Simple Cost Sharing Agreement With 100 In Maricopa

Category:

State:

Multi-State

County:

Maricopa

Control #:

US-00036DR

Format:

Word;

Rich Text

Instant download

Description

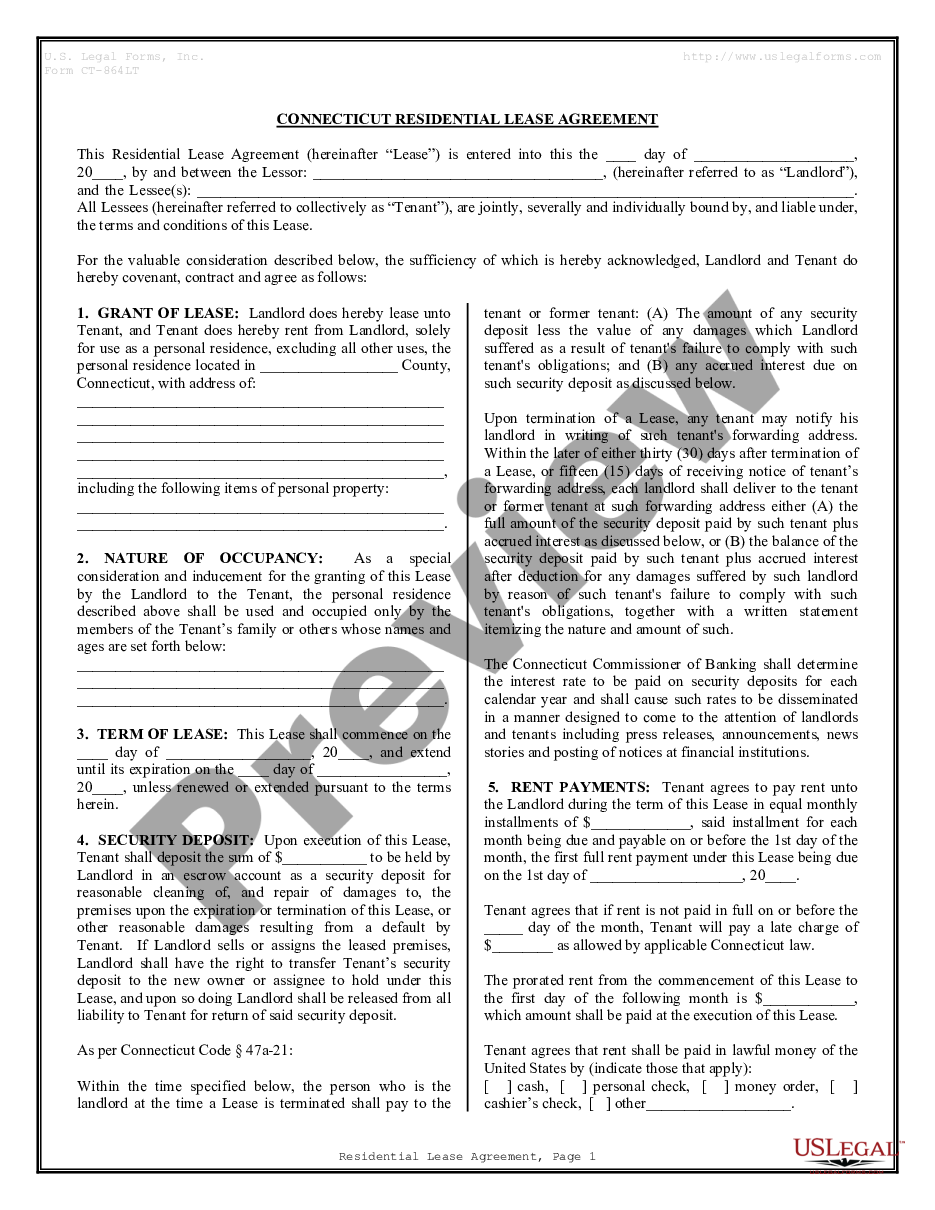

The Simple Cost Sharing Agreement with 100 in Maricopa provides a framework for two parties to outline the terms of sharing costs associated with a specified property or service. This agreement features key sections including purchase price allocation, property residency stipulations, equity contribution specifics, and provisions for rental obligations. It allows both parties to clarify their financial responsibilities, ensuring that expenses like down payments, maintenance, and future improvements are shared equitably. This form simplifies legal complexities around property co-ownership and financing by delineating terms clearly. Users must fill in personal information, property details, and specific financial arrangements. Editing is permitted where necessary, particularly in detailing percentages involved and the legal descriptions. Attorneys can use this form to advise clients in property partnerships, while paralegals and legal assistants can assist in documentation and compliance. Overall, this agreement serves as a vital tool for legal professionals and partners looking to establish a transparent understanding of their financial interactions regarding shared investments.

Free preview

Form popularity

FAQ

Under A.R.S. 42-13301 the LPV is the limited property value of the property in the preceding valuation year plus five percent of that value.

Under A.R.S. 42-13301 the LPV is the limited property value of the property in the preceding valuation year plus five percent of that value.

FCV is used to calculate taxes for voter approved bonds, BUDGET overrides and certain special districts. Limited Primary Value (LPV) is a legislatively established value based on a mathematical formula that limits the amount of increase in any given year.