Factoring Agreement Filed With State In Orange

Description

Form popularity

FAQ

Average Factoring Rates and Advances in 2024 Average Factoring Rates in 2024 IndustryFactoring RateAdvance Rate General Small Business 1.95% – 4.5% 85% – 95% Retail & Wholesale 1.95% – 4.5% 80% – 95% Construction 3.0% – 6.0% 70% – 80%5 more rows •

In summary, factoring rates range from 1.15% to 4.5% per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing. In these cases, advances can reach or exceed 90%.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

Primary risks in invoice factoring include potential client defaults, impacting the factor's recovery; high costs due to fees and interest rates; customer relationships strain from third-party involvement; and hidden fees or contractual obligations.

How To Get Out Of Factoring Check your factoring contract. Get some guidance. Identify your problems with factoring. Consider product migration. Plan any product migration. Take over the credit control function. Calculate the residual funding gap. Plan your funding migration.

Factoring Companies Rely on Self-Regulation Similar to most alternative finance institutions, invoice factoring companies in the U.S. are not regulated by a formal government body.

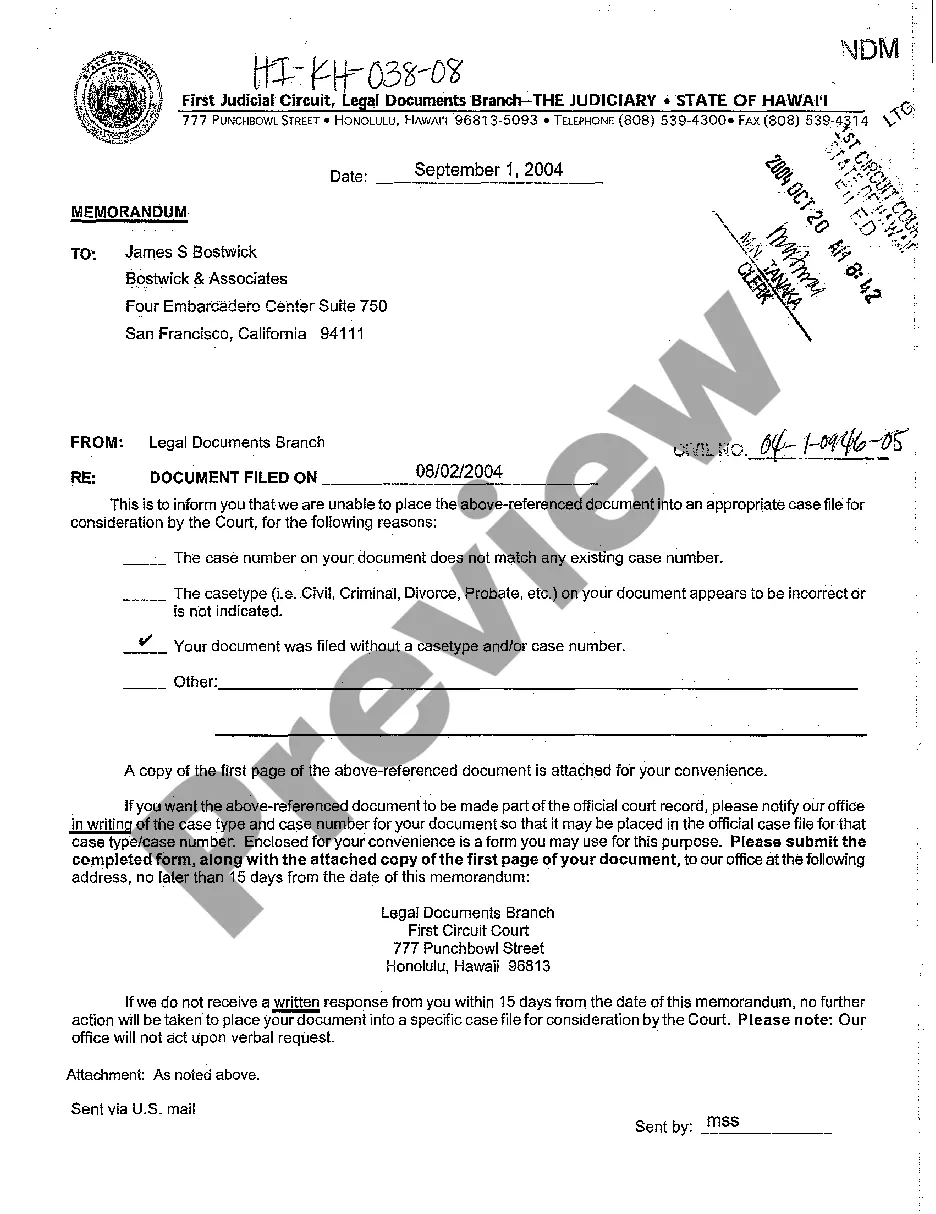

Uniform Commercial Code (UCC) Filing in Factoring Summary UCC filings place liens on a specific asset or blanket liens on all business assets for factoring agreements. The lien reveals the factoring company's claim to assets in the event of default.

4 ways to search for UCC and federal or state tax liens Use a dedicated lien search tool. Search business records at a state Secretary of State office. Look for liens on a state or county recorder's office website. Get a list from the IRS via a Freedom of Information Act request.