Equity Agreement Document For Lease In Suffolk

Description

Form popularity

FAQ

If you're looking for a rent-to-own option, it's best to contact a landlord directly and ask if the arrangement is possible. Also, if real estate sales are sluggish in your area, it might be worth contacting a local real estate agent and asking if they know of any landlords who haven't been able to sell.

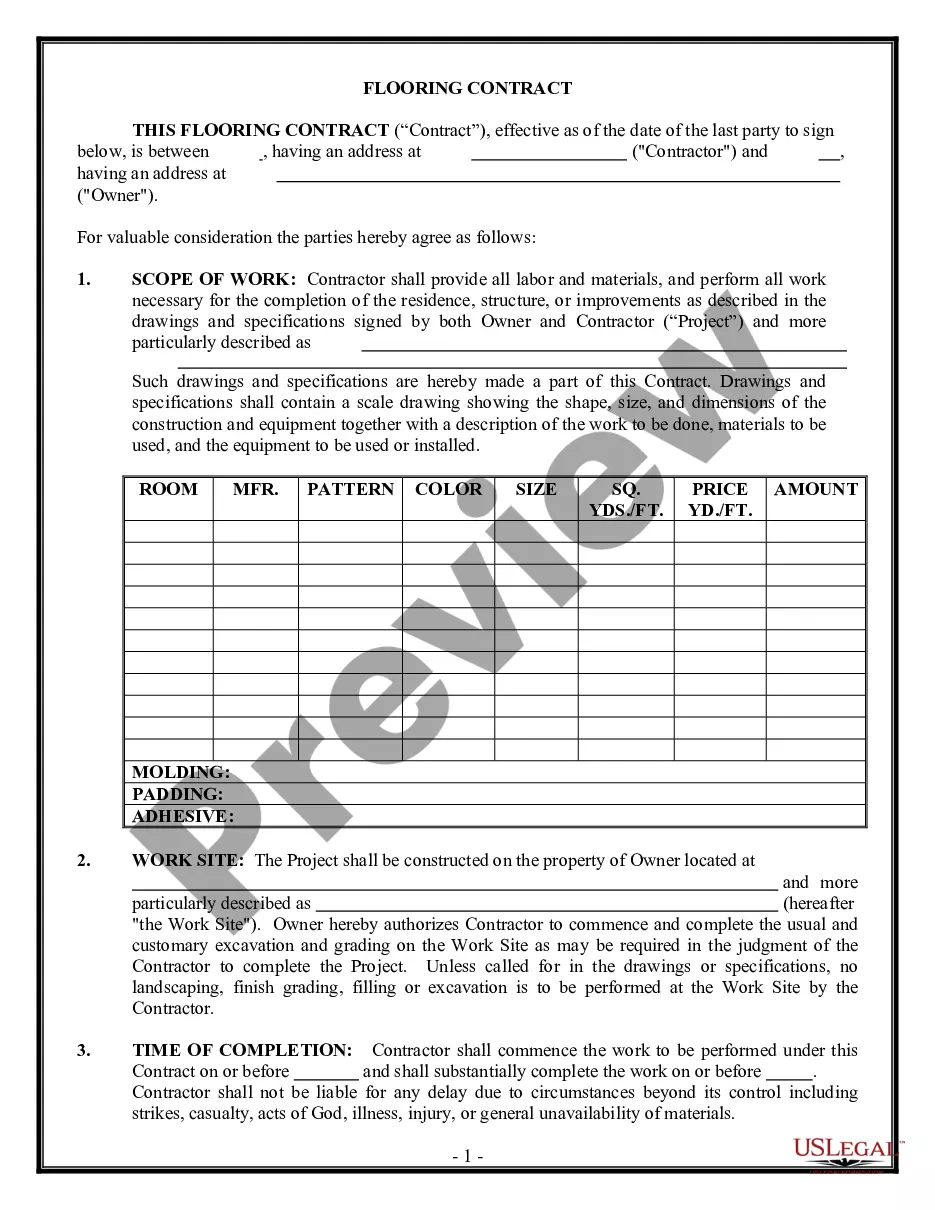

Here are 16 steps on how to make a lease agreement: Include the contact information of both parties. Include property details. Outline property utilities and services. Define the lease term. Disclose the monthly rent amount and due date. Detail the penalties and late fees. Describe any additional or services fees.

Lease-to-own agreement is a good idea when: Tenants want to lock in a property at current market prices, potentially gaining equity as property values increase over time.

It is possible to draft your own lease agreement, but you are leaving yourself open to issues.

Owner or manager sends an unsigned lease agreement to an approved rental applicant. Applicant reviews the lease agreement, signs the lease, agreeing to the terms, and mails it back to the owner/manager. By returning a signed lease agreement, they are accepting the offer to rent the property.

The lease signing process has three steps. First, the landlord creates the lease and sends it to the renter. Then, the renter reviews the lease, signs it, and returns it to the landlord. The landlord then reviews the agreement once more and provides a final signature.

Tenant Provides First Signature It's best practice to have the tenant sign the lease agreement first for a few reasons. If you provide a lease with your signature and the tenant does not sign the document right away, then it makes it harder to move on to another tenant.

A written agreement is required for residential lease agreements in California, outlining details such as parties, property, and terms. California Civil Code has specific laws governing lease agreements, including regulations on security deposits, maintenance, and landlord's rights.

If you cannot find the lease information, contact your landlord/property manager via Messenger and ask them to share the lease with you. Your landlord/property manager can share a lease with you or require you to sign an agreement.

State laws on leases and rental agreements can vary, but a landlord or property management company should provide you with a copy of your signed lease upon request. You should make your request in writing, so you have proof if there is a dispute later.