Factoring Agreement Online With Steps In Fairfax

Description

Form popularity

FAQ

You may obtain the deed book and page number by searching for the document in the Court Public Access Network (“CPAN”) on one of the public computers in the Land Records Research Room or through a subscription. Subscribers to CPAN are able to make non-certified copies from their own computer.

All deeds must be prepared by the owner of the property or by an attorney licensed to practice in Virginia.

Fairfax County Clerk's Office The Clerk's Office is open from 8 A.M. to 4 P.M., Monday through Friday. It is located at 4110 Chain Bridge Road, Fairfax, VA, 22030. Email: The Clerk's Office answers email during normal business hours. You can email us at GDCMail@fairfaxcounty.

In Fairfax County and the City of Fairfax, homestead deeds are recorded in the Land Records Division of the Fairfax Circuit Court. The address of the Land Records Division is: Fairfax Circuit Court, 4110 Chain Bridge Road, Suite 317, Fairfax, VA 22030. The telephone number is 703/691-7320 (press 3, then 3).

Invoice discounting provides regular returns and benefits to the investors of the platform but it comes with various risks as each invoice is backed by a small business.

Primary risks in invoice factoring include potential client defaults, impacting the factor's recovery; high costs due to fees and interest rates; customer relationships strain from third-party involvement; and hidden fees or contractual obligations.

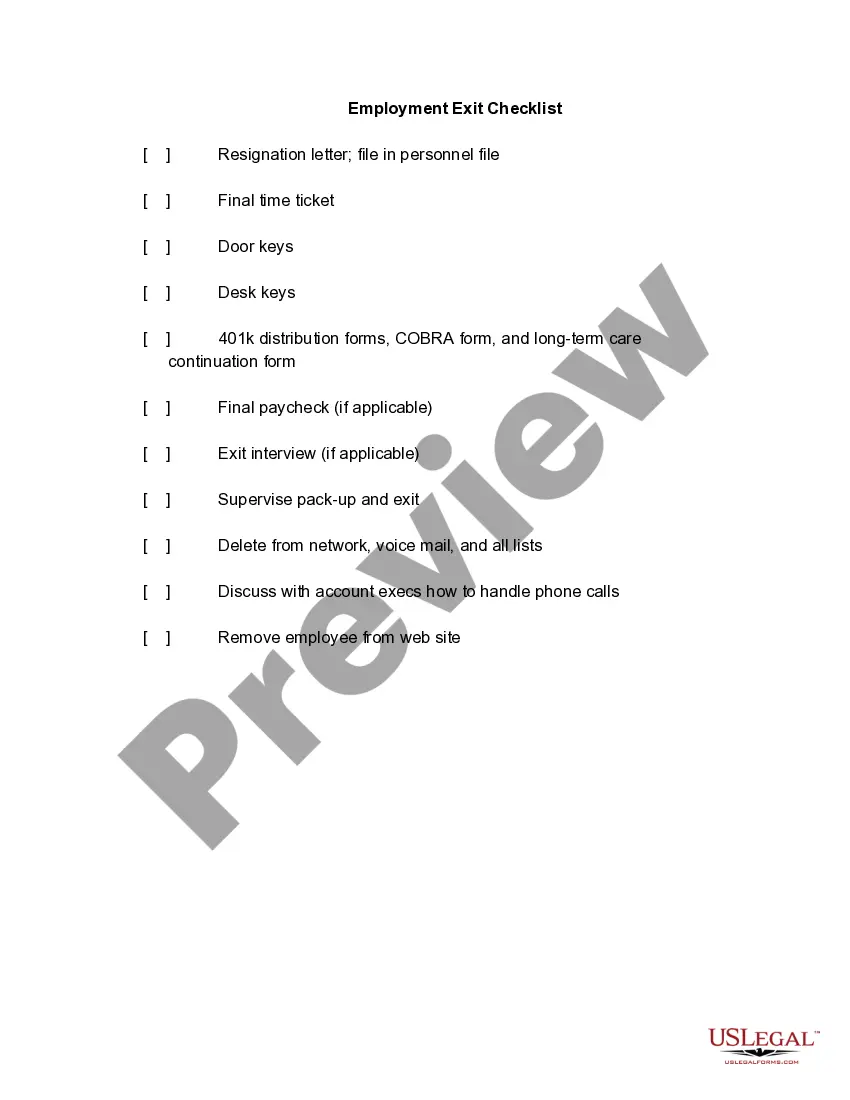

Here's a breakdown of the basic invoice factoring requirements: Bank statements. Factoring application. Invoices you want to factor. Proof of delivery or service. Customer credit information. Accounts receivable aging report. Articles of incorporation or business registration.

