Share Agreement Contract With Consultant In Houston

Description

Form popularity

FAQ

As an independent contractor, you are not legally required to form a Limited Liability Company (LLC), but there are several reasons why you might consider doing so: Advantages of Forming an LLC: Limited Liability Protection: An LLC can protect your personal assets from business liabilities.

Another important way to find contract work as a consultant is to build and optimize your online presence. This includes creating a professional website, portfolio, and social media profiles that highlight your skills, experience, and testimonials.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all ...

The consultant doesn't implement the strategies they suggest. The client puts the suggestions into action. On the other hand, a contractor performs the work for their clients. A typical contract stipulates that they're responsible for completing a defined set of tasks in the way the client wants.

To limit your liability and protect your assets, you should include a liability clause in your consulting contract that defines the maximum amount of compensation you are liable for, the types of damages you are not liable for, and the situations in which you are not liable at all.

Key takeaways: The primary difference between a consultant and a contractor is that a consultant advises on an organization's needs and potential solutions, while a contractor executes tasks based on those requirements.

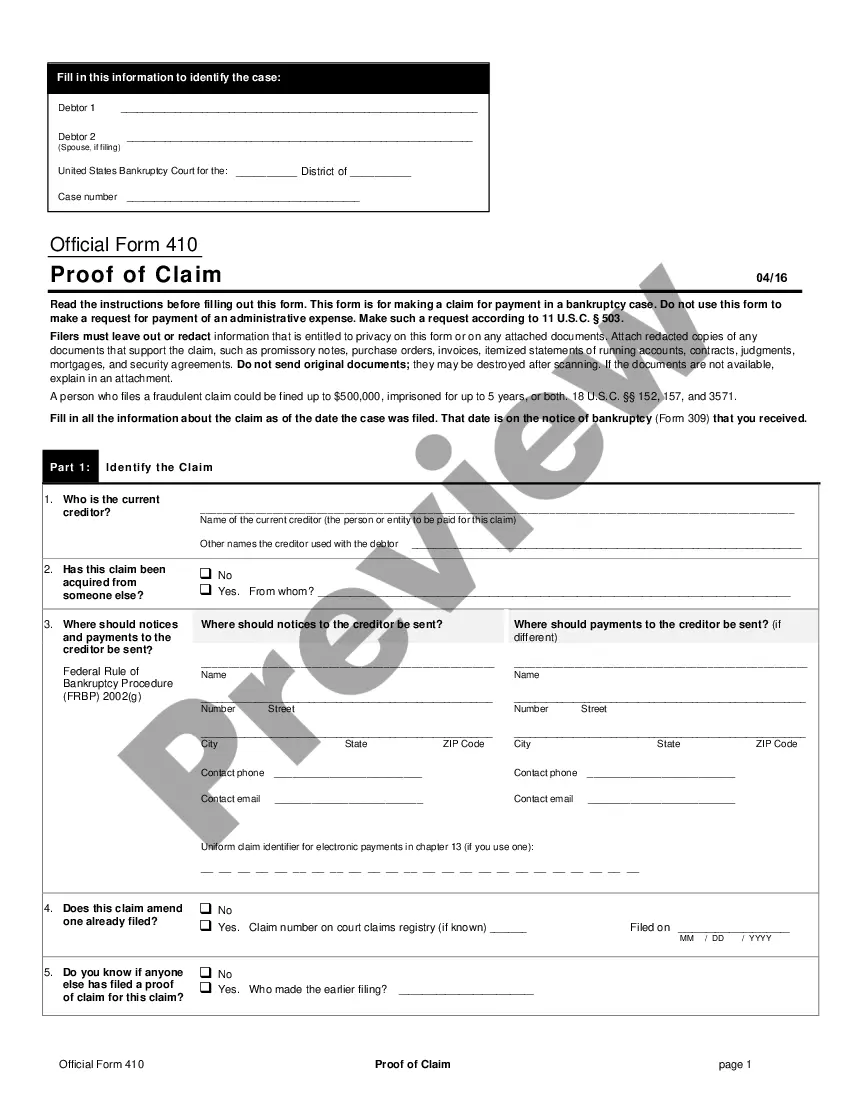

A consulting agreement is a contractual document that describes a working relationship between a business and a consultant providing that company with their services. Other terms that are used to refer to a consulting agreement include: Business consulting agreement. Independent contractor agreement. Freelance contract.

A consultancy agreement allows two parties to engage in a business relationship where one side works as an external consultant. A consultant can be either an individual or a company.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.