Shared Ownership Agreement In Principle In Orange

Description

Form popularity

FAQ

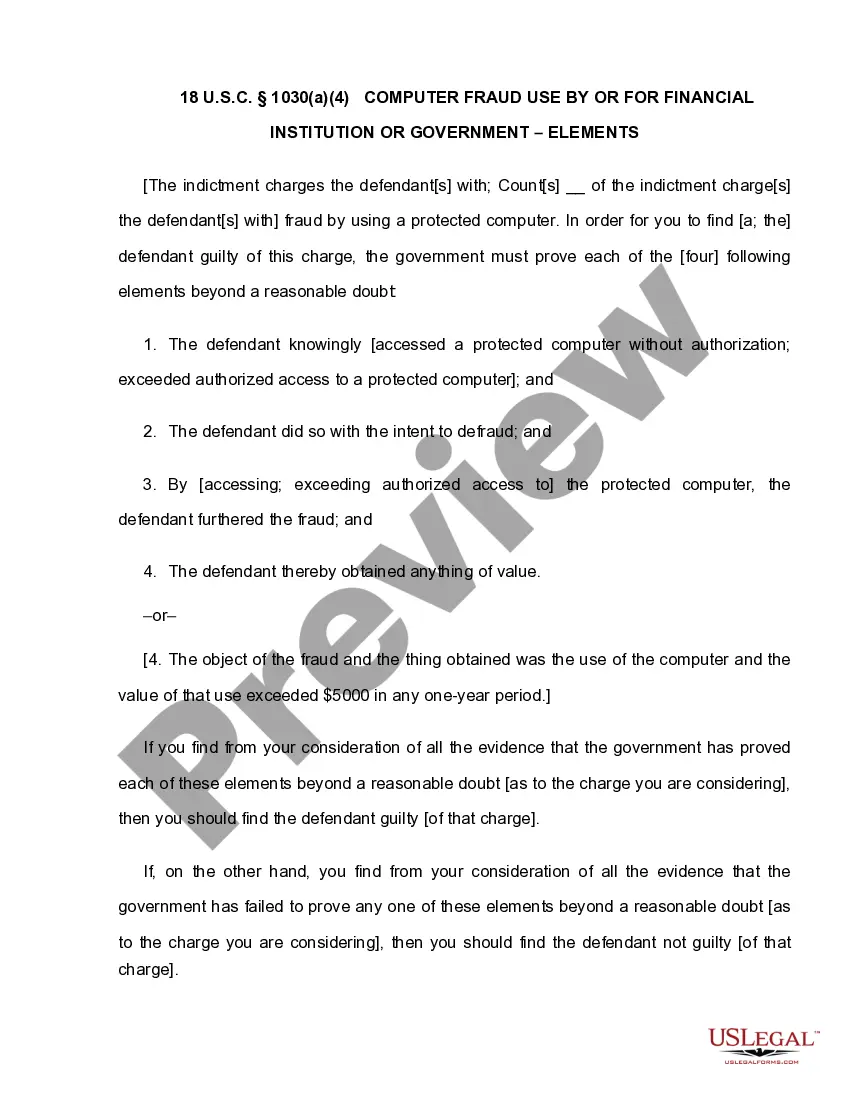

Joint Tenancy Has Some Disadvantages They include: Control Issues. Since every owner has a co-equal share of the asset, any decision must be mutual. You might not be able to sell or mortgage a home if your co-owner does not agree. Creditor Issues.

owner can be an individual or a group that owns a percentage of an asset in conjunction with another individual or group. The revenue, tax, legal, and financial obligations can be different for each coowner and will depend on the coownership agreement and nature of the asset.

