Factoring Agreement Form In Los Angeles

Description

Form popularity

FAQ

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

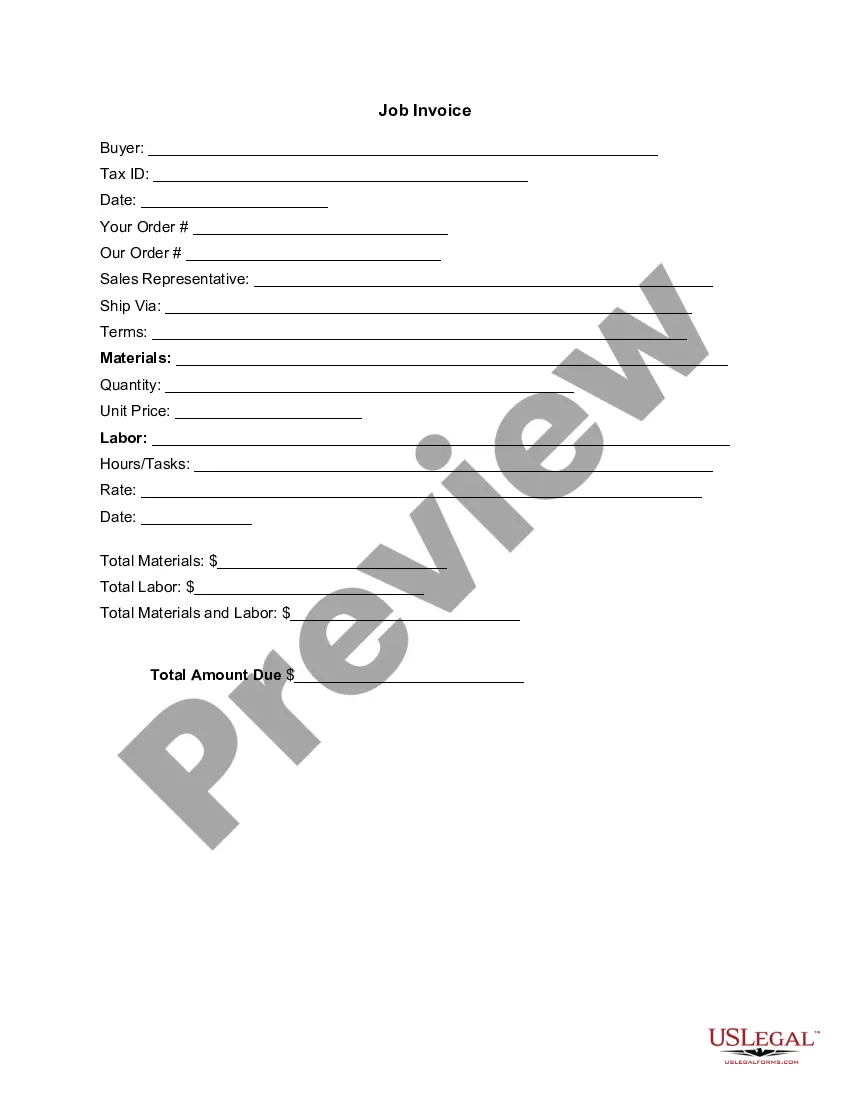

Average Factoring Rates and Advances in 2024 Average Factoring Rates in 2024 IndustryFactoring RateAdvance Rate General Small Business 1.95% – 4.5% 85% – 95% Retail & Wholesale 1.95% – 4.5% 80% – 95% Construction 3.0% – 6.0% 70% – 80%5 more rows •

In summary, factoring rates range from 1.15% to 4.5% per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing. In these cases, advances can reach or exceed 90%.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

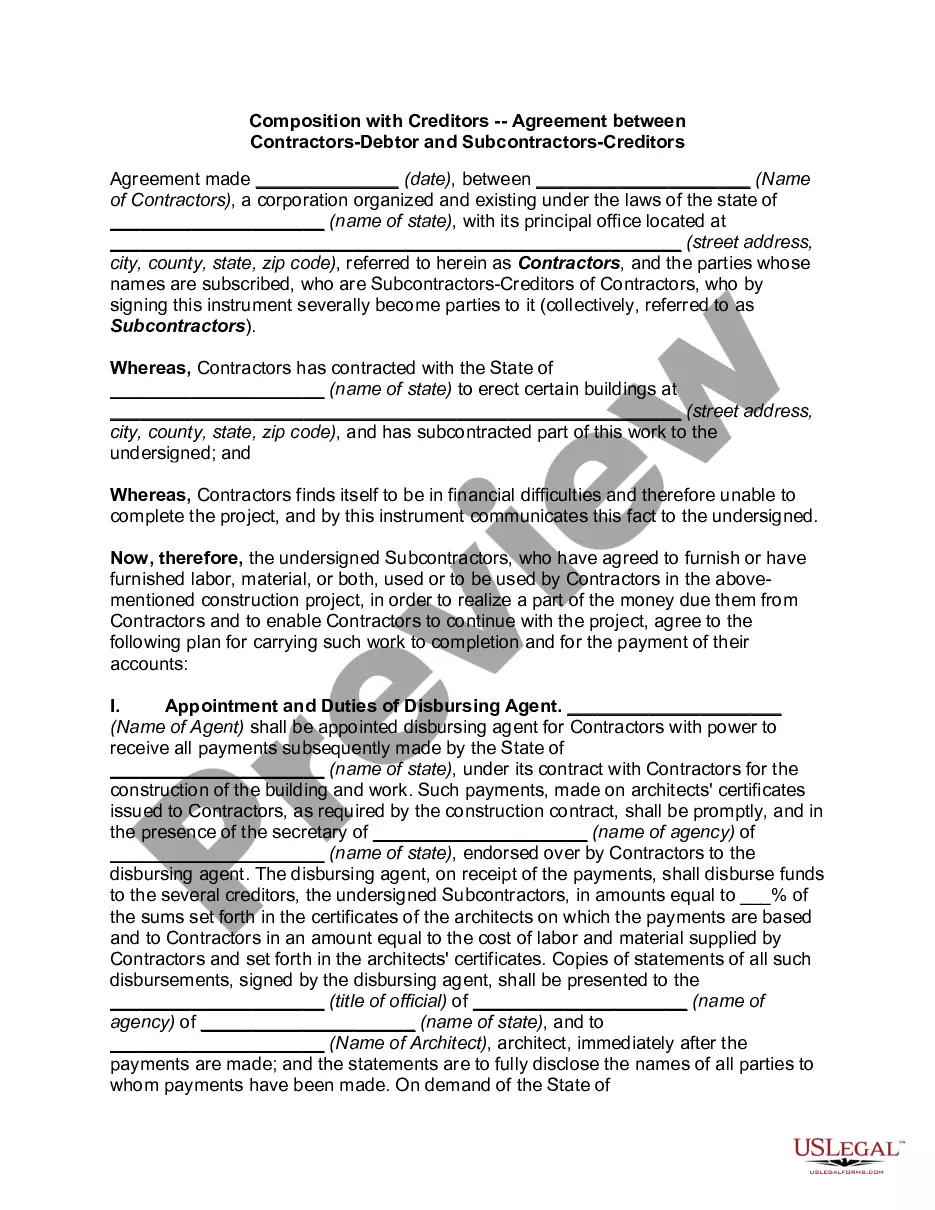

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

Invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R.

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

Get a Release Letter: Once all obligations are fulfilled, ask for a release letter from the factoring company. This document should state that you have fulfilled all contractual obligations and that the factoring company has no further claim on your invoices or receivables.