Equity Share Purchase With Differential Rights In San Jose

Description

Form popularity

FAQ

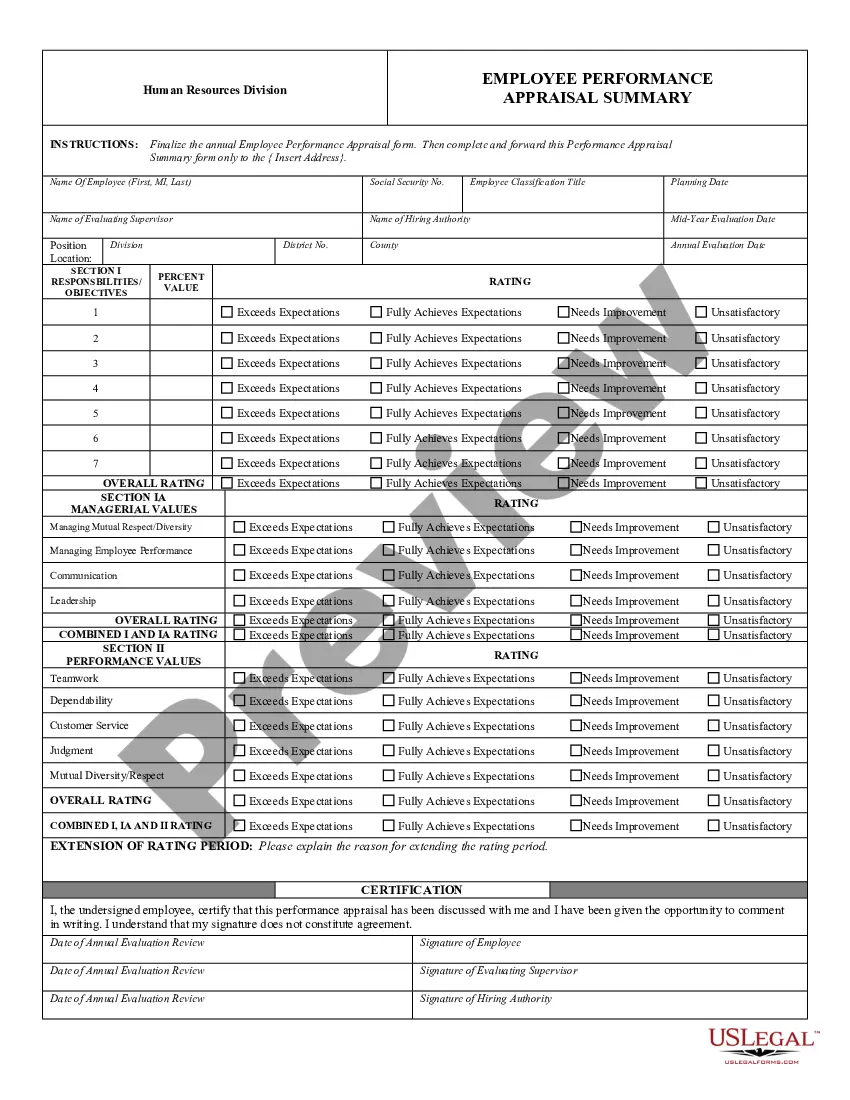

Companies may divide their ordinary shares into different classes (e.g. “A” and “B”) with different rights attached to each class. Read our guide on shares for more information about share types, transfer and allotment of shares etc.

A company may issue equity shares which carry rights only with respect to dividend and do not carry any voting rights. Superior voting right means any right that gives the shareholder more than one vote per share.

Shares issued with differential rights shall not exceed 74% of the total voting power, including voting power in respect of equity shares with differential rights issued at any point of time.

Issue of Prospectus, Receiving Applications, Allotment of Shares are three basic steps of the procedure of issuing the shares. The process of creating new shares is known as Allocation or allotment.

Equity shares with differential voting rights (DVRs) are the kind of shares issued by a company that offers shareholders varying levels of the voting power. This means that some shareholders have more voting power than others and this can significantly impact the control and decision-making capabilities of the company.

DVR shares offer fewer voting rights but often provide higher dividends, while ordinary shares carry complete voting rights but may offer lower dividends. If you are an investor in the stock market, or even just starting out, you are bound to come across different types of shares.