Business Equity Agreement With Negative In Harris

Description

Form popularity

FAQ

What Happens If Return on Equity Is Negative? If a company's ROE is negative, it means that there was negative net income for the period in question (i.e., a loss). This implies that shareholders are losing on their investment in the company.

If total liabilities exceed total assets, the company will have negative shareholders' equity. A negative balance in shareholders' equity is generally a red flag for investors to dig deeper into the company's financials to assess the risk of holding or purchasing the stock.

Negative brand equity occurs when a brand's associations and brand experience become unfavorable among customers. This can stem from various factors, including product or service failures, unethical business practices, poor customer experience, outdated brand positioning, or negative publicity crises.

Negative equity is when your property becomes worth less than the remaining value of your mortgage. To be in negative equity, the value of your house must fall below the amount you still owe on your mortgage. Equity is the value of your property that you own outright.

A person who has negative equity is said to have a negative net worth, which essentially means that the person's liabilities exceed the assets he owns. A common example of people who have a negative net worth are students with an education line of credit.

Key Takeaways: Negative equity is when your home is worth less than you owe on it. Declining property values are the primary cause of negative equity, but it also can be affected by failing to maintain your home or missing mortgage payments.

A firm's book equity is a measure of the value held by a firm's ordinary shareholders. Increasingly, it is being reported as a negative number. Because a firm's limited liability structure means that shareholders cannot have negative value, negative book equity has no obvious interpretation.

