Shareholder Consent Form For Existing Company In Maryland

Description

Form popularity

FAQ

To submit the Maryland Sales and Use Tax Form 202, ensure that all fields are accurately completed. You can file the form electronically through the Maryland taxes website or submit it by mail to the Comptroller of Maryland at Revenue Administration Division, PO Box 17405, Baltimore, MD 21297-1405.

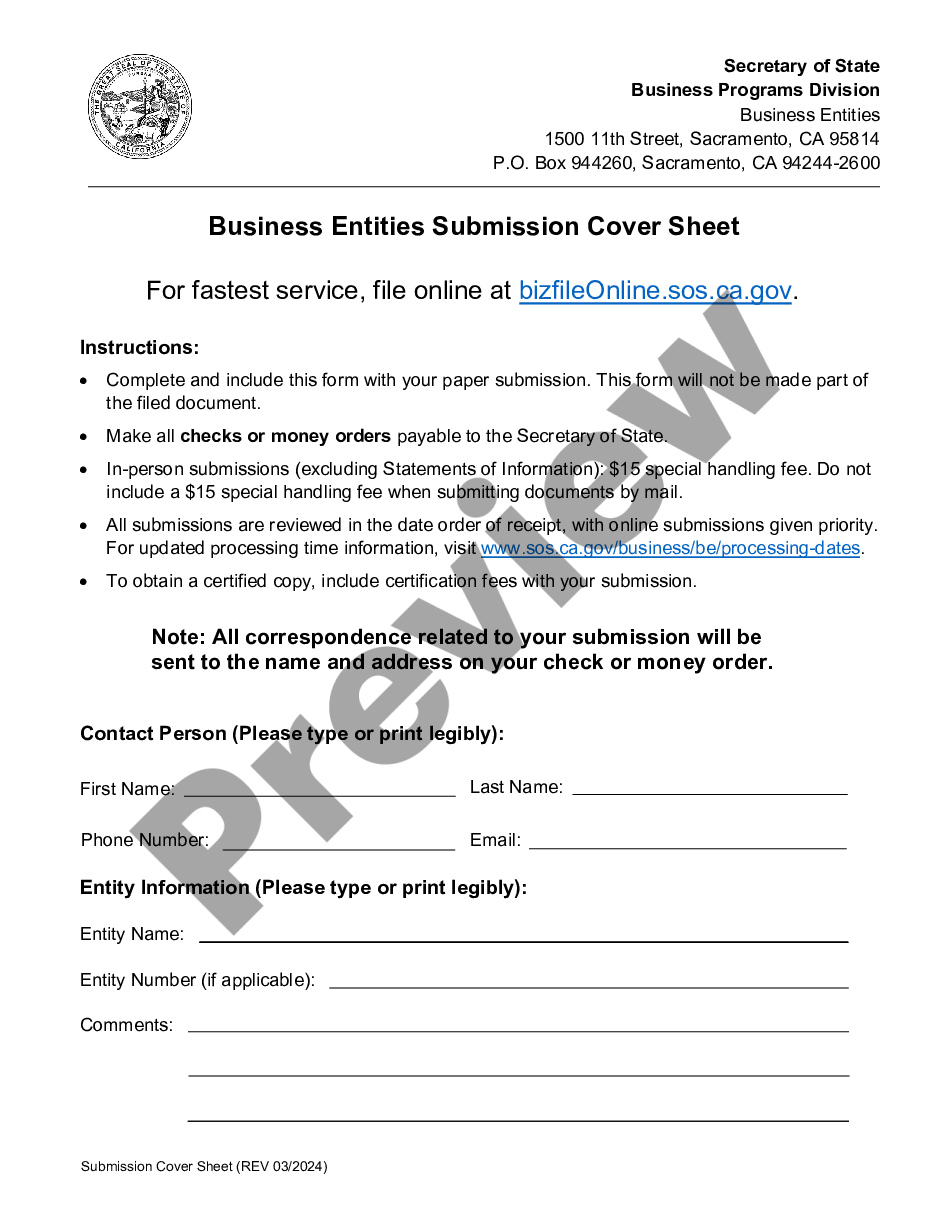

How to Form an S Corp in Maryland Name your Maryland LLC. Appoint a resident agent in Maryland. File Maryland Articles of Organization. Create an operating agreement. Apply for an EIN. Apply for S Corp status with IRS Form 2553.

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply) Credit Unions must file a Form 3 Annual Report (fees apply)

BUSINESS PERSONAL PROPERTY RETURN An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st .

Upon approval, the Department of Assessments and Taxation will issue you an SDAT Identification Number, which will begin with a letter (“D”, “F”, “W”, “L”, “T” or “Z”). This number serves as Maryland's unique identifier for your business.

An electronic certificate of good standing will be emailed to you within five business days. All certificates are valid for ninety days from issuance.

Maryland Department of Transportation Motor Vehicle Administration.

The Maryland Department of Assessments and Taxation (also known as the State Department of Assessments and Taxation, or SDAT) is a customer-focused agency that works to ensure property is accurately assessed, business records are appropriately maintained, and necessary tax-related information is conveyed to state ...

BUSINESS PERSONAL PROPERTY RETURN An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st .