Equity Agreement Statement Format In Pennsylvania

Description

Form popularity

FAQ

Pennsylvania Teacher Reciprocity Agreements Through the NASDTEC Interstate Agreement, Pennsylvania allows individuals who have completed a teacher preparation program, or who have already become teachers in other states, to be awarded Pennsylvania teaching certification through reciprocity.

Filing Requirements – Partnership A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations. The partnership passes through any profits (losses) to the resident and nonresident partners.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, in person, or online, but we recommend online. Online processing costs $40, plus $3 per document, and is usually immediate.

Composite returns: 1065 Pennsylvania (PA) Composite filer. Per form instructions, any payments will always be sent with Form PA-65.

A PTET election allows PTEs, which are not subject to the SALT cap, to deduct the state income taxes on the PTE's activities for federal income tax purposes. Pennsylvania is one of only five states, along with Delaware, Maine, North Dakota, and the District of Columbia, to have a PIT but no PTET election.

As of July 9, 2024, 36 states (and one locality) had enacted a PTET intended to meet the requirements of Notice 2020-75.

Pennsylvania families can choose from traditional public schools, public charter schools, public magnet schools, private schools, online learning, and homeschooling.

Pennsylvania does not permit the IRC § 732(d) or IRC § 754 election. The partnership must allocate each item of income (loss) by class to the partners in the same proportion that it uses for federal purposes.

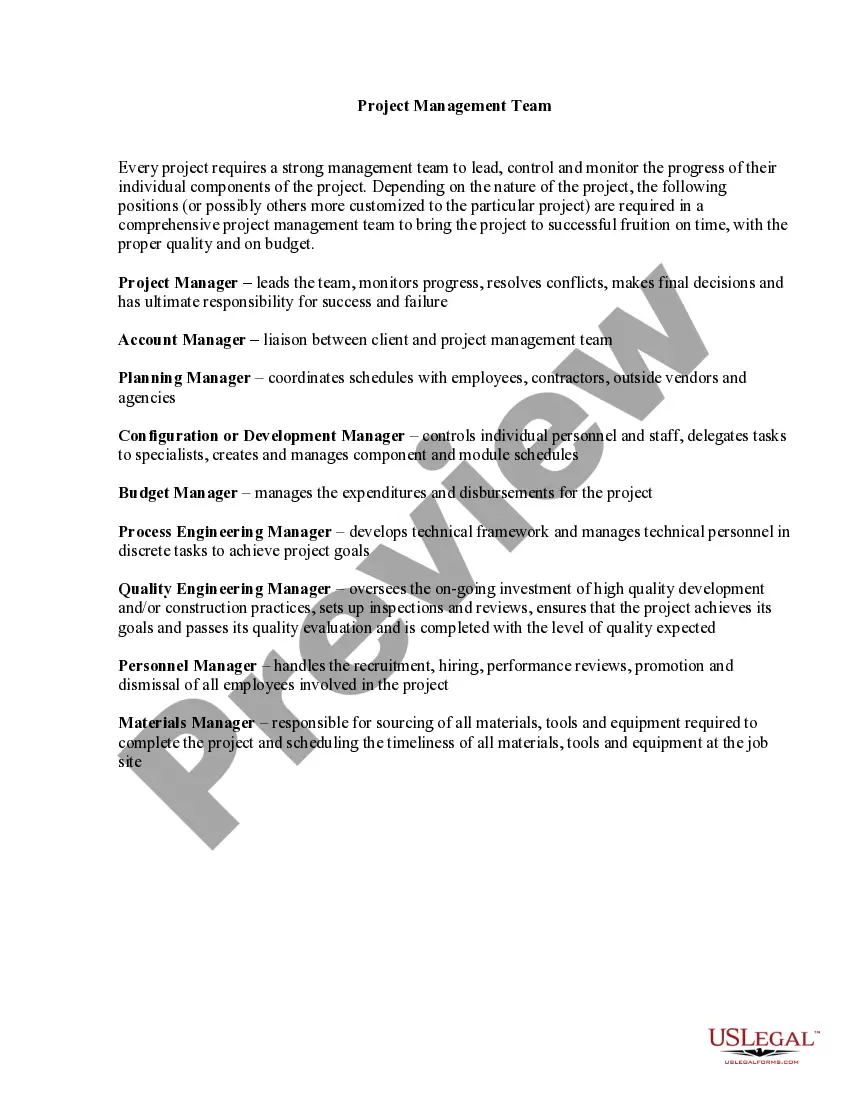

How to create an LLC operating agreement in 9 steps Decide between a template or an attorney. Include your business information. List your LLC's members. Choose a management structure. Outline ownership transfers and dissolution. Determine tax structure. Gather LLC members to sign the agreement. Distribute copies.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.