Agreement Accounts Receivable For Dummies In New York

Description

Form popularity

FAQ

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

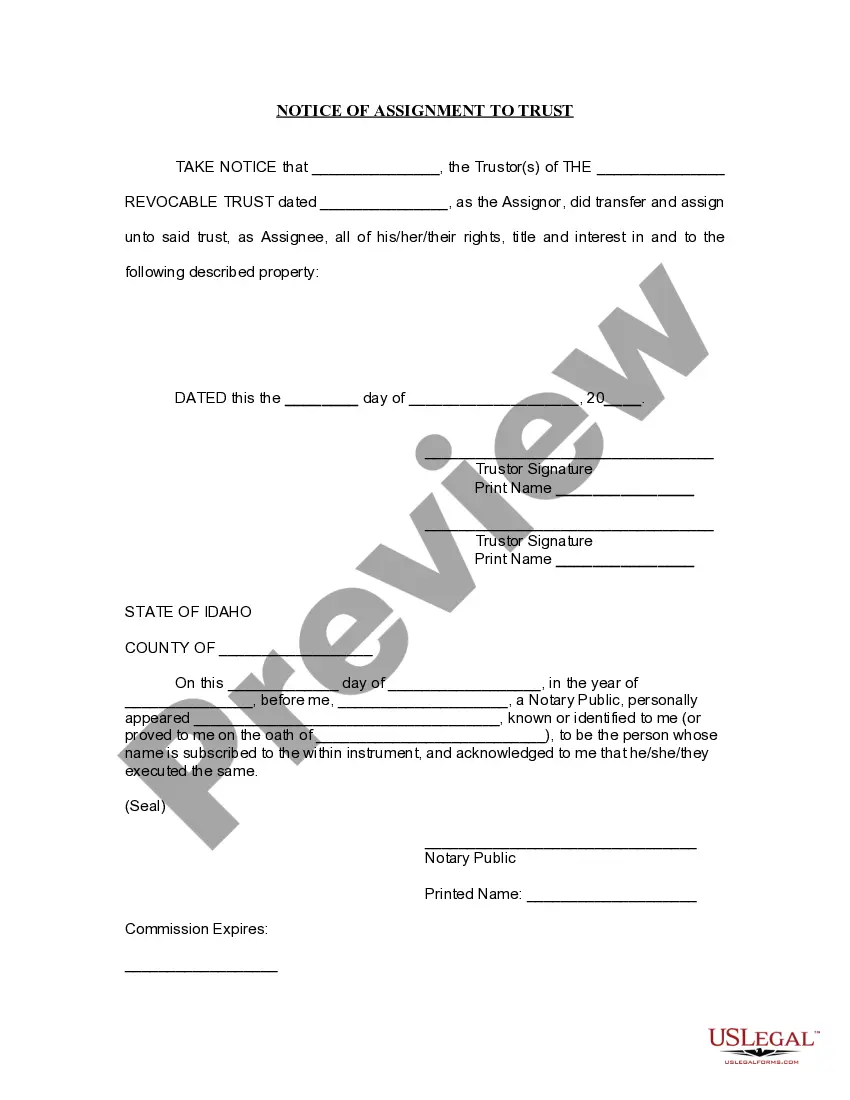

Article 9 of the UCC protects purchasers of accounts receivable by providing a method to record ownership. Recording the sale of the receivable is accomplished by filing a UCC financing statement.

Days Sales Outstanding (DSO) It's calculated by dividing 365 by the receivables turnover ratio. If the turnover ratio is 10, the DSO would be 36.5, indicating that the company has 36.5 days of outstanding receivables.

Average accounts receivables is calculated as the sum of the starting and ending receivables over a set period of time (usually a month, quarter, or year). That number is then divided by 2 to determine an accurate financial ratio.

What is the 10 rule for accounts receivable? The 10 Rule for accounts receivable suggests that businesses should aim to collect at least 10% of their outstanding receivables each month.

The “10% Rule” is a specific guideline used in cross-aging to determine when a portion of a company's accounts receivable should be classified as doubtful or uncollectible.