Factoring Agreement File With Irs In Broward

Description

Form popularity

FAQ

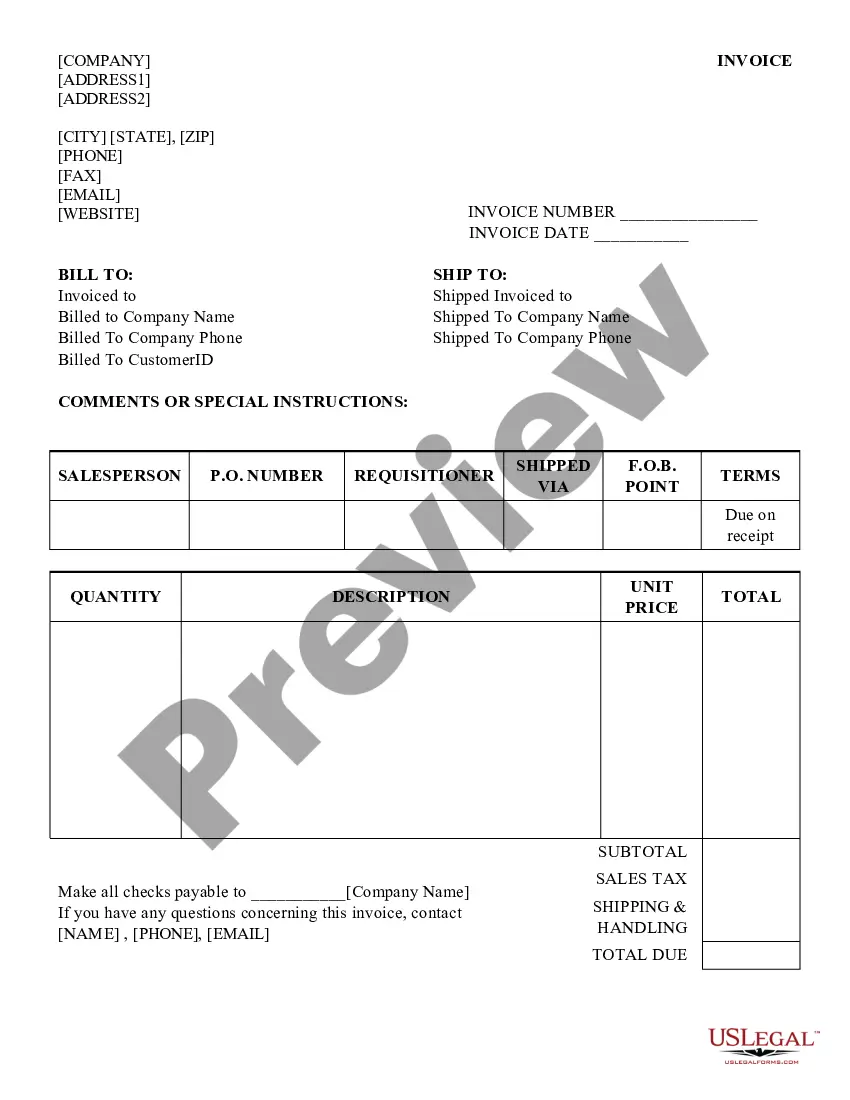

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

Factoring companies will typically run a background check. While less-than-perfect backgrounds can be approved for factoring, certain violent or financial crimes may be disqualifying.

How do I complete abatement form 843? Line 1 is the tax year the abatement is for. Line 2 is the total fees/penalties you are asking the IRS to remove. Line 3 is generally going to be Income (tax). Line 4 is the Internal Revenue Code section. Line 5a is the reason you are requesting the abatement.

Send Form 843 to the Internal Revenue Service Center where your return was filed. If the erroneous advice does not relate to an item on a Federal tax return, Form 843 should be sent to the service center where your return was filed for the tax year you relied on the erroneous advice.

In most cases, no. Recourse and nonrecourse factored receivables are treated as regular income.

Your reporting of factoring expenses as a deduction Commissions, set-up fees, and other factoring expenses are all tax deductible. But the reporting method differs depending on whether you retain the ownership of your receivables or end up selling them to a factoring company as described above.

WHY THE IRS REJECTS INSTALLMENT AGREEMENT REQUESTS. The IRS typically rejects an installment agreement request for one of three reasons. If the IRS determines that your living expenses do not fall under the category of “necessary,” your agreement will more than likely be rejected.