Template For Sale Of Shares Agreement In North Carolina

Description

Form popularity

FAQ

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

You'll need to use some sort of brokerage service or share trading platform to carry out your sale. An exception would be if you owned private equity shares and sold them directly to another investor. With this, the private company often has to approve the sale.

6 tips for writing the perfect sales letter Write a catchy hook. Engage people right from the start with a catchy headline (if applicable) and a hook in the introduction. Integrate case studies. Use statistics. Make it time-sensitive. Speak to the audience's desires and pain points. Make it easy to read.

Template of a Shareholder Letter Introduction. The introductory part is the welcoming section of a shareholder letter, and it outlines a brief history of the company, its primary activity, core objectives, mission, and vision. Financial Results. Achievements. Market Conditions. Plans and Measures. Acknowledgment.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

The core of the process involves selecting the specific stock you wish to buy or sell. You will need to input essential transaction details, including the quantity of shares to be bought or sold, and then place the buy or sell order on the trading platform.

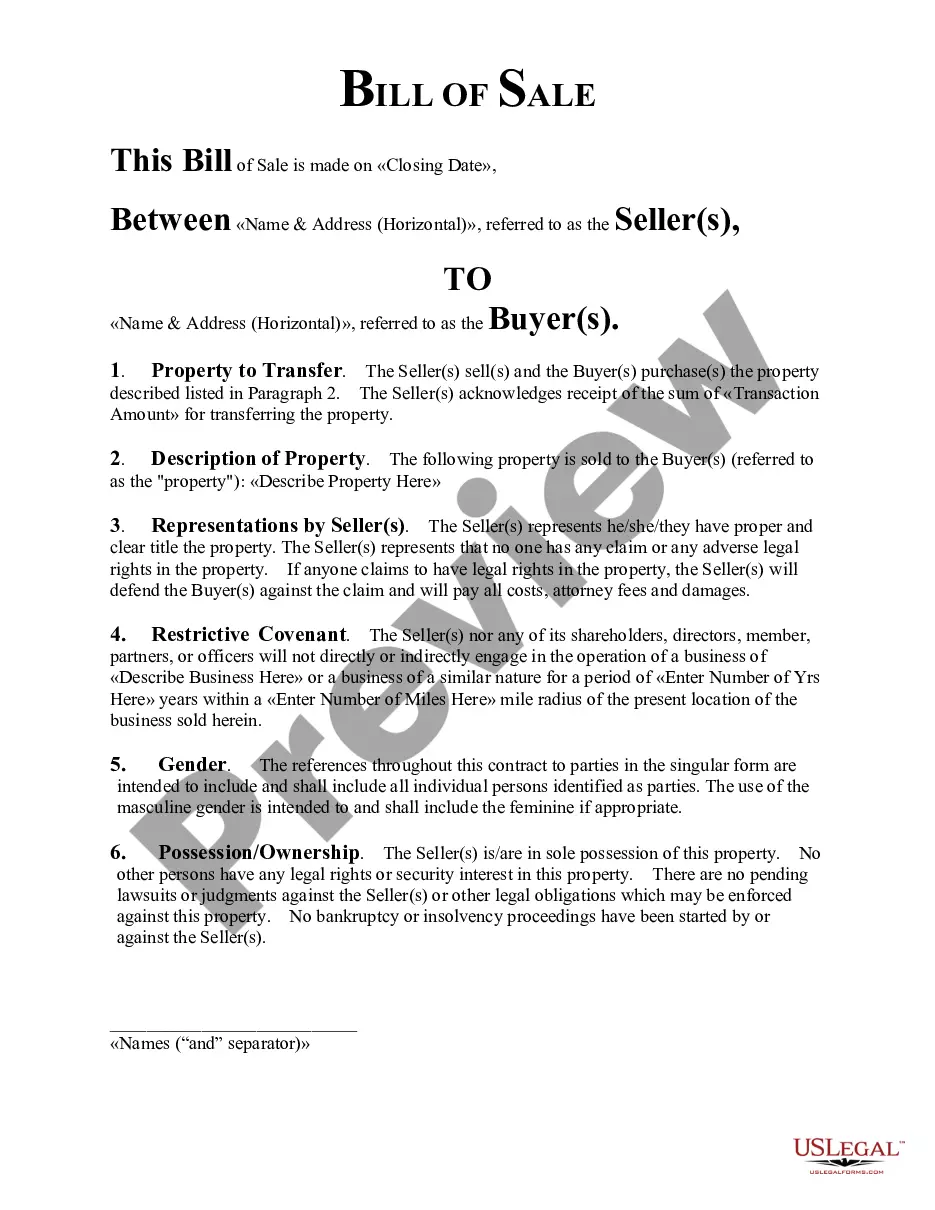

Key components of a Share Sale Agreement Identification of Buyer and Seller: Full names and addresses, ensuring the agreement's legality. Representations and Warranties: Essential clauses that protect the buyer from potential undisclosed liabilities. Dividends: Clarity on the allocation of dividends pre- and post-sale.

A share sale agreement provides a written record of the agreement between the buyer and the seller. It may be relevant in the event of future disagreement. As such, it should be as comprehensive as possible. There are typical provisions that each share sale agreement will include.