Share Agreement Contract With Bank In Franklin

Description

Form popularity

FAQ

Franklin Templeton mutual funds offer a range of benefits and risks for investors. While diversification, professional management, and flexibility are among the benefits, market risk, management risk, and fees are among the potential downsides.

Download the Franklin Templeton US mobile app to buy, sell, track and manage your accounts right from your Apple® or Android™ phone. Click the link below to learn more or scan the QR code with your phone's camera to download the app!

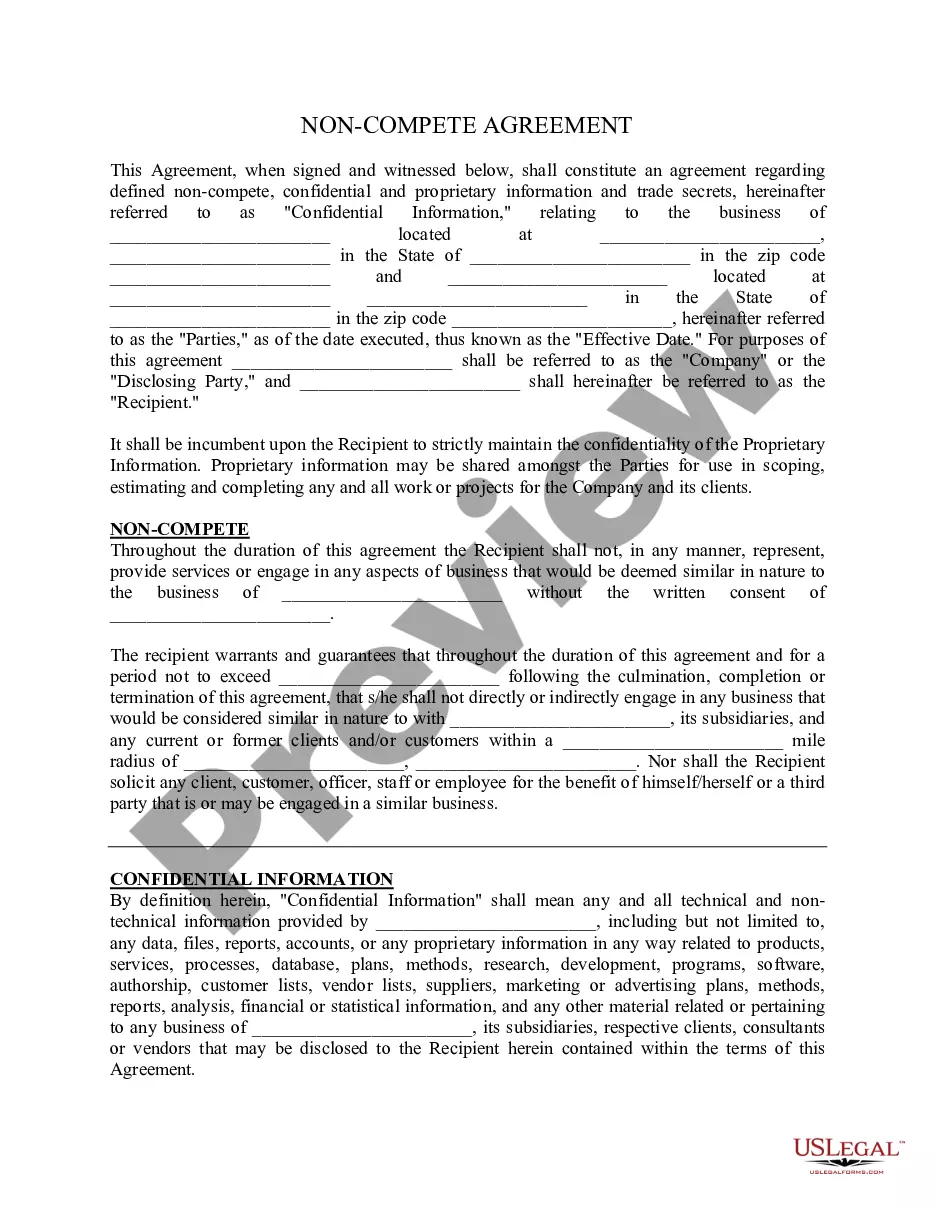

How to draft a contract between two parties: A step-by-step checklist Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

Account agreements include deposits and security assets used to secure funding, the responsibilities and liabilities of the bank or intermediary, and the type of interest that may be charged on the deposits or collateral. These agreements also assist in defining terms between parties so that the expectations are clear.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

How to draft a contract between two parties: A step-by-step checklist Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.