Ownership Agreement For Property In Washington

Description

Form popularity

FAQ

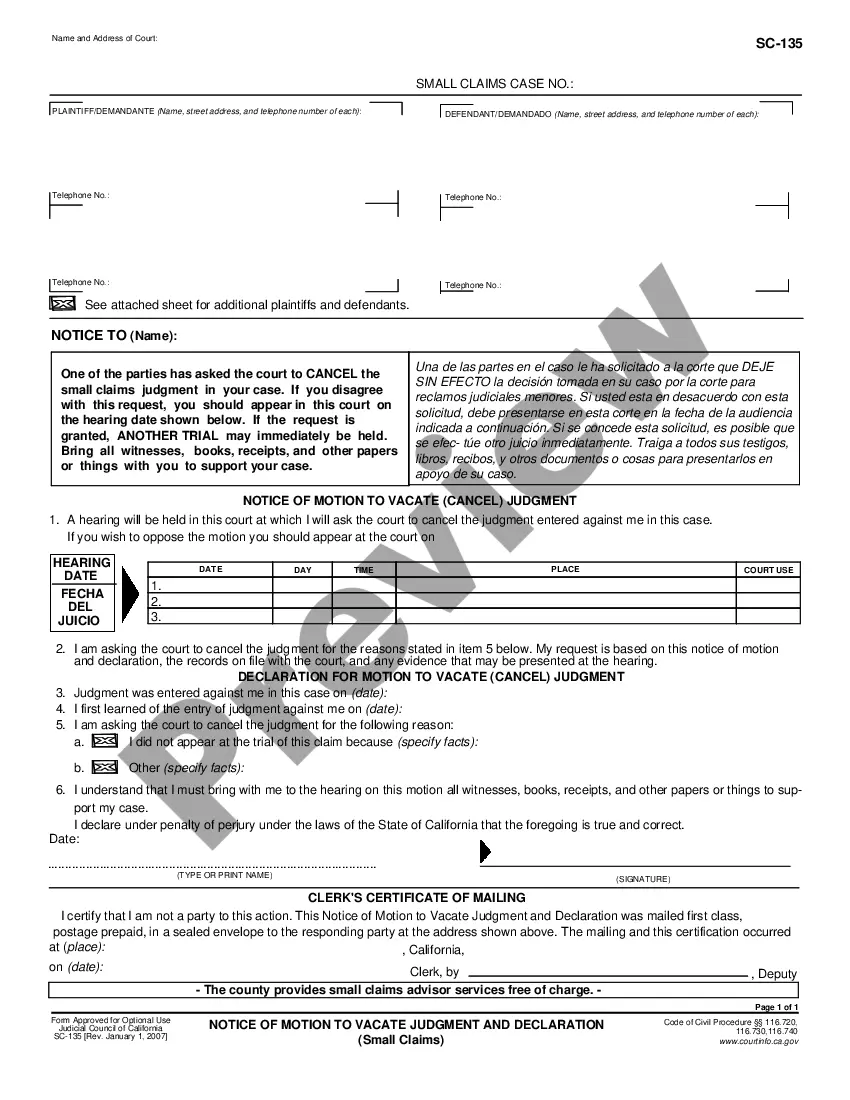

A deed is legal document that conveys in interest in real property from one person to another. The basic requirements for a deed in Washington are simple: it must be in writing, contain a legal description of the property, be signed by the grantor, and the grantor's signature must be notarized.

Go to the recorder's office or county clerk's office. You'll be able to get your deed and the satisfaction of mortgage. Those are the 2 docs you want.

Overview. Washington property law is broader than “ownership rights and interest.” Ownership rights include: the right to “possess” property (i.e., the right to exclude others from using or occupying property) and the right to peaceful enjoyment of property.

To access a digital copy, go to your county recorder's website and search public records and recorded documents. You can print an unofficial copy or request a certified one from the county recorder.

