Cost Sharing Contract Example Withholding Tax In California

Description

Form popularity

FAQ

California is a community property state. When filing a separate return, each spouse/RDP reports the following: One-half of the community income. All of their own separate income.

Number of regular allowances claimed on DE-4 or W-4. Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages. AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4 or W-4.

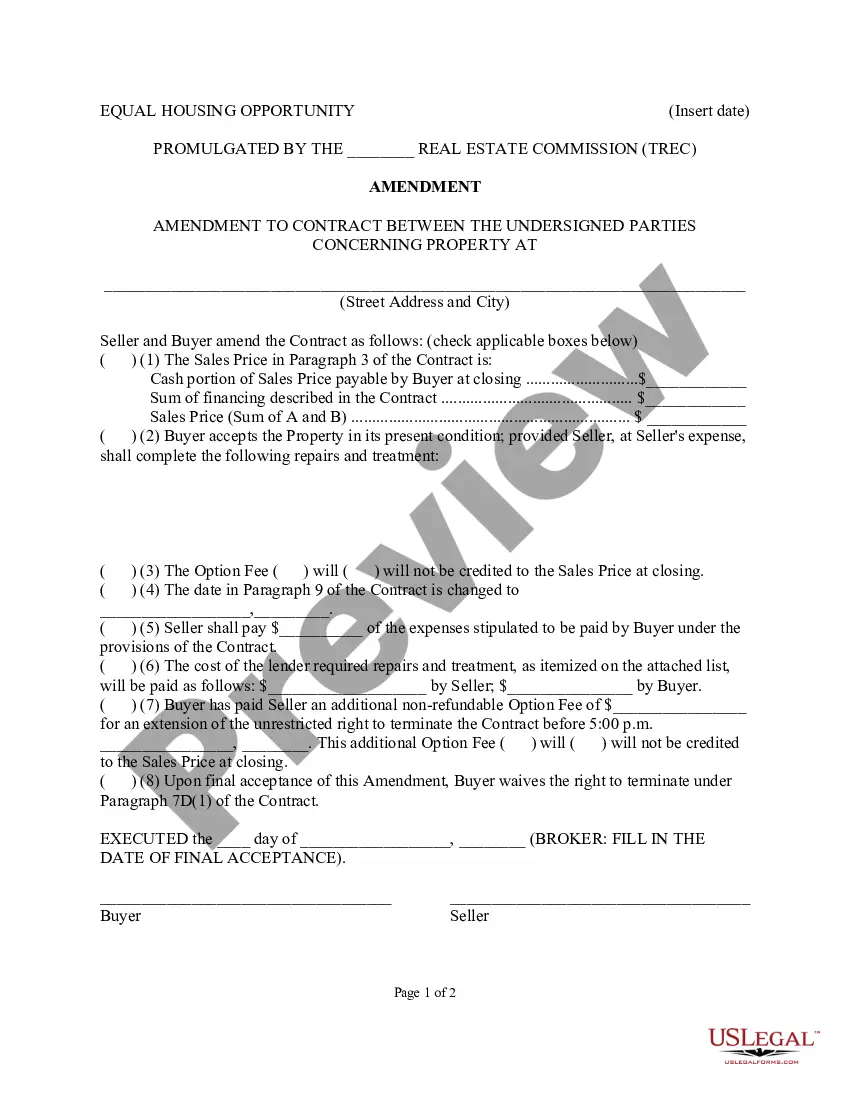

Seller/Transferor and Buyer/Transferee must complete the perjury statement, sign and date on Side 3 of Form 593 when the initial sale occurs. For the remaining installment payments, the Buyer/Transferee must sign all subsequent Form 593s.

How To Complete Form 540: A Step-by-Step Guide Step 1: Gather required information and documents. Step 2: Provide basic information. Step 3: Report income. Step 4: Calculate adjustments and deductions. Step 5: Determine tax liability and credits. Step 6: Withholdings and payments. Step 7: Review and sign.

How To Complete Form 540: A Step-by-Step Guide Step 1: Gather required information and documents. Step 2: Provide basic information. Step 3: Report income. Step 4: Calculate adjustments and deductions. Step 5: Determine tax liability and credits. Step 6: Withholdings and payments. Step 7: Review and sign.

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

The amount of tax withheld is determined by the following. The amount of income subject to tax. The number of allowances claimed on your Employee's Withholding Allowance Certificate (IRS Form W-4 or EDD Form DE 4 ) submitted to your employer.

Number of regular allowances claimed on DE-4 or W-4. Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages. AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4 or W-4.

Overview of California Taxes Gross Paycheck$2,415 Federal Income 8.58% $207 State Income 3.08% $74 Local Income 0.00% $0 FICA and State Insurance Taxes 8.65% $20923 more rows