Factoring Purchase Agreement With Credit Card In Middlesex

Category:

State:

Multi-State

County:

Middlesex

Control #:

US-00037DR

Format:

Word;

Rich Text

Instant download

Description

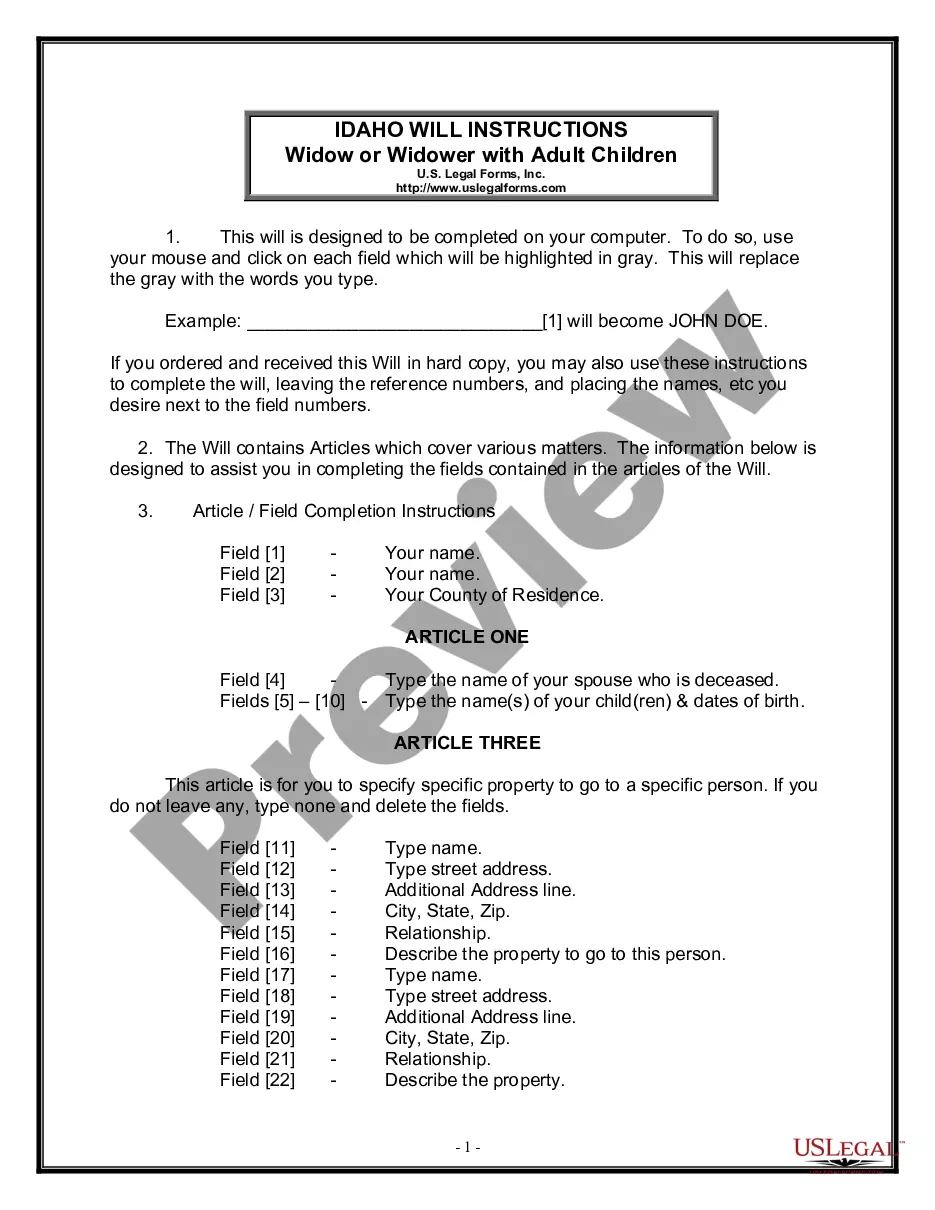

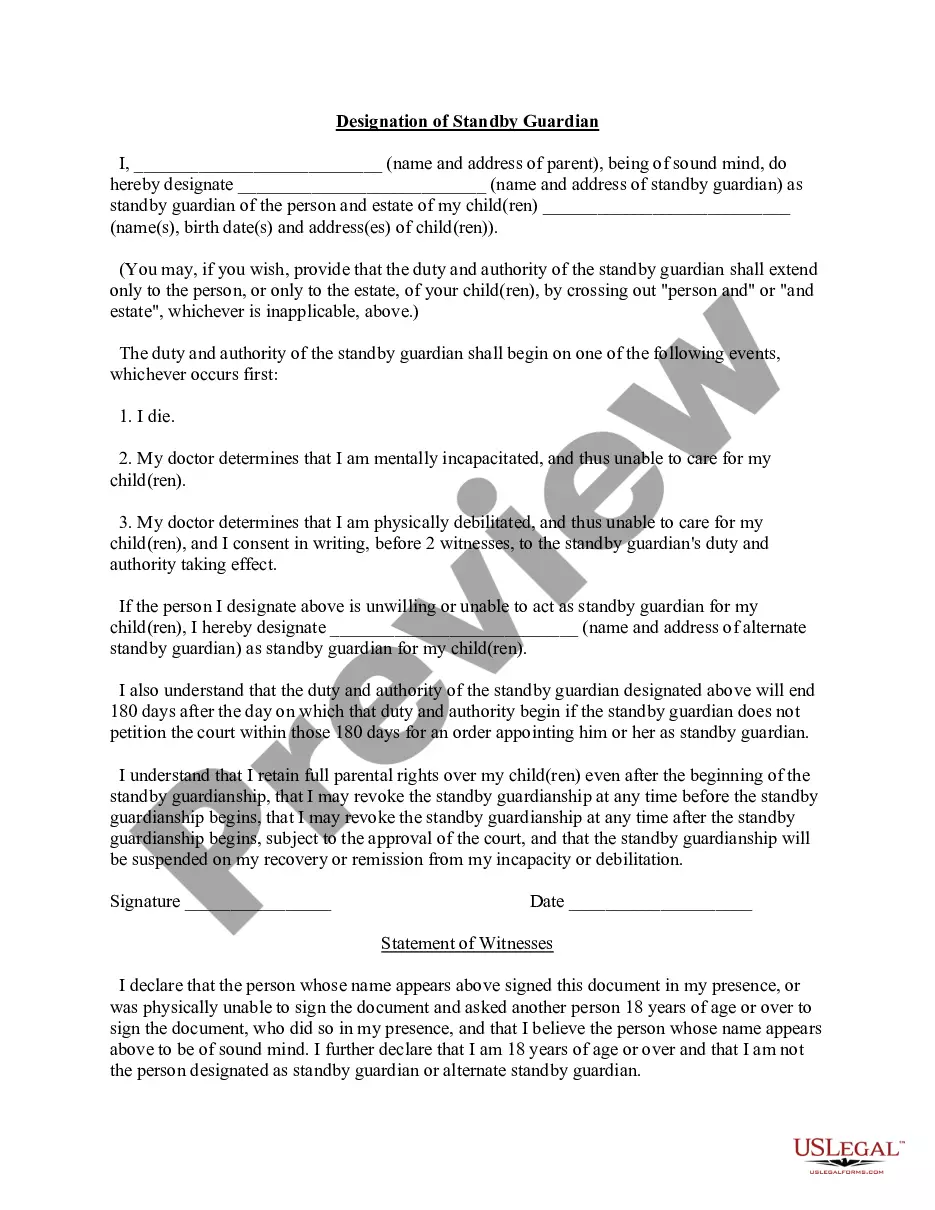

The Factoring Purchase Agreement with Credit Card in Middlesex is a legal document defining the relationship between a Factor and a Seller regarding the purchase of accounts receivable. Key features of this agreement include the assignment of accounts receivable, sales and delivery obligations, credit approvals, and the assumption of credit risks. It outlines the process for the Factor to assume losses, charge fees, and manage receivables, ensuring that all accounts are bona fide obligations. The agreement also includes provisions for warranties, book entries, rights under contracts, and conditions for termination. Filling out this form requires the parties involved to complete specific fields related to their identities and the terms of the sale. Legal professionals such as attorneys, partners, owners, associates, paralegals, and legal assistants will find this form useful for managing client receivables and ensuring compliance with financial regulations. They can leverage the structure of the agreement to safeguard their client's interests while also providing clear guidelines on responsibilities and rights, thereby facilitating smoother financial transactions.

Free preview

Form popularity

FAQ

FACTORING IN A CONTINUING AGREEMENT - It is an arrangement where a financing entity purchases all of the accounts receivable of a certain entity.

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.