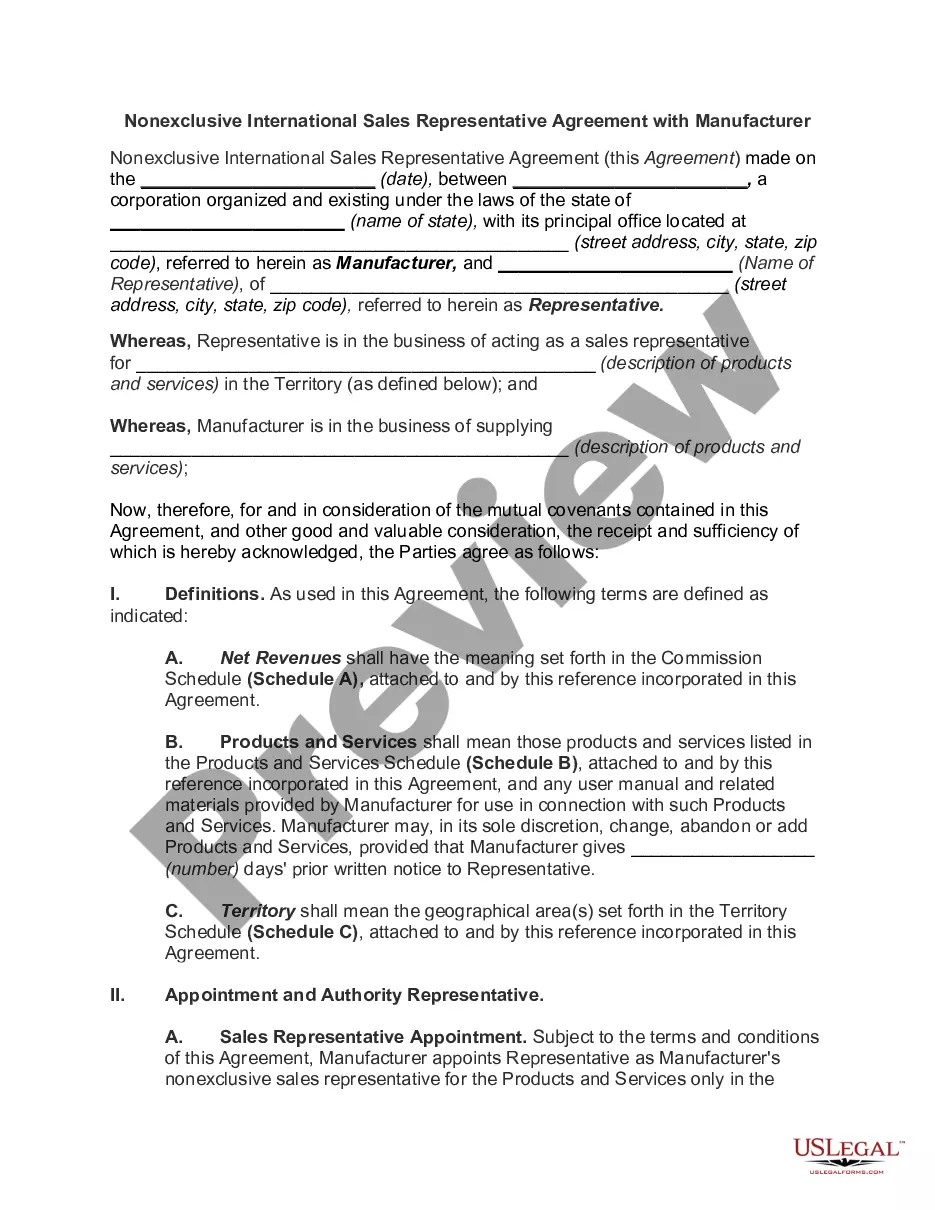

Invoice factoring eligibility depends on what type of business you have, where you're located, the type of industry you work in, and whether or not you have any outstanding liens or tax balance. You'll also need to work with creditworthy customers, who aren't at risk of not paying their outstanding receivables.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

The name, bankfactoring, might suggest that it is the bank that provides factoring services, but this is a simplification. It is not the banks, but actually companies specifically delegated by them to use bank capital, that offer factoring.