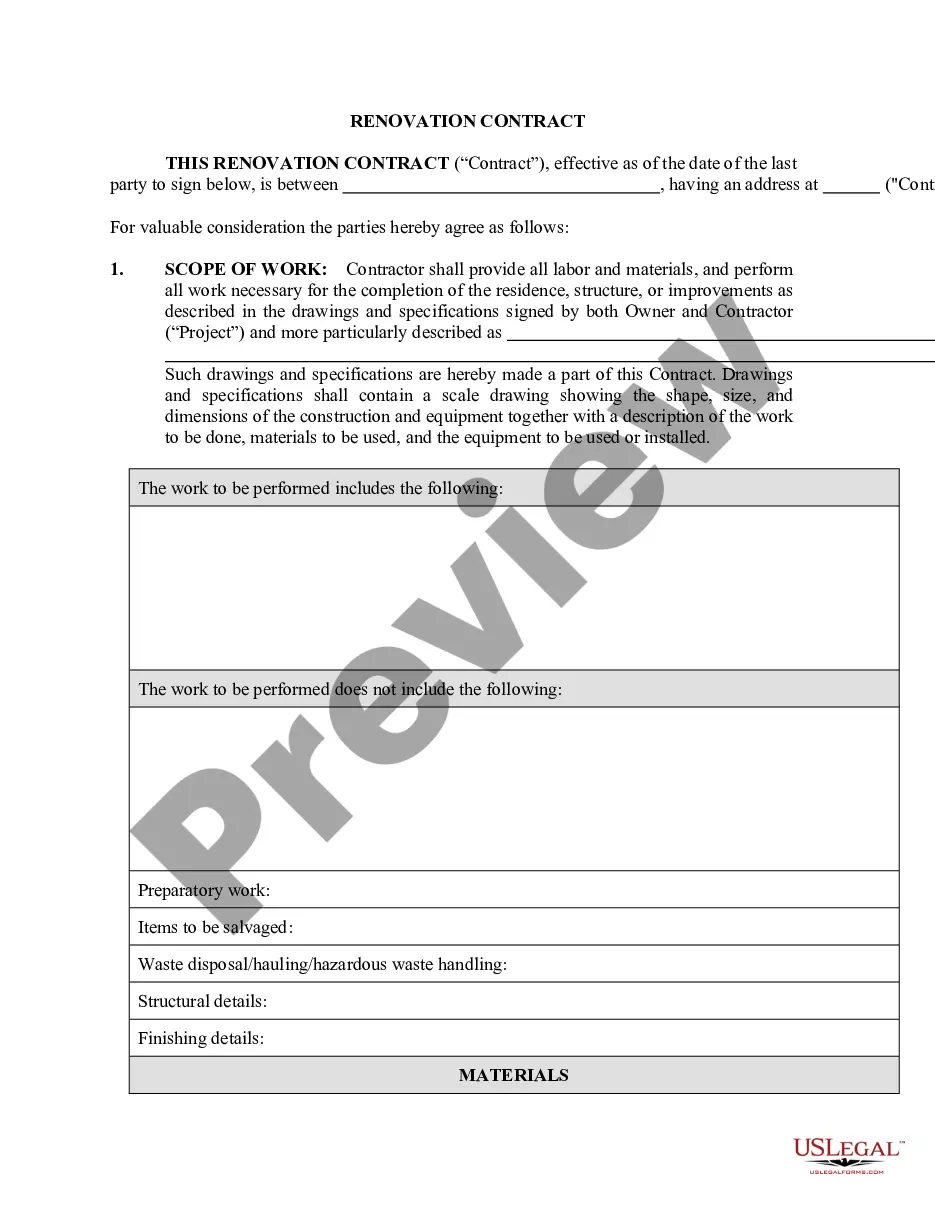

Contents Researching the relevant laws and regulations. Establishing the purpose of the agreement. Identifying the parties involved in the agreement. Determining the co-owners' rights and responsibilities. Drafting the agreement. Outlining the financial contributions and distributions of the co-owners.

To access a digital copy, go to your county recorder's website and search public records and recorded documents. You can print an unofficial copy or request a certified one from the county recorder.

This process involves completing specific documentation, such as the title deed, and submitting it to the Washington State Department of Licensing. The new owner gains all rights and responsibilities associated with the property once the transfer is recorded.

To use a Washington state community property agreement, you and your spouse or partner must agree to leave everything to each other, complete the document, and sign it in front of a notary public. When one spouse or partner dies, the survivor will become the owner of the deceased person's property, without probate.

THE DANGERS OF ADDING SOMEONE TO THE TITLE OF YOUR REAL ESTATE Loss of Control. Legal and Financial Implications. Tax Consequences. Impact on Estate Planning. Potential for Loss. Emotional Strain and Relationship Impact. Alternatives to Consider. Professional Guidance is Essential.

The best way is to create a new deed listing all of the owners as “joint tenants with rights of survivorship.” If you simply add someone to your current deed, they become a co-owner, but they may not have rights of survivorship, and the property may still need to go through probate.