Consulting For Equity Agreement Template In Miami-Dade

Description

Form popularity

FAQ

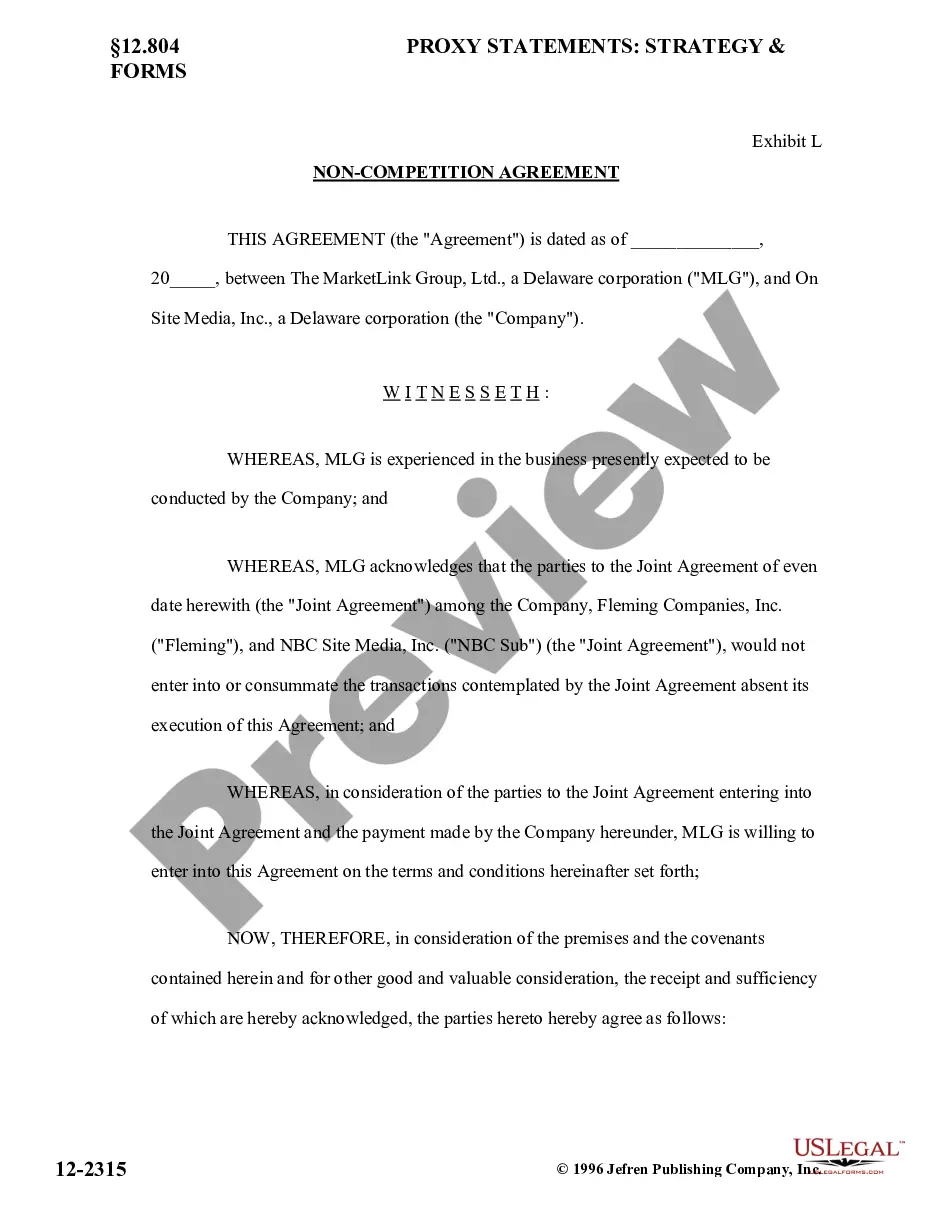

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

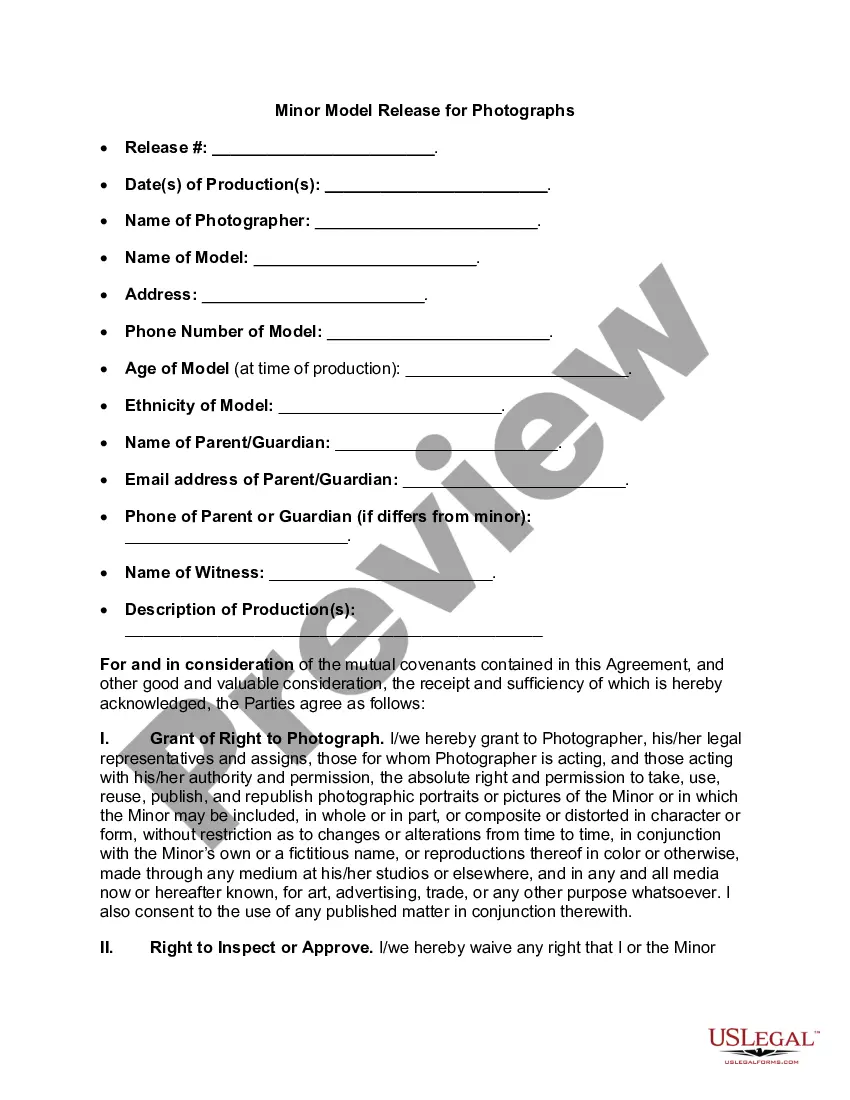

How do you structure a consulting agreement? Your consulting agreements should start with the details of each party, lay out the scope of work, define the terms and conditions of the contract, and leave a space for each party to add their signature.

Many consultants choose to join an Operations Team at the Private equity level because it allows them to leverage their consulting toolkit to assess and drive operational improvement opportunities within a firm's portfolio.

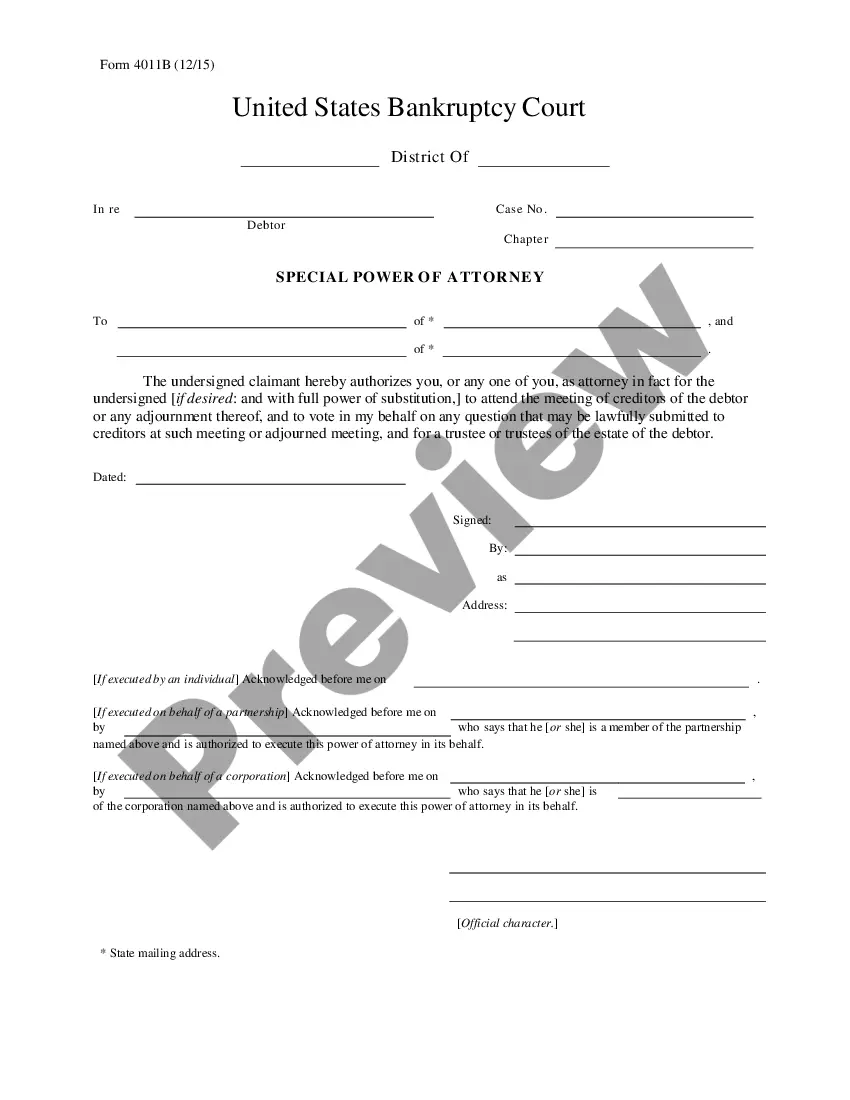

The short answer is yes. However, you have to ensure that your offering is compliant with all the relevant regulations in both your and your contractor's country. In some regions, for instance, your contractor may be eligible to receive non-qualifying stock options, but your contractors in other countries may not.

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants. Also known as non-statutory stock options, profits on these are considered to be ordinary income and are taxed as such.

Key Differences Scope: Service Agreements generally define a broader scope of services, while Consulting Agreements have a narrower focus on the consultant's specialized expertise.

Are Consulting Agreements Legally Binding? Consulting agreements are binding contracts that can have legal consequences. The terms of a consulting agreement often have clauses that explain what to do if a dispute occurs and what actions the offended party could take.