Agreement General Form With Collateral In King

Description

Form popularity

FAQ

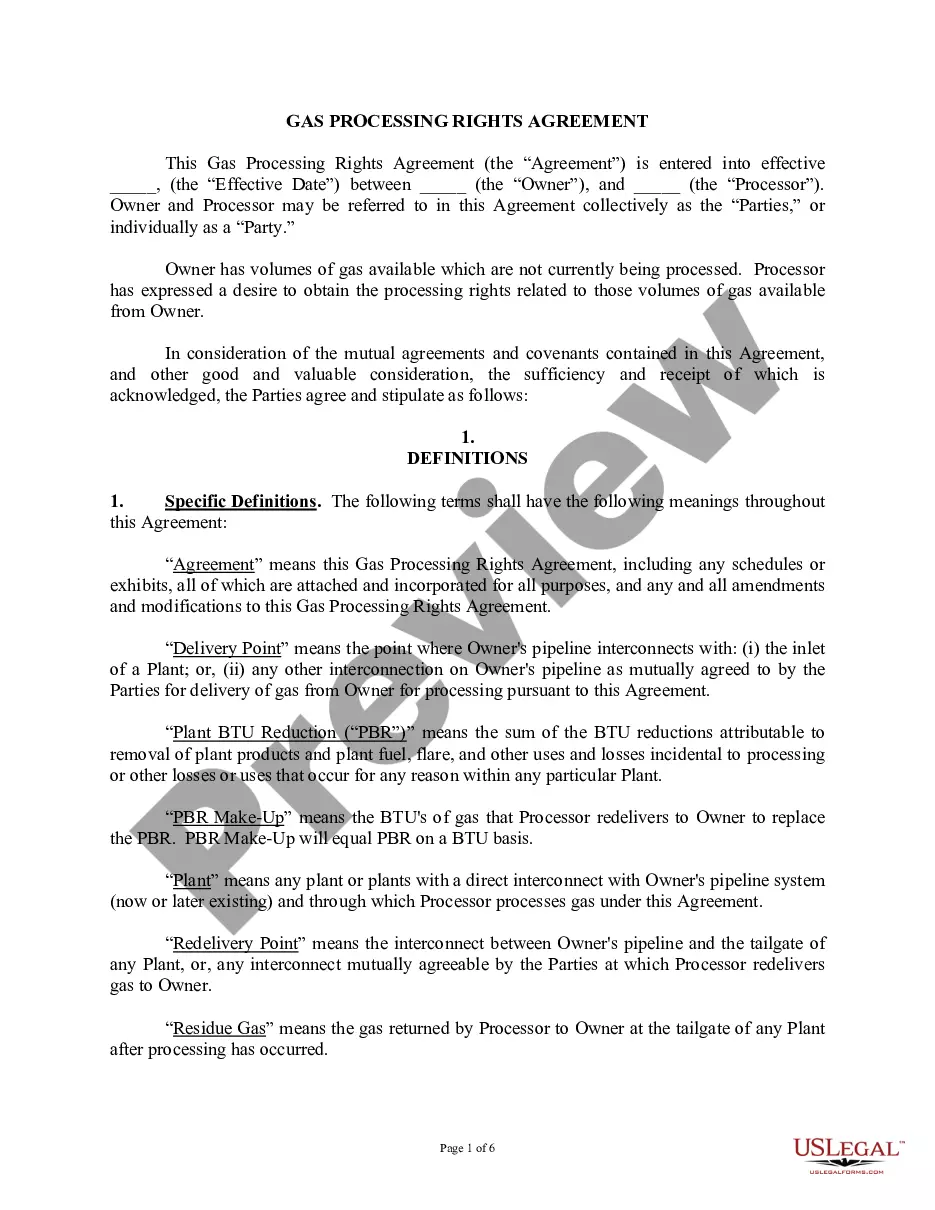

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

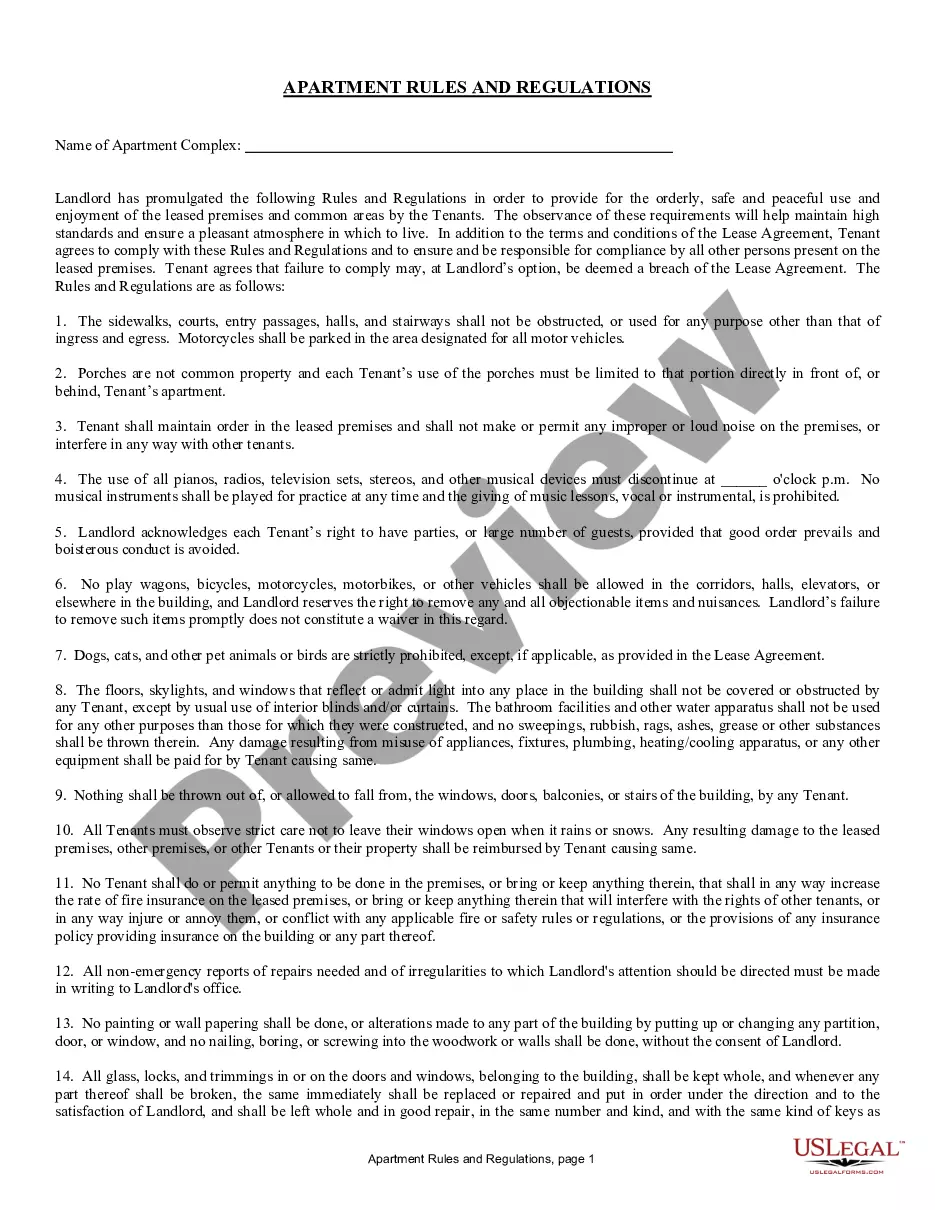

Suppose you agree to rent an apartment. The lease agreement you sign with the landlord is the main contract. However, your landlord promises to fix the toilet drainage. Therefore, this is the collateral contract.

Definition: The term “Collateral” as used herein means the securities and obligations, any addition thereto or substitution therefor, all interest, dividends, distributions and sums distributed or payable therefrom, all other rights and privileges incident to such securities, and all proceeds and profits of such ...

Collateral form (plural collateral forms) (linguistics) A synonymous but not identical, coexisting form (variation) of a word, such as an accepted alternative spelling.

These agreements allow the secured party to perfect a security interest in collateral posted by the pledgor while ensuring that, in the event of the bankruptcy or insolvency of the secured party, such collateral will not become a part of the secured party's estate and will, to the extent owed to the pledgor, be ...

Unlike a payoff letter that terminates all security interests in connection with the repayment and satisfaction of obligations under a credit facility, this collateral release letter removes collateral support, but leaves a credit facility intact as an unsecured facility.

A collateral contract is a contract to enter into an future contract. Part of the consideration for the collateral contract is the promise to enter into the second contract. This is similar to a conditional contract whereby the consideration for one party is conditioned on the other party doing something.

To secure this Agreement, the Debtor hereby agrees to provide the Secured Party with full right and title of ownership to the following property as collateral (the “Collateral”) to secure the debt listed in the “Debt” section of this Agreement: (Property name, address)

A collateral contract is one where the parties to one contract enter into or promise to enter into another contract. Thus, the two contracts are connected and it may be enforced even though it forms no constructive part of the original contract.