Form Assignment Accounts Receivable For Your Business In Michigan

Description

Form popularity

FAQ

You can register for a Michigan seller's permit online through the Michigan Department of Treasury. To apply, you'll need to provide the Michigan Department of Treasury with certain information about your business, including but not limited to: Business name, address, and contact information. Federal EIN number.

The Uniform Commercial Code (UCC) contains rules applying to many types of commercial contracts, including those related to: the sale of goods. the lease of goods. the use of negotiable instruments. banking transactions. letters of credit. documents of title for goods. investment securities, and. secured transactions.

The UCC includes a statute of frauds, which is a state law that generally requires certain contracts to be in writing and signed by the parties in order to be enforceable. The UCC requires contracts to be in writing in these limited situations: Contracts for the sale of goods worth $500 or more.

Professional services that require specialized knowledge or expertise are exempt from Michigan sales tax. These services include but are not limited to: Accounting and bookkeeping services. Legal services.

AN ACT to enact the uniform commercial code, relating to certain commercial transactions in or regarding personal property and contracts and other documents concerning them, including sales, commercial paper, bank deposits and collections, letters of credit, bulk transfers, warehouse receipts, bills of lading, other ...

Created by the National Conference of Commissioners on Uniform State Laws (NCCUSL) and the American Law Institute (ALI), the primary purpose of the UCC is to make business activities consistent and therefore efficient, across all U.S. states.

The UCC applies to the sale of goods and securities, whereas the common law of contracts generally applies to contracts for services, real estate, insurance, intangible assets, and employment.

