Cost Sharing Contract Example Withholding Tax In Maryland

Description

Form popularity

FAQ

For self-employed individuals, this tax is similar to the payroll taxes withheld from employees' paychecks. The current rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

Determine the amount of withholding for Social Security and Medicare taxes by multiplying each payment by the employee tax rate. For the current year social security wage base limit and Social Security and Medicare tax rates refer to Publication 15, (Circular E), Employer's Tax Guide.

All Maryland employers paying any kind of wage, salary, or other compensation must withhold Maryland state tax from these payments. Employers are responsible for withholding and remitting income taxes, unemployment insurance taxes, and local jurisdiction taxes.

Calculating Your Withholding Tax Marginal Tax Rates for 2024 10% $11,600 or less $23,200 or less 12% $11,601 to $47,150 $23,201 to $94,300 22% $47,151 to $100,525 $94,301 to $201,050 24% $100,526 to $191,950 $201,051 to $383,9004 more rows

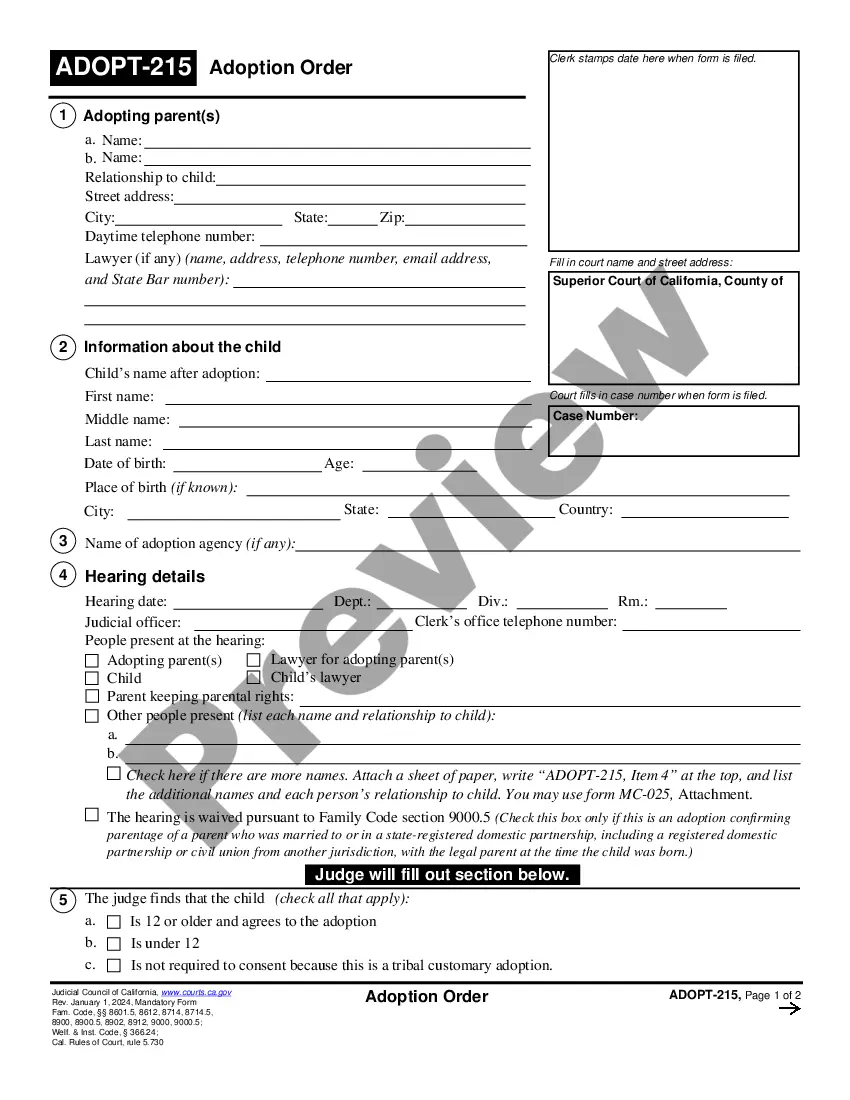

At the top of form MW507 is the section to input all of your personal information. The details listed in this area will include your full name, social security number (SSN), street address, country of residence, and whether you are single, married, or married but you withhold your taxes at the single rate.

Note: The W-4 form 2024 steps are the same as the W-4 form 2025 steps. Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

EXEMPTION AMOUNT CHART The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

Because claiming Exempt has a clearly falsifiable attestation (that you had no tax liability in the prior year), it is generally a Bad Idea to falsely claim Exempt.

Ing to the IRS Tax Topic 751 on withholding, to claim exempt, you must have had no federal income tax liability last year and expect to have no federal income tax liability this year.