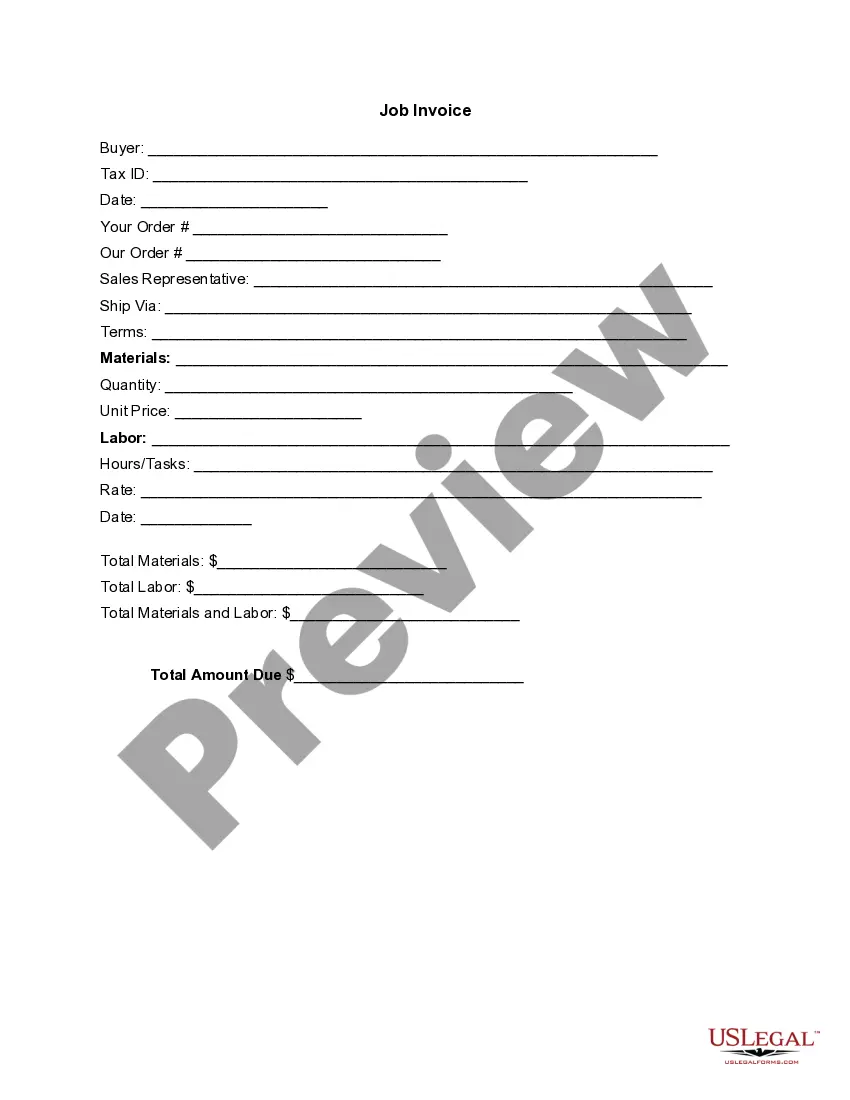

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

A factoring agreement involves three key parties: The business selling its outstanding invoices or accounts receivable. The factor, which is the company providing factoring services. The company's client, responsible for making payments directly to the factor for the invoiced amount.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

How to Start Factoring: The Process Explained Complete the application process. First, you'll get your account setup. Submit invoices to factor. Now you're approved and ready to send your invoices to the factor. The factor collects from your customers. The factor releases the reserve.

Step 1: Group the first two terms together and then the last two terms together. Step 2: Factor out a GCF from each separate binomial. Step 3: Factor out the common binomial. Note that if we multiply our answer out, we do get the original polynomial.

A typical factoring rate ranges from 1% to 5% of the invoice value per month. The exact rate depends on details such as the creditworthiness of the customers, net terms, and the type of rate.

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.