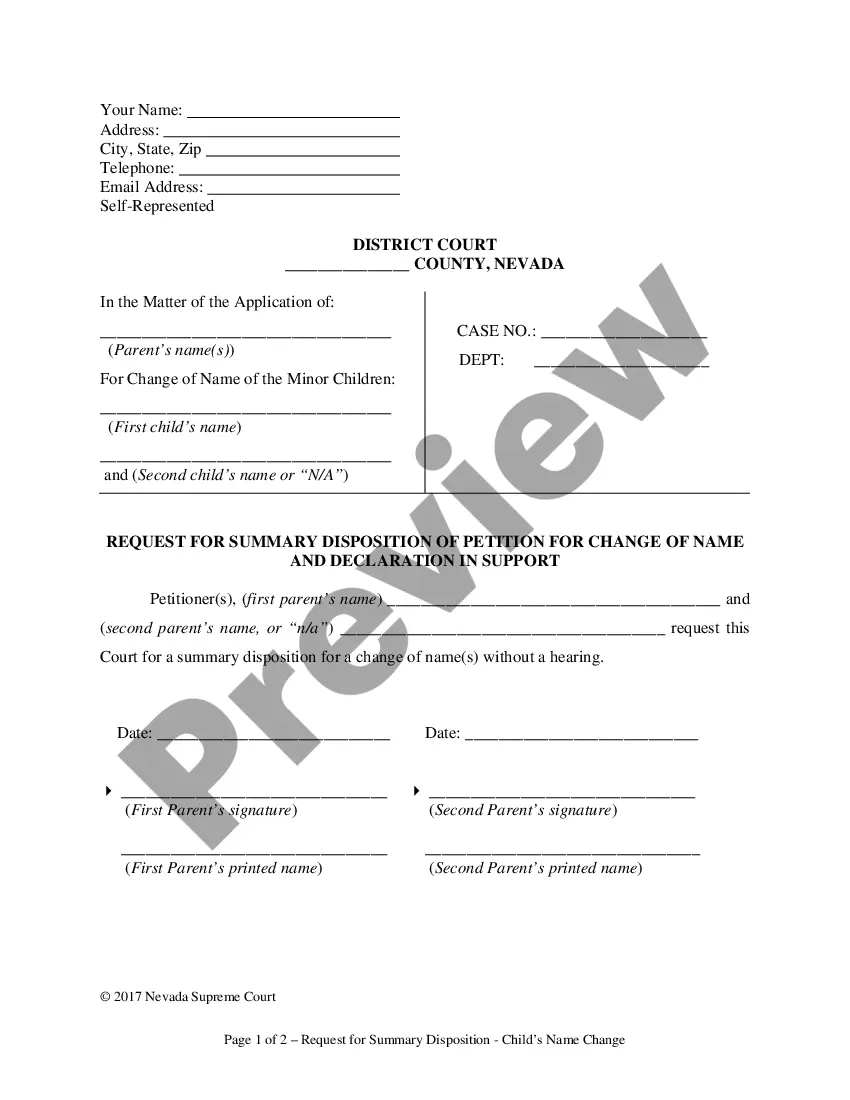

The Living Together section of Nolo also discusses various forms of contracts for unmarried people who want to share ownership of property. Also, because your shared home represents a major economic investment, you should hire a lawyer to help you prepare an agreement that meets your needs.

owner can be an individual or a group that owns a percentage of an asset in conjunction with another individual or group. The revenue, tax, legal, and financial obligations can be different for each coowner and will depend on the coownership agreement and nature of the asset.

