Agreement General Form Formula In Nevada

Description

Form popularity

FAQ

In Nevada, you must report the change to the Nevada Secretary of State. For more information on the required forms and fees, visit nvsos.

The State of Nevada does not impose a state income tax on individuals or participate in the administration of Federal Income Tax. This means that if you live and work in Nevada, you do not need to file a state income tax return based on your earned income, such as wages or salaries.

Nevada State Tax ID Number Your first step in getting a Nevada state tax ID number is to get your federal tax ID number. Once you have that, you can use our Nevada state tax ID number obtainment services. Fill out our online questionnaire, and you'll receive your Nevada state tax ID number in 4 to 6 weeks.

Good news! Nevada does not have a personal income tax, so that's one tax return you won't need to file. Just use 1040 to file your federal return, and any returns you need to file for states that do have an income tax.

The first-time filing is called the Initial List. Following filings are called Annual Lists. The form is slightly different, but basically it asks for the same information (name of Resident Agent, company name, filing number, filing period, names and addresses of officers, directors or managers/members).

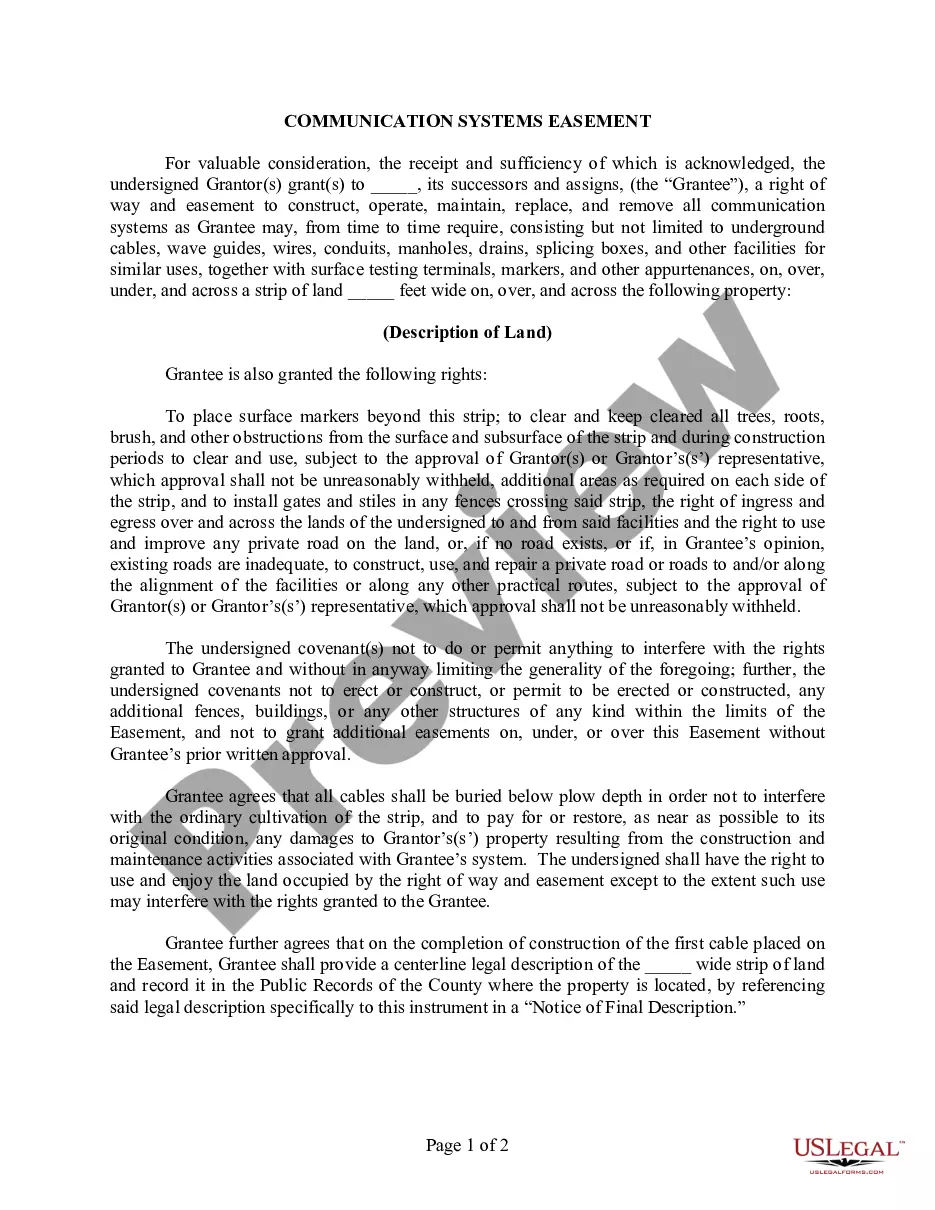

To be enforceable, the contract must be entered into voluntarily, have clearly agreed upon terms and conditions and demonstrate the exchange of “consideration”. Clearly agreed upon terms refers to the idea that everyone understands the nature of the deal being made.

Contracts are made up of three basic parts – an offer, an acceptance and consideration. The offer and acceptance are what the purpose of the agreement is between the parties. A public relations firm offers to provide its services to a potential client.

No. An operating agreement is not required to form a valid LLC in Nevada. An attorney should be consulted to understand the potential implications of operating an LLC without a valid operating agreement. The State Bar of Nevada provides a lawyer referral service, which might be of assistance to you.

When two or more parties agree to do or not to do something, these parties enter a legally binding contract in Nevada. The obligations under the contract are enforceable by mutual understanding—until a dispute arises. Then, the parties go to court, where the Nevada judiciary adjudicates the case.

A contract is an agreement between parties, creating mutual obligations that are enforceable by law. The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.