Factoring Agreement Document For Business In Fulton

Description

Form popularity

FAQ

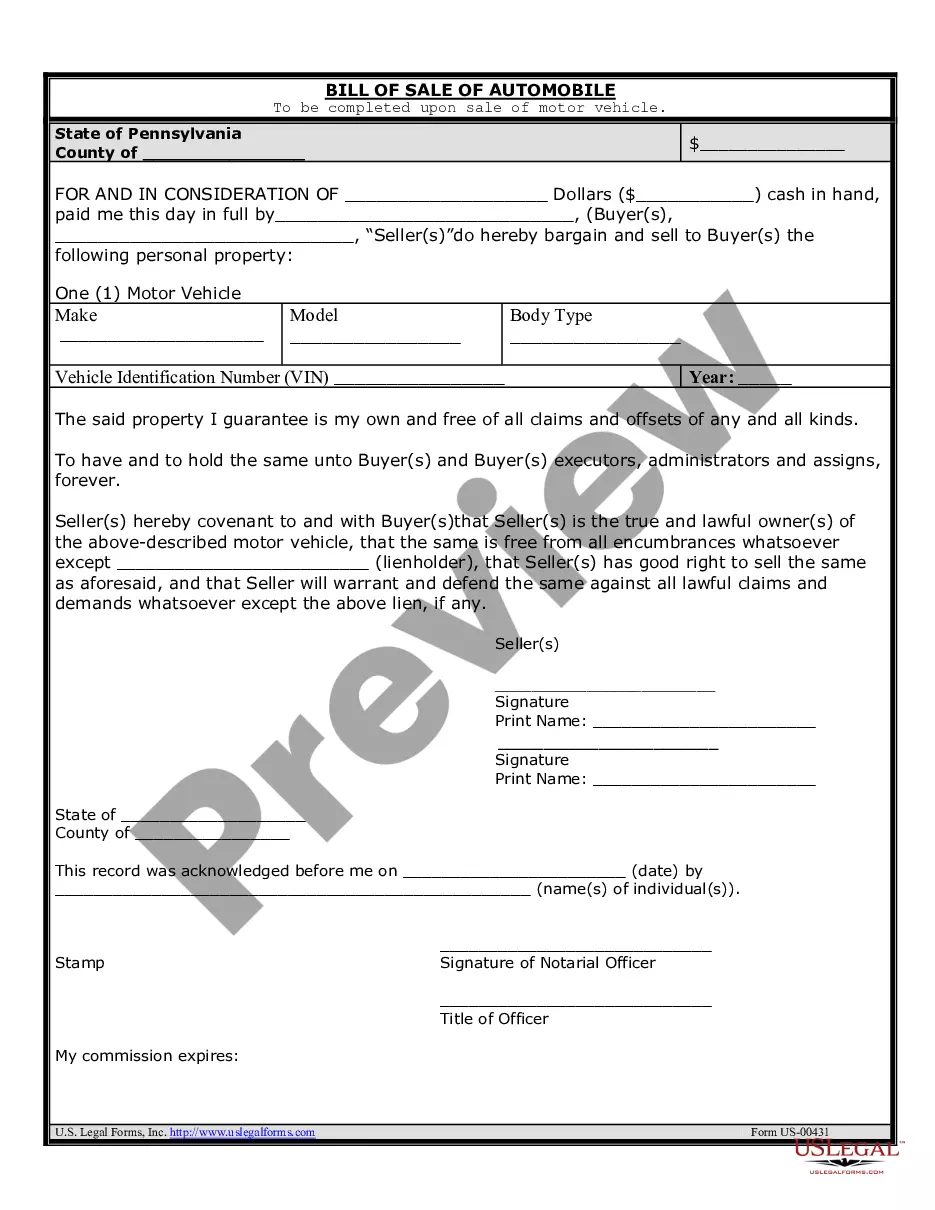

This is the most common system of international factoring and involves four parties i.e., Exporter, Importer, Export Factor in exporter's country and Import Factor in Importer's country.

Transaction Finance Parties means the Lenders, each Swap Counterparty, the Arranger, the Facility Calculation Agent, the Facility Agent and the Security Agent (each a “Transaction Finance Party”).