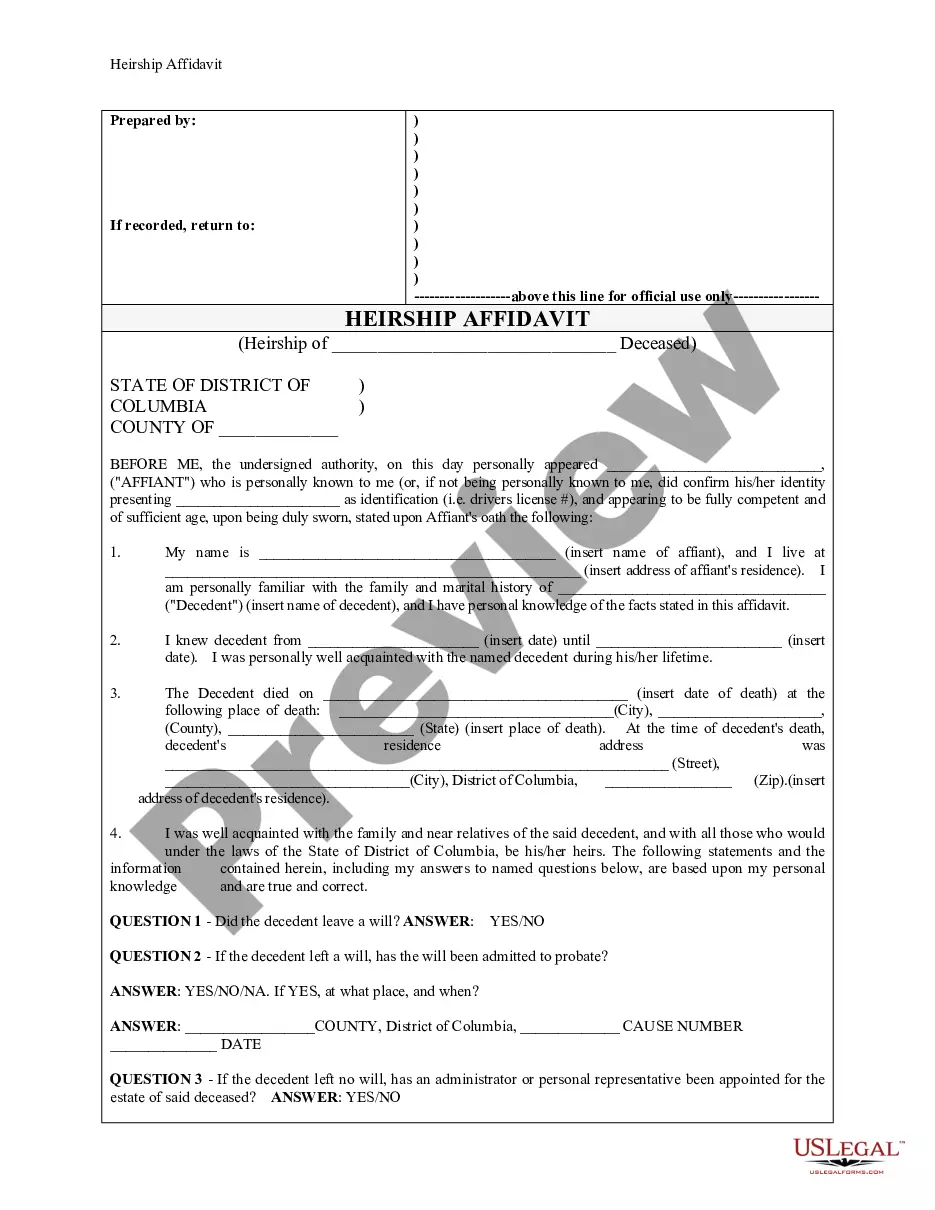

Draft a document for the parties to sign specifying the relationship between them, such as joint tenants in common, tenants in entirety, etc. Both parties must agree to the terms of the relationship, and sign the document to ensure that it is legally binding.

Contents Researching the relevant laws and regulations. Establishing the purpose of the agreement. Identifying the parties involved in the agreement. Determining the co-owners' rights and responsibilities. Drafting the agreement. Outlining the financial contributions and distributions of the co-owners.

Ownership agreements go by various names depending on the kind of entity you've created for your business. In a partnership, it's called a "partnership agreement." In an LLC, it is called an "operating agreement." And corporations have "bylaws" as well as perhaps a "shareholders' agreement."

A mortgage Agreement in Principle isn't legally binding and does not guarantee that the mortgage will be offered, even when applying with the same lender.

7 Best Practices When Drafting Simple Agreements Start with a clear statement of purpose. Define key terms and definitions. Use clear and concise language. Include dispute resolution provisions. Consider the potential consequences of the breach. Include termination and renewal provisions. Use a standard contract template.

Outlining the rights and obligations of each party Agree on what rights and responsibilities each party will have. Ensure that each party understands and agrees to the duties and obligations assigned to them. Identify what each party is responsible for, including any financial contributions.