Factoring Agreement Filed With Court In Oakland

Description

Form popularity

FAQ

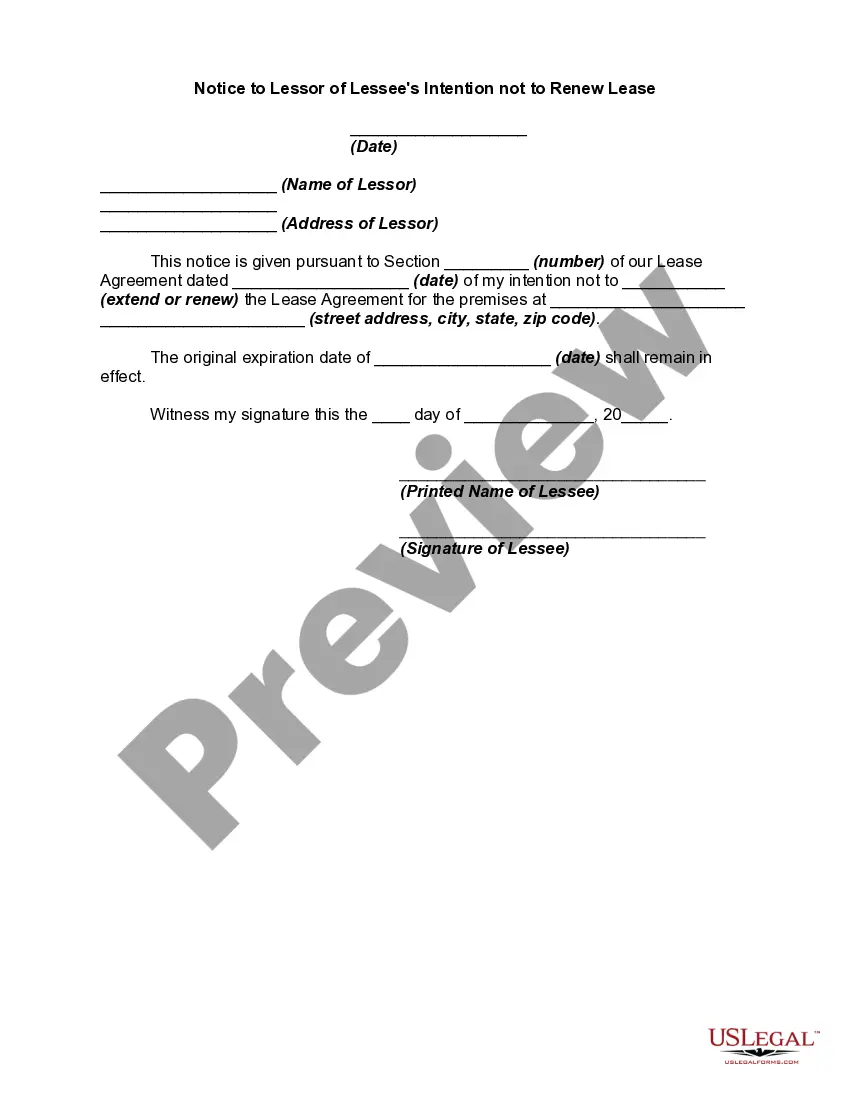

Once you've chosen a new partner, formally notify your current factoring company of your intent to switch. Be sure to prepare for the buyout process by confirming that all outstanding invoices are accounted for and that both companies are aligned on the transition.

How To Get Out Of Factoring Check your factoring contract. Get some guidance. Identify your problems with factoring. Consider product migration. Plan any product migration. Take over the credit control function. Calculate the residual funding gap. Plan your funding migration.

A carrier might refuse a factoring company for a number of reasons. 1) They've been burned by them in some way. 2) They themselves have burned their factoring company lied or tried to invoice fraudulently. 3) They believe that it's a scam.

You need to consider the fees associated with switching before committing to the change. Once you've decided to leave your current factor, you will need to give notice. All factoring companies require written notice to terminate the contract. The expectation is usually 30 – 60 days prior to the renewal date.

Submit Termination Notice & Confirm Buyout Eligibility Date If you plan on waiting to the end of the term, identify when and how to submit your official notice and confirm your eligibility date. Review your current factoring agreement to ensure you are submitting the termination notice correctly.

This is the most common system of international factoring and involves four parties i.e., Exporter, Importer, Export Factor in exporter's country and Import Factor in Importer's country.

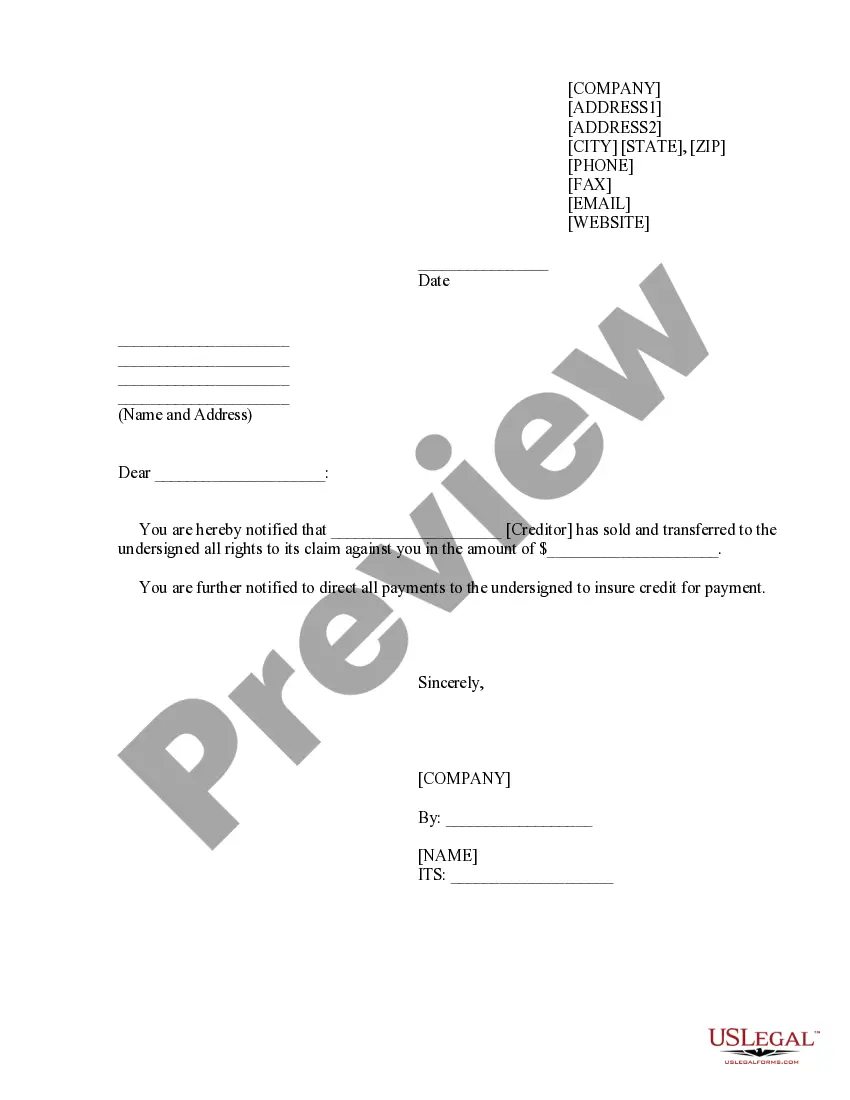

There are three parties directly involved in a transaction involving a factor: The first party is the company selling its accounts receivables. The second party is the factor that purchases the receivables.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

A "complex case" is an action that requires exceptional judicial management to avoid placing unnecessary burdens on the court or the litigants and to expedite the case, keep costs reasonable, and promote effective decision making by the court, the parties, and counsel.

The Superior Court has jurisdiction over misdemeanor and felony criminal charges. Misdemeanors are offenses generally punishable by fine and/or county jail term, and felonies are generally punishable by imprisonment in the State prison and/or fines, or even the death penalty.