These parties may be referred to as vendor and buyer, client and service provider, or more commonly, promisor and promisee. In certain cases, a third-party beneficiary may be assigned to profit from the agreement without being legally obligated to perform anything under the contract.

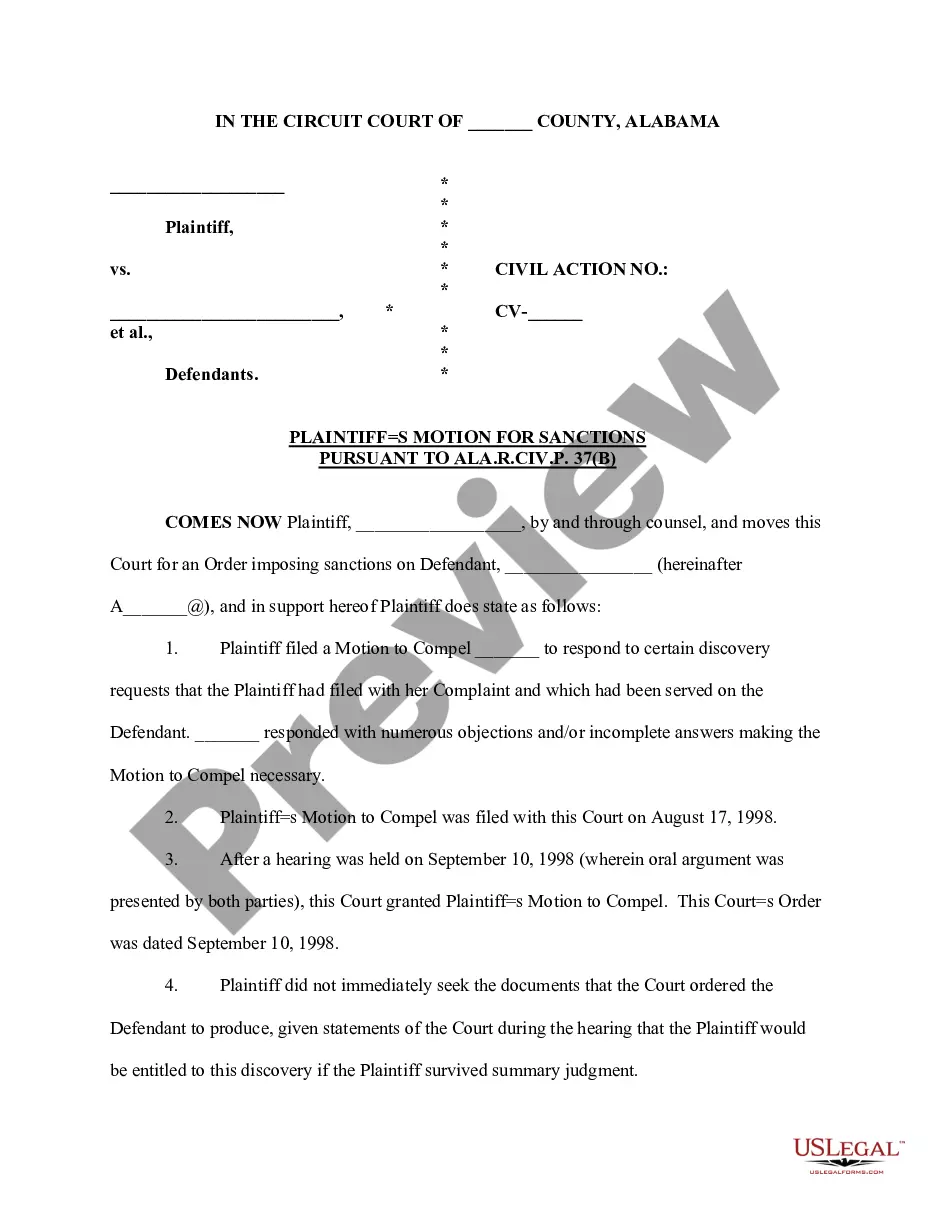

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

There are four parties involved, i.e. exporter (client), the importer (customer), export factor and import factor. This is also termed as the two-factor system. advance to the client, against the uncollected receivables. In maturity factoring, the factoring agency does not provide any advance to the firm.

Factor expressions, also known as factoring, mean rewriting the expression as the product of factors. For example, 3x + 12y can be factored into a simple expression of 3 (x + 4y). In this way, the calculations become easier. The terms 3 and (x + 4y) are known as factors.

