Shareholder Withdrawal Agreement Sample In Chicago

Description

Form popularity

FAQ

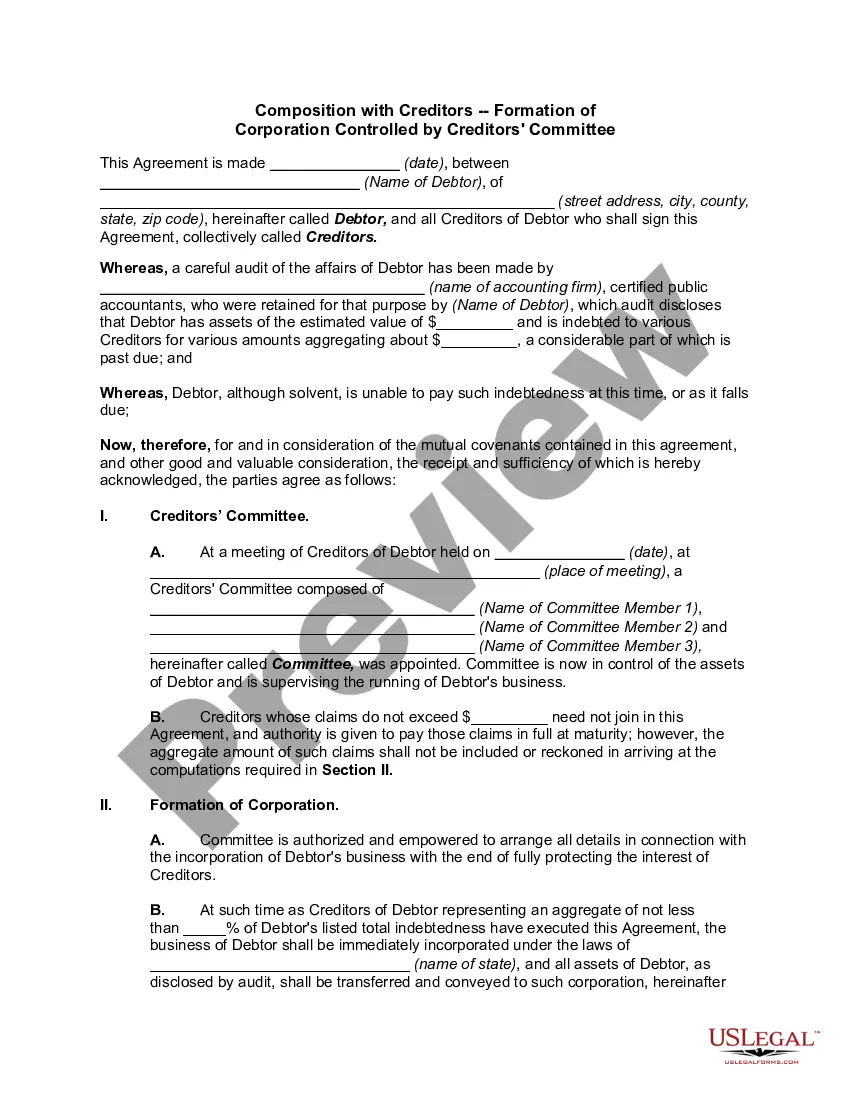

How to remove a shareholder Refer to the shareholders' agreement. A shareholders' agreement outlines the rights and obligations of each shareholder in an organization. Consult professionals. Claim majority. Negotiate. Create a noncompete agreement.

A shareholders' agreement is an agreement between the shareholders of a company. It can be between all or some shareholders, like holders of a certain share class. Its purpose is to protect your investment, build good relationships between you and other shareholders, and govern how you run the company together.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

How do I create a Shareholder Agreement? Step 1: Provide details about the corporation. Step 2: Include details about the shareholders. Step 3: Provide details about share ownership. Step 4: Outline share information including class and number. Step 5: Determine how the corporation's directors will be appointed.

First, the shareholder must have violated either the shareholders' agreement or the bylaws (or both), and a resolution for removal has to be drawn up and presented to the Board of Directors. The cause for the removal must be stated, and a buy-out request to gain back the shares can also be included.

The first way you can terminate a shareholders agreement is by mutual agreement. This is when all of the shareholders decide that they no longer want to comply with the agreement due to various reasons.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

Provided it has been properly executed, a shareholder agreement is a legally binding contract and can be enforced. This is a good reason to ensure that it has been drawn up by an expert, as it could one day end up before the court, where it will be examined in detail.

The first way you can terminate a shareholders agreement is by mutual agreement. This is when all of the shareholders decide that they no longer want to comply with the agreement due to various reasons.