Factoring Agreement File Format Canada In Bexar

Description

Form popularity

FAQ

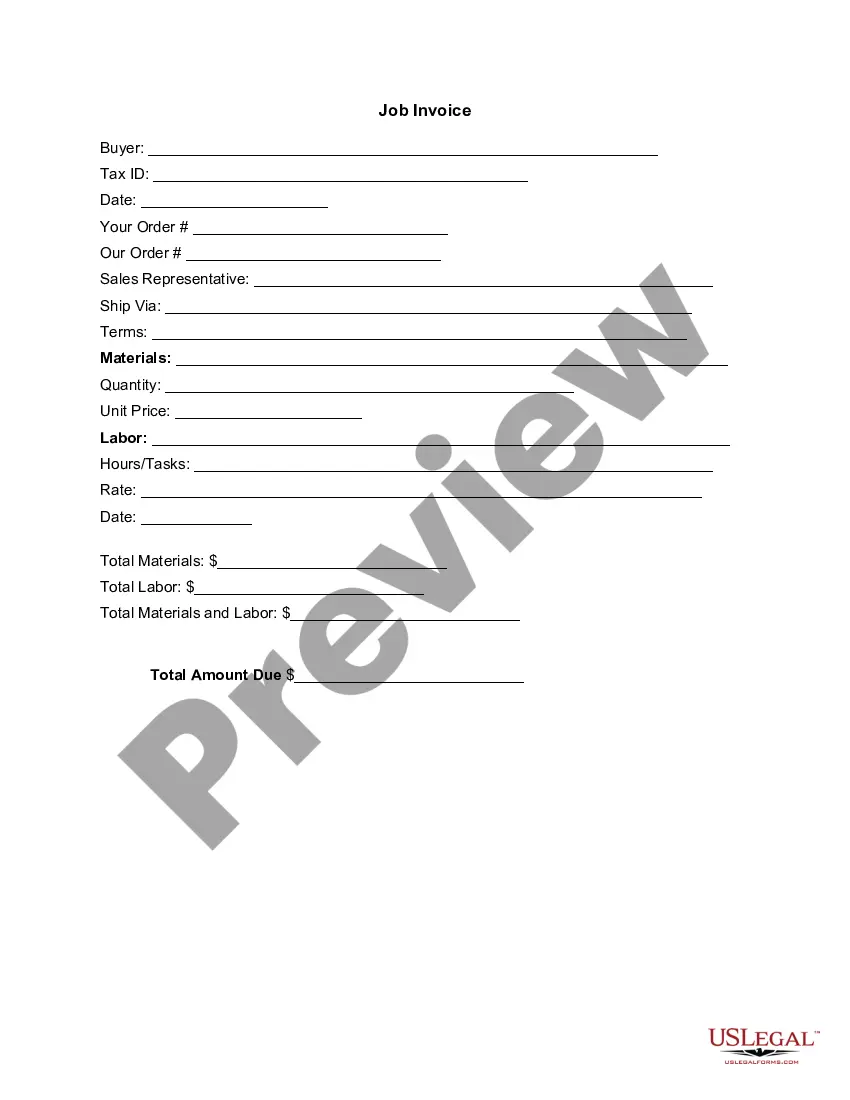

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

In summary, factoring rates range from 1.15% to 4.5% per 30 days. Advances range from 70% to 85%. There are some exceptions, such as transportation and staffing. In these cases, advances can reach or exceed 90%.

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

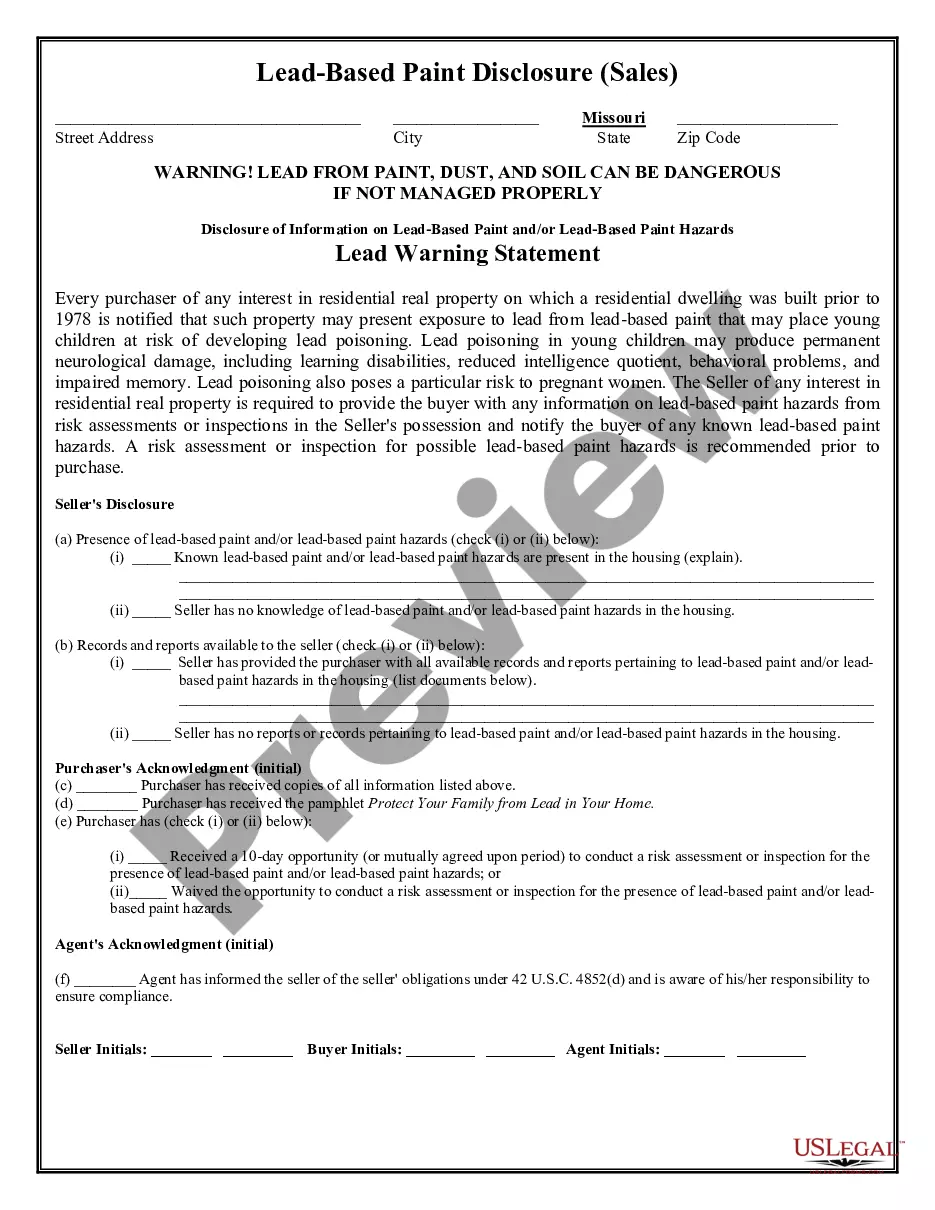

Average Factoring Rates and Advances in 2024 Average Factoring Rates in 2024 IndustryFactoring RateAdvance Rate General Small Business 1.95% – 4.5% 85% – 95% Retail & Wholesale 1.95% – 4.5% 80% – 95% Construction 3.0% – 6.0% 70% – 80%5 more rows •