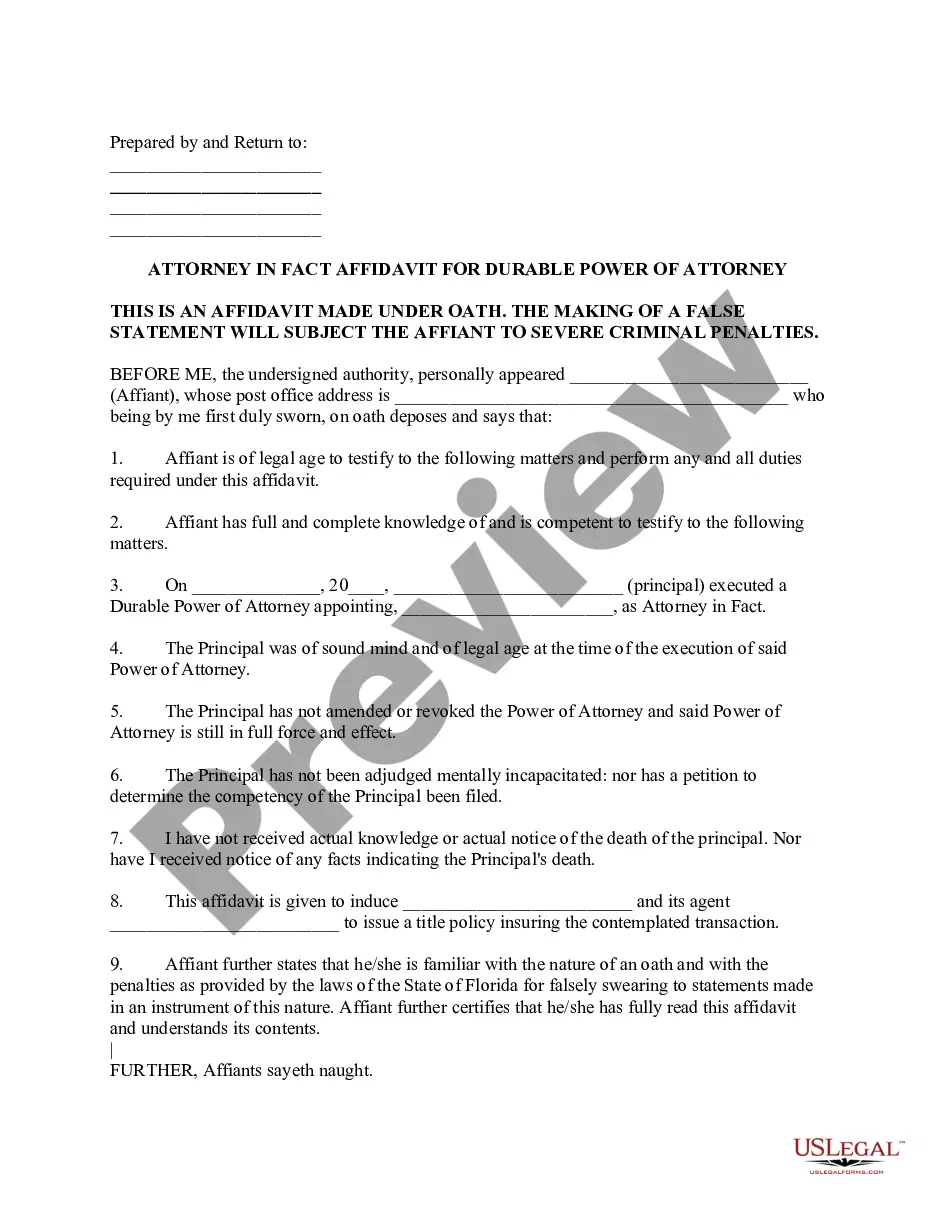

Factoring Application. Filling out a factoring application is very easy, yet one of the most important requirements for invoice factoring. Accounts Receivable Aging Report. Copy of Articles of Incorporation. Invoices to Factor. Credit-worthy Clients. Business Bank Account. Tax ID Number. Personal Identification.

Export factoring is the process where a lender or a factor buys a company's receivables at a discount. It includes services like keeping track of accounts receivable from other countries, collecting and financing export working capital, and providing credit insurance.