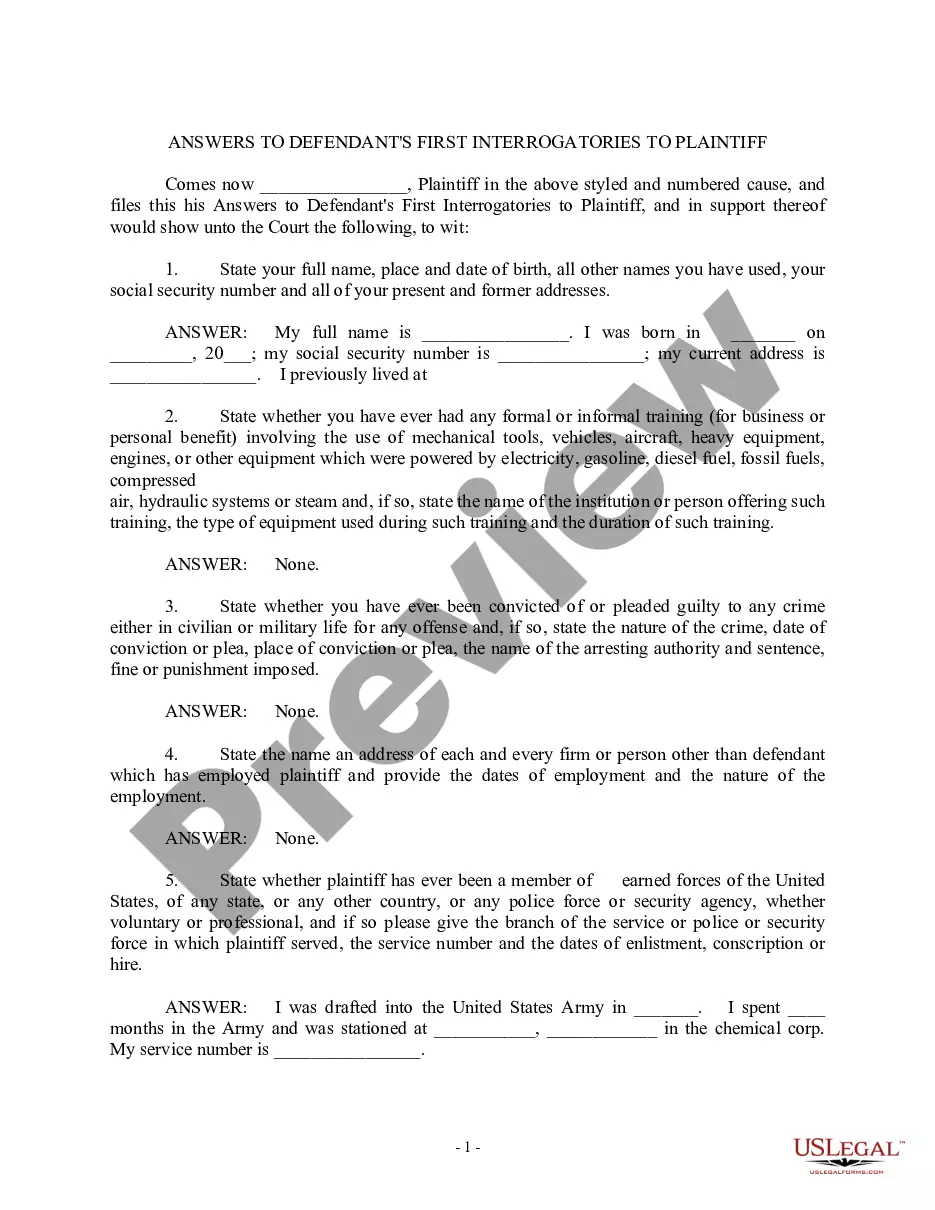

To report accounts receivable, gather information about outstanding amounts owed by customers, create an accounts receivable ledger, categorize the accounts by age, prepare a report that summarizes the outstanding amounts, analyze the report, and take action to collect payments and manage the balance.

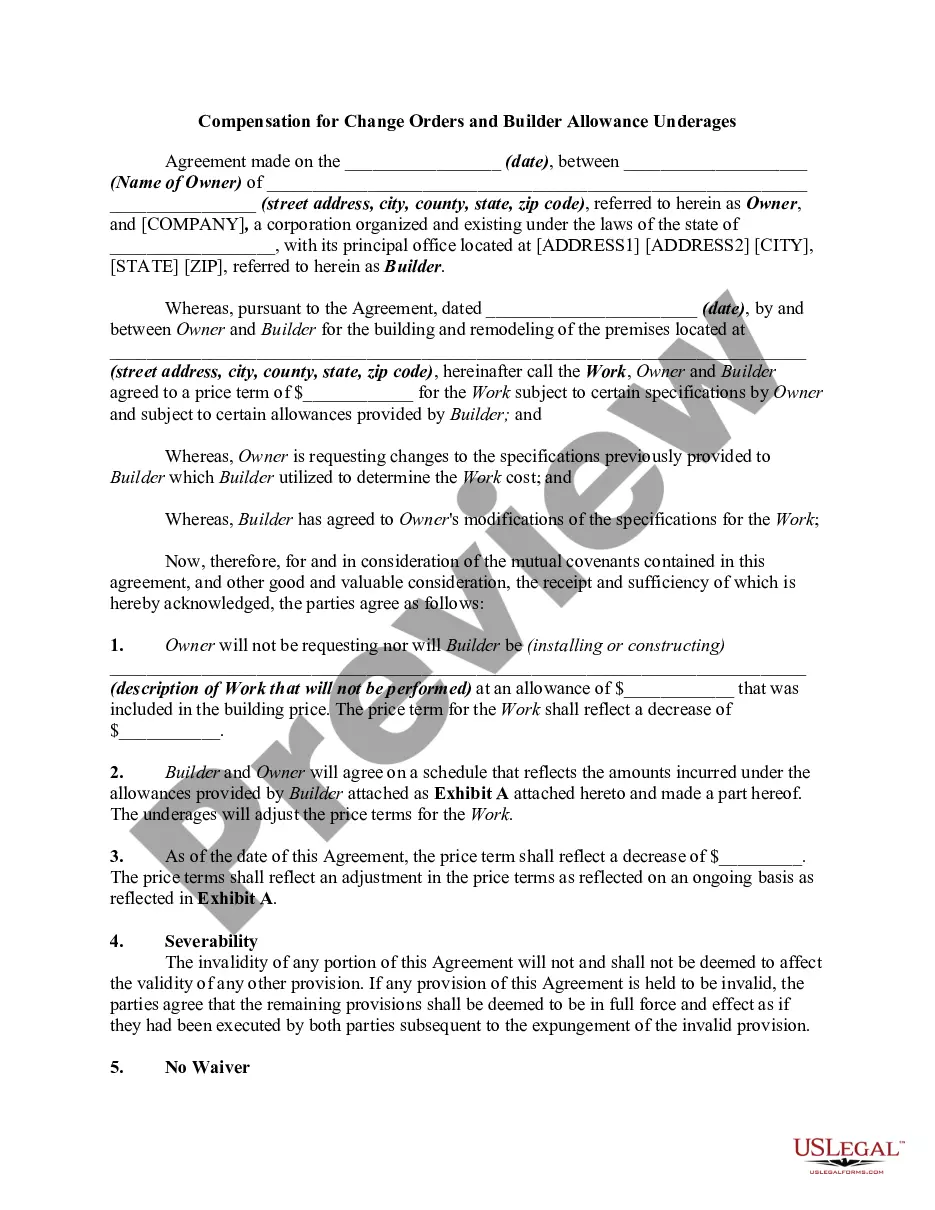

Assignment in the context of a receivable means the transfer of rights related to it to another person or entity. For this purpose, an appropriate contract is usually concluded (although this is not a necessary condition).

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.