Stock With Equity In New York

Description

Form popularity

FAQ

Enacted in 1905, New York State's stock transfer tax (STT) is an excise tax levied on stock trades. The STT taxes each sale of stock worth over $20 at 5 cents.

You must report all 1099-B transactions on Schedule D (Form 1040), Capital Gains and Losses and you may need to use Form 8949, Sales and Other Dispositions of Capital Assets. This is true even if there's no net capital gain subject to tax. You must first determine if you meet the holding period.

TurboTax Tip: Since stock you receive through RSUs and stock grants is compensation, you'll typically see it reported automatically on your W-2 and subject to income and payroll taxes. You may be able to have taxes withheld from the sales proceeds of the stock shares instead of your paycheck.

Profits from a stock are taxed as either short-term or long-term capital gains. Tax rates on long-term capital gains are usually lower than those on short-term capital gains. That can mean paying lower taxes — and sometimes even no tax — on profits.

ITR Form. ITR-2 i.e. ITR Form to report capital gains income from sale of equity shares and equity mutual funds. In case trading in equity shares and mutual funds is treated as business income, ITR 3 should be filed.

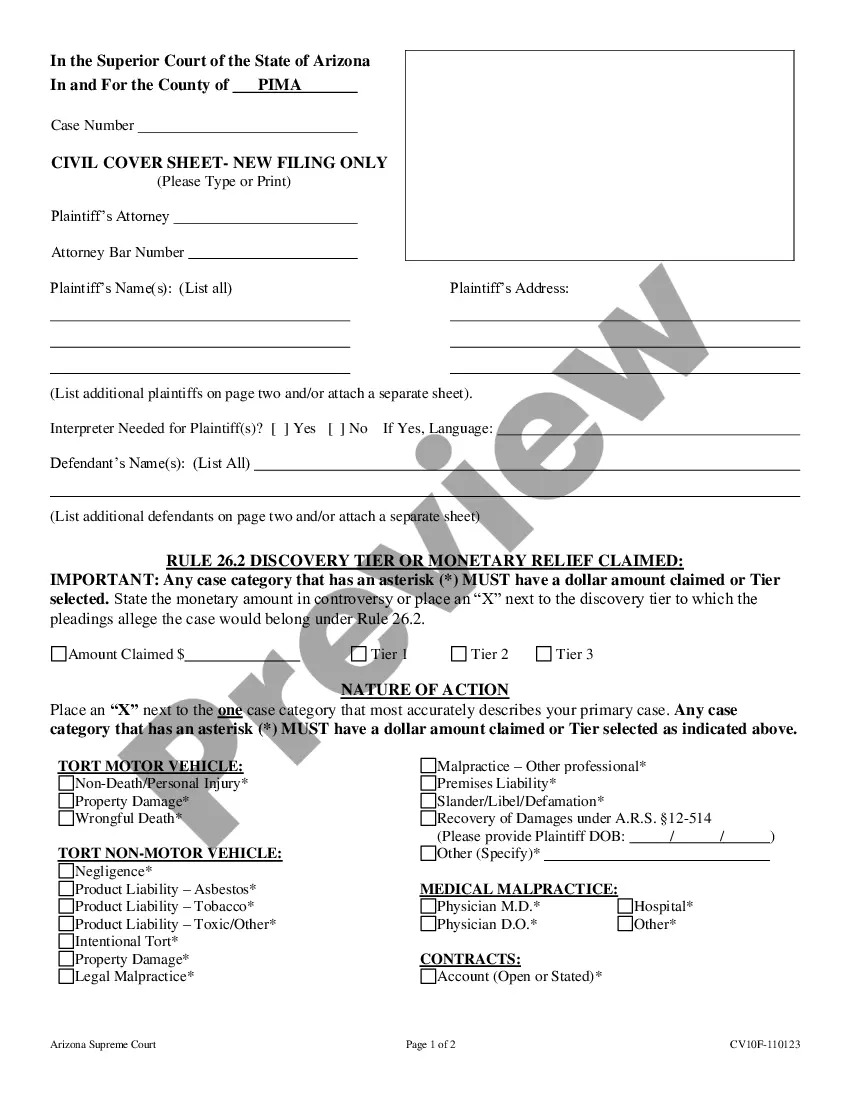

To trade US stocks on the New York Stock Exchange (NYSE), corporate and trust accounts are required to be registered on the NYSE website in addition to submitting the W-8BEN E form. This can be done by completing and submitting an NYSE form, followed by a 3rd Party Billing Addendum.

To buy shares independently, open a Demat and trading account with a registered broker. Log in to your trading platform, search for the stock, enter the quantity, and place an order. Once executed, shares are credited to your Demat account.

In investing, the 80-20 rule often manifests as 20% of a portfolio's holdings driving 80% of its growth. Conversely, the principle also suggests that 20% of the holdings could account for 80% of the portfolio's losses.

The :10 rule is an investment strategy where 70% of your portfolio is allocated to low-risk investments, 20% to medium-risk investments, and 10% to high-risk investments, helping manage market fluctuations and ensuring balanced growth.

Membership Process Step 1: Qualify. Membership is available to SEC registered broker-dealers who have obtained a self-regulatory organization (SRO) and have an established connection to a clearing firm. Step 2: Fill out the necessary forms. Step 3: Connect.