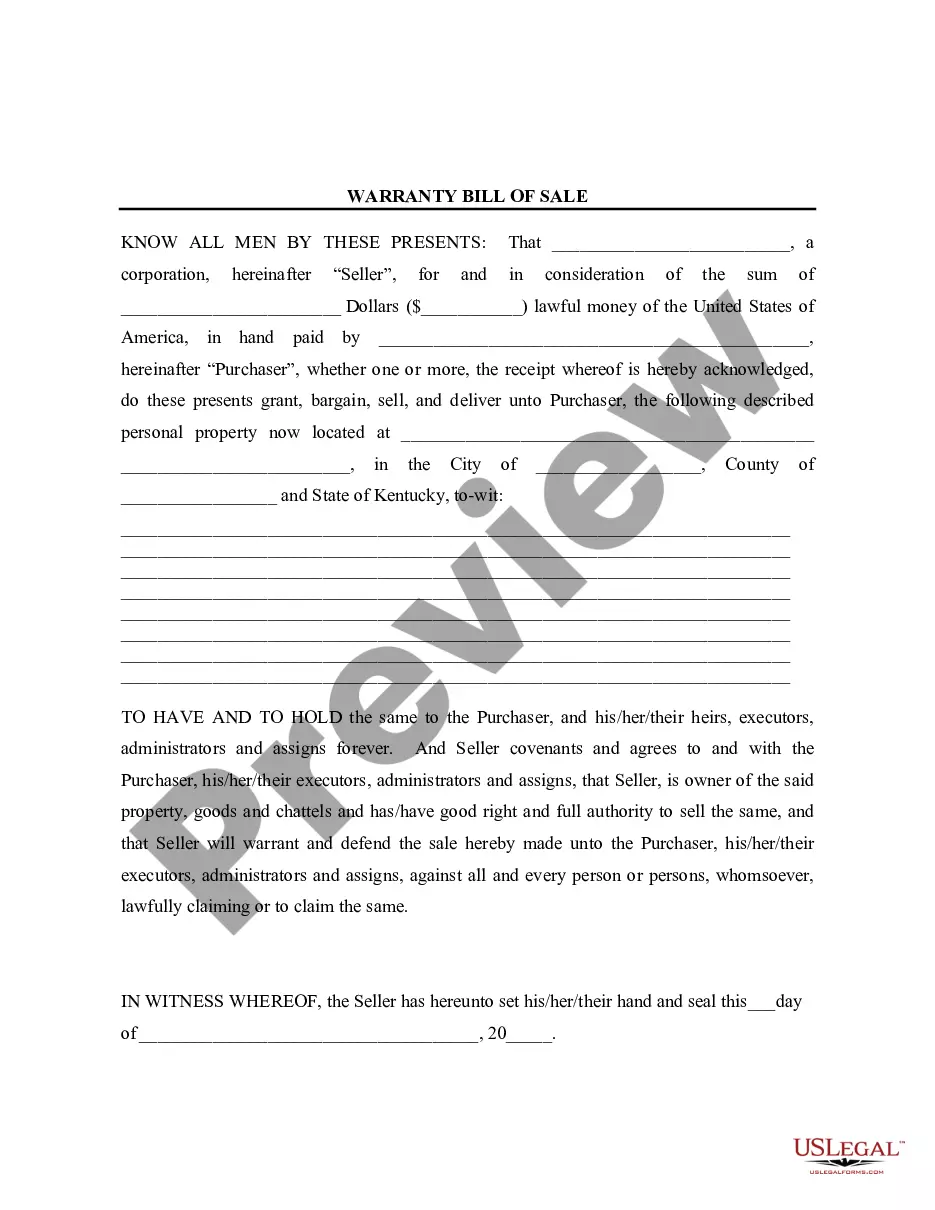

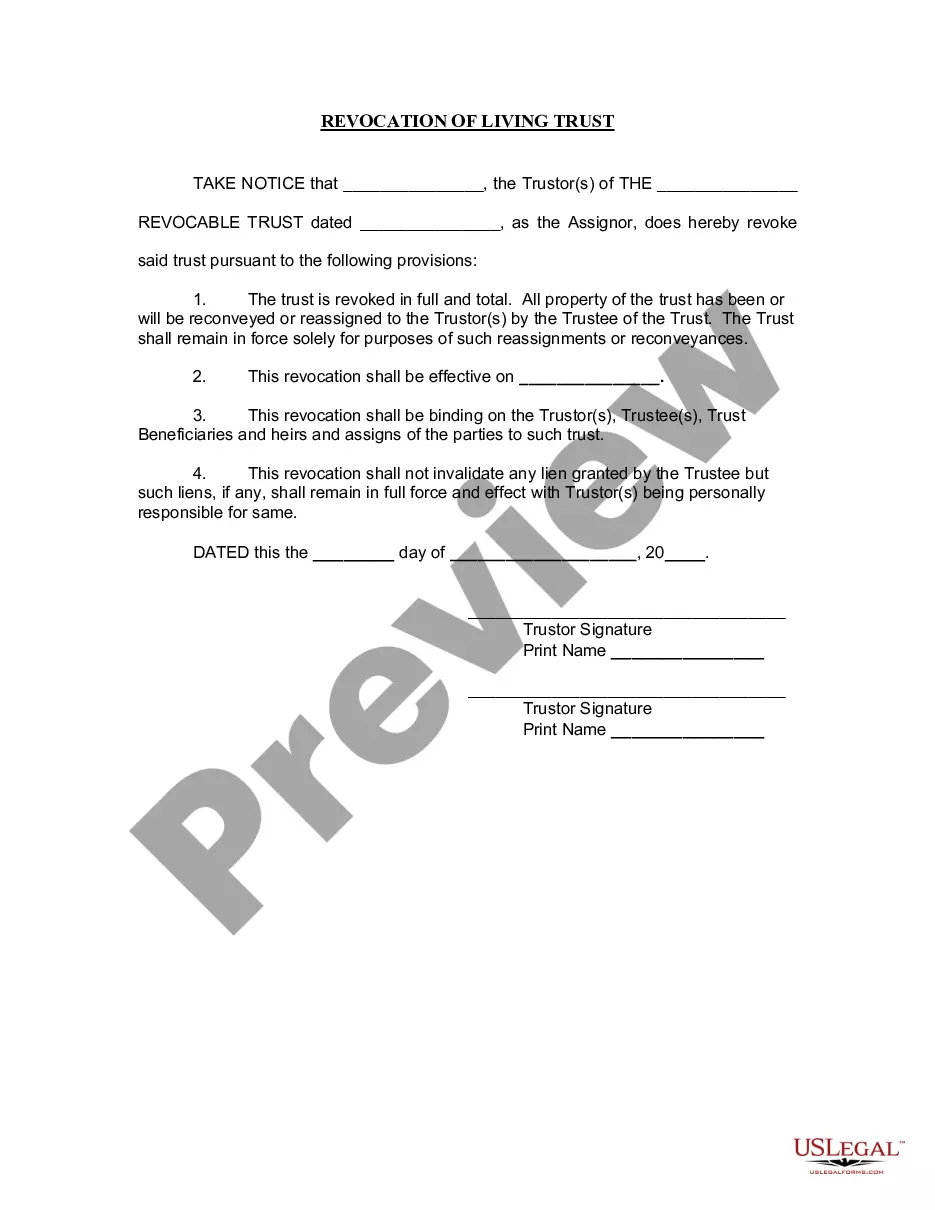

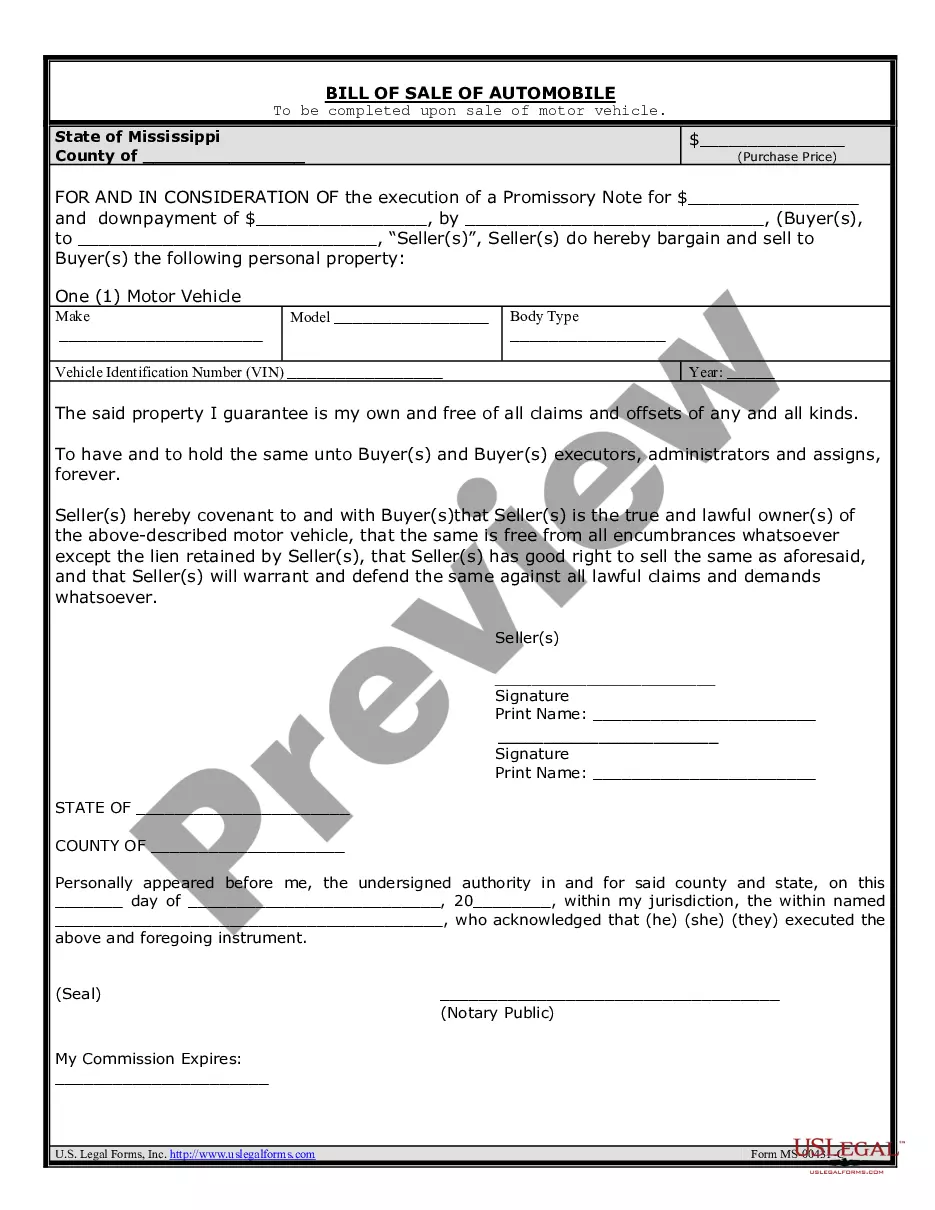

This contract is usually employed when businesses or individuals make a contribution to a project, partnership, or company in return for equity or shares. The agreement can also be used for other types of contributions, such as services or time spent on a project.

If total liabilities exceed total assets, the company will have negative shareholders' equity. A negative balance in shareholders' equity is generally a red flag for investors to dig deeper into the company's financials to assess the risk of holding or purchasing the stock.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.