Equity Shareholders Agreement With Call Option In Cook

Description

Form popularity

FAQ

Equity can be thought of as a call option on the company's assets with a strike equal to the face value of the debt. This is true because of the concept of limited liability. Limited liability reduces the risk of loss for equity investors if the firm is valued less than the value of the outstanding debt.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

There are two main types of options: call options, which give the holder (buyer) the right to buy the underlying asset, and put options, which give the holder (buyer) the right to sell the underlying asset.

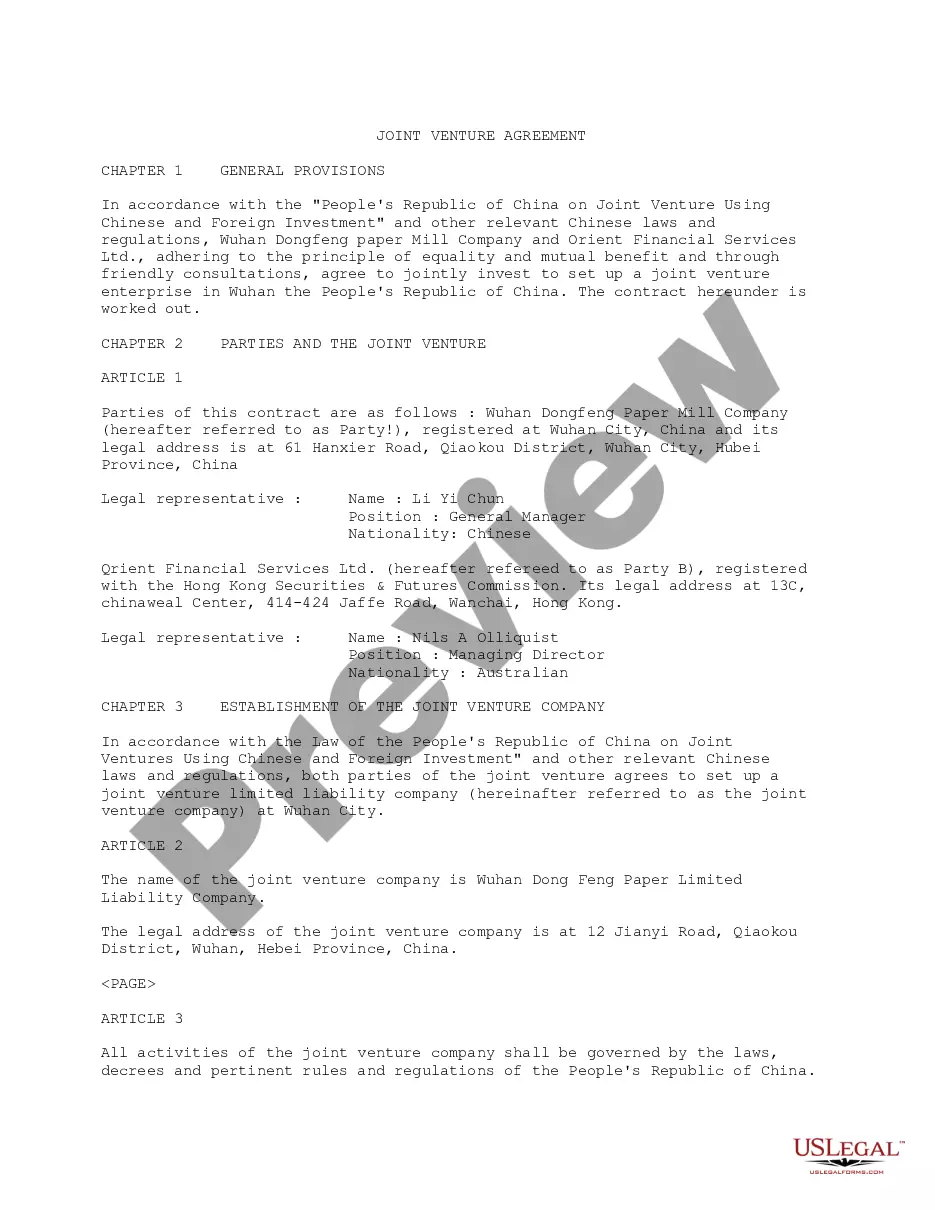

A put and call option agreement for use by a private limited company where the seller grants the buyer a call option over shares and the buyer grants the seller a put option over the same shares.

How do I create a Shareholder Agreement? Step 1: Provide details about the corporation. Step 2: Include details about the shareholders. Step 3: Provide details about share ownership. Step 4: Outline share information including class and number. Step 5: Determine how the corporation's directors will be appointed.

Any company – whether organized as an LLC, Corporation, or partnership – with more than one shareholder, especially if they are actively involved in the business, should have a shareholder agreement.