Sweat Equity Agreement Format In Phoenix

Description

Form popularity

FAQ

What Is Sweat Equity? The term sweat equity refers to a person or company's contribution toward a business venture or other project. Sweat equity is generally not monetary and, in most cases, comes in the form of physical labor, mental effort, and time.

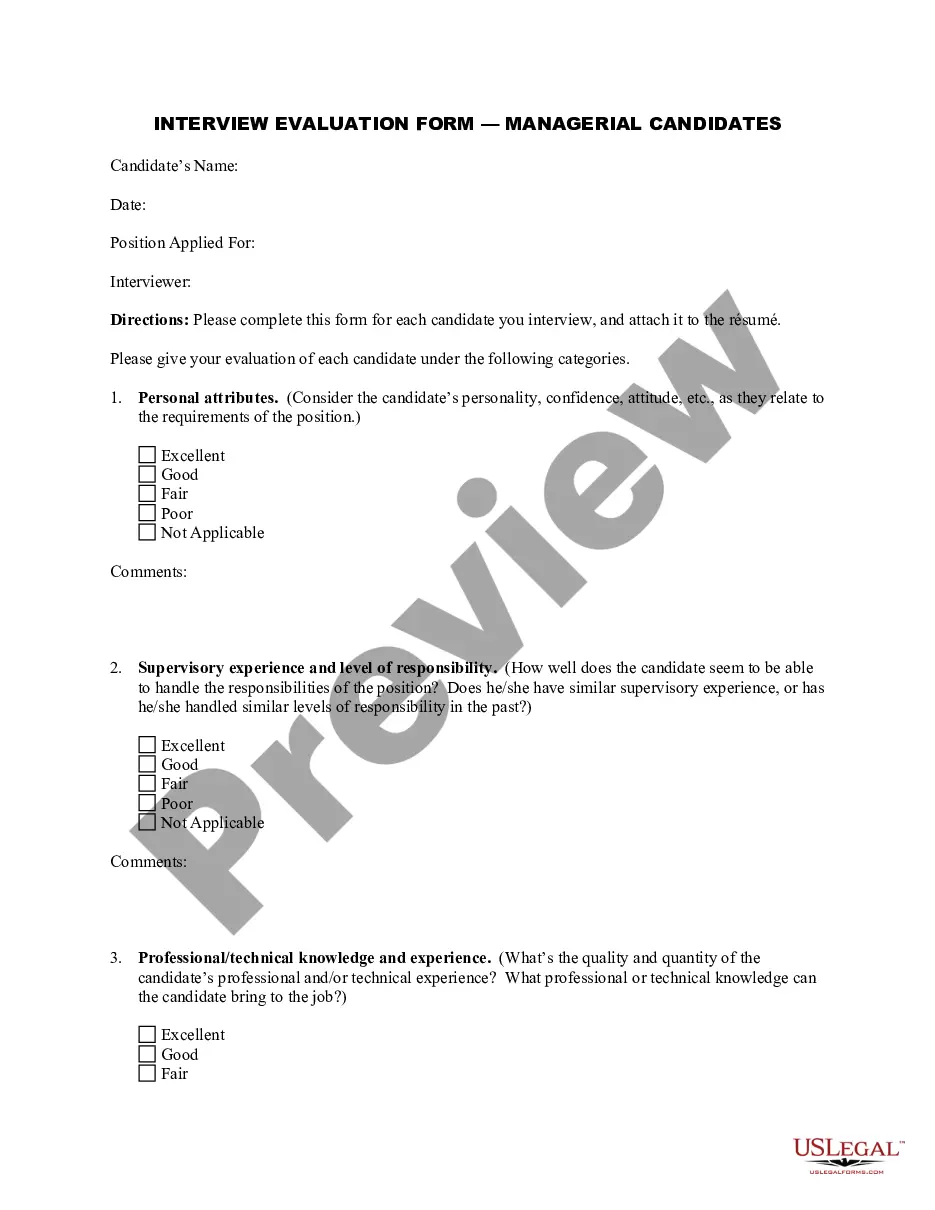

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Accounting for Sweat Equity in a Corporation Determine the par value of your stock. Calculate the value of the sweat equity beyond the par value of the stock. Debit expenses for the entire value of the sweat equity. Credit the appropriate capital accounts.

Key considerations when structuring a sweat equity agreement Role and equity: Ensure that equity is offered in exchange for work performed rather than just as an incentive. Also make sure the role of the employee or advisor is clearly defined so everyone understands what is expected from them.

Divide the amount of the investor's contribution by the percentage of equity it represents. This fetches you the exact amount of sweat equity that you'll need. Here's a good read to understand few more examples of calculating sweat equity.

A Sweat Equity Agreement should clearly identify the company and the individual(s) contributing sweat equity and outline the nature of the contributions being made, whether it is in the form of time, skills, expertise, intellectual property, or any combination of those or millstones for granting equity (for example, a ...

The following Persons (directors or employees) shall be eligible for SWEAT Equity Shares: An individual who is a permanent employee of the company and has been working in or outside India for at least a year, or. A director of the company, regardless of being a whole-time director or not, or.

Accounting for Sweat Equity in a Corporation Determine the par value of your stock. Calculate the value of the sweat equity beyond the par value of the stock. Debit expenses for the entire value of the sweat equity. Credit the appropriate capital accounts.