Ownership Agreement For A Business In Phoenix

Description

Form popularity

FAQ

Any license(s) you need to be in business could be - and often is - generically referred to as a "business" license, however, there are basically three different types of "business" licenses in Arizona: Transaction Privilege (Sales) Tax (TPT), Business, and Regulatory (professional/special).

Key takeaways. Although they're similar, operating agreements and partnership agreements are not the same. Typically, partnership agreements clarify ownership stakes in a business. Operating agreements, conversely, are designed to protect members in a limited liability company.

You can go to the Secretary of State's website and register the name as a trade name; or. You can submit your formation documents online at . As an alternative, you can also submit your formation documents via fax or mail.

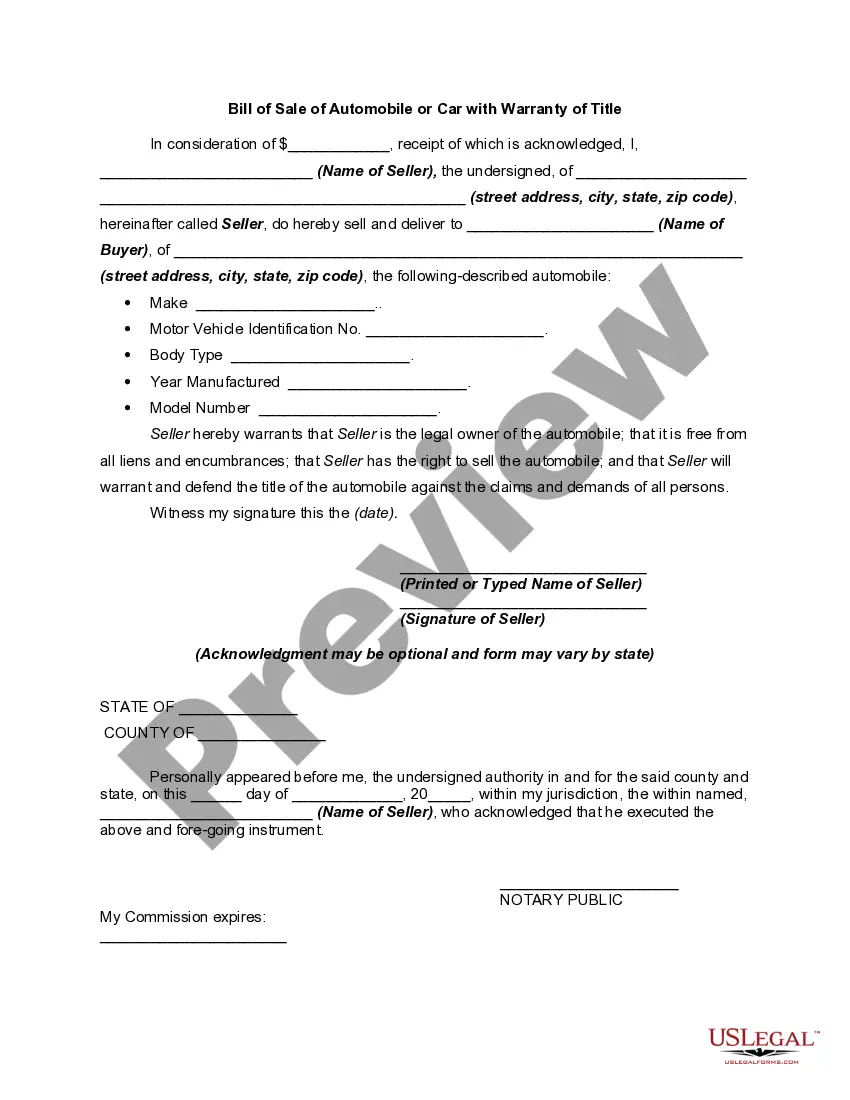

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

The state of Arizona does not require limited liability companies to have LLC operating agreements. However, the Arizona Limited Liability Company Act does encourage the creation of one. As most LLCs are owned and operated by two or more people, an LLC operating agreement is a good idea.

The City of Phoenix requires a license from all businesses that have a privilege (sales) or use tax liability. We do not require a license for businesses without a tax liability, except for business activity subject to a Business / Regulatory license.

But good news: Arizona doesn't require a general license to do business in the state. Meaning, your Arizona LLC doesn't need a general state business license. But depending on what type of business you run, your LLC might need an occupational license (aka “industry-specific license”).

Business owners have the authority to make decisions, manage resources, assume risks, and enjoy the profits or bear the losses generated by the business. Ownership can take various forms, including sole proprietorship, partnership, corporation, or cooperative.

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A limited liability company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure.