Equity Share For In Bexar

Description

Form popularity

FAQ

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home.

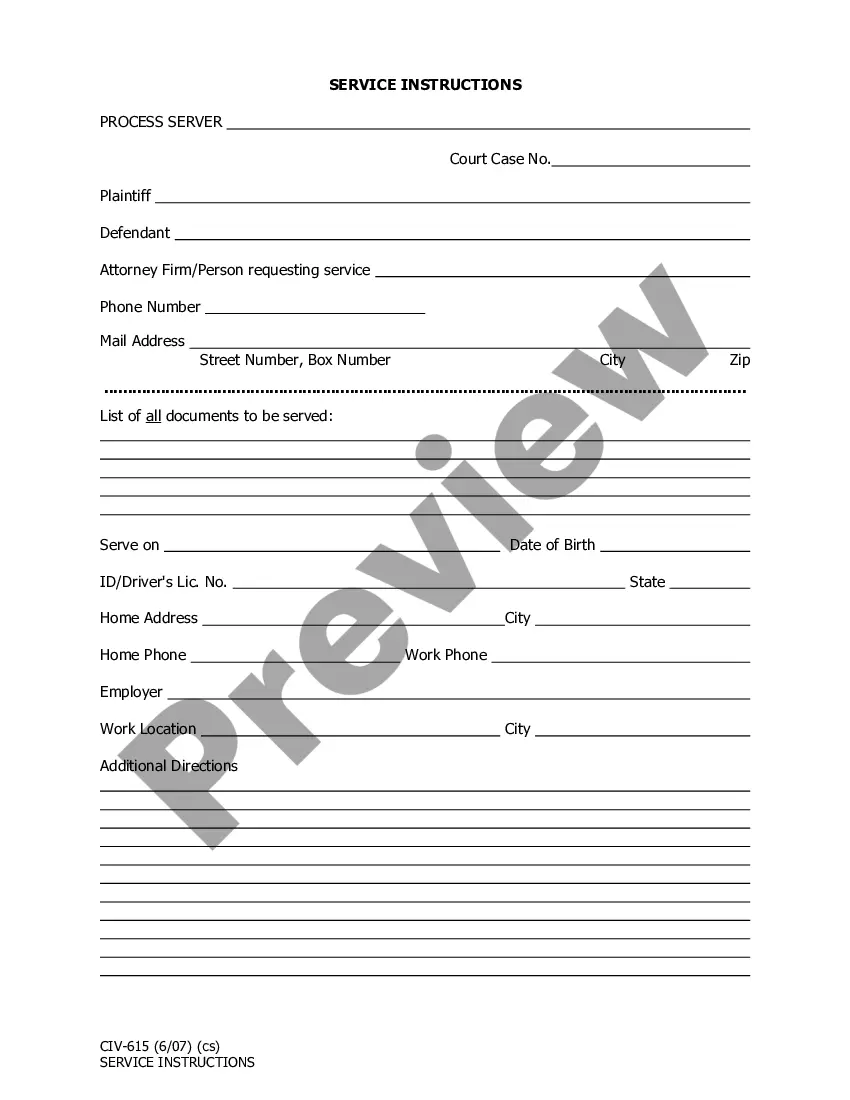

Procedures: Please e-file all appropriate documents for your case with the Bexar County Probate Clerk's office, including Proposed Orders, Judgments, Affidavits of Heirship, and Proof of Death for review.

File & ServeXpress is recognized as a “Texas Best” for eFiling by Texas Lawyer, and provides eFiling and eService for multiple large U.S. and state government entities including more than 20 attorney generals' offices and more than 100 top U.S. litigation firms.

For all non-emergencies, please call the Dispatch Office. Dispatch Office: 210-335-6000 (TTY Available) 210-335-GANG (210-335-4264) Crime Stoppers Tip Line: 210-224-STOP (7868) or 800-252-8477.

Electronic filing is mandated for civil cases filed by attorneys in county- level, district, and appellate courts and is permissive for criminal cases. Administration administers the state's contract with a private vendor to provide mandated electronic filing services in the judicial system.

How To eFile. Choose an electronic filing service provider (EFSP) at eFileTexas. An electronic filing service provider (EFSP) is required to help you file your documents and act as the intermediary between you and the eFileTexas system. For eFiling questions you may call 210-335-2496 or 855-839-3453.

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

Find a Inmate's SID (System Identification Number) Visit the Magistrate's Office Search Website. Call Central Filing at 210-335-2238 (Misdemeanor Records) Call District Clerk at 210-335-2591(Felony Records)

Bexar County is included in the San Antonio–New Braunfels, TX metropolitan statistical area. It is the 16th-most populous county in the nation and the fourth-most populated in Texas. Bexar County has a large Hispanic population with a significant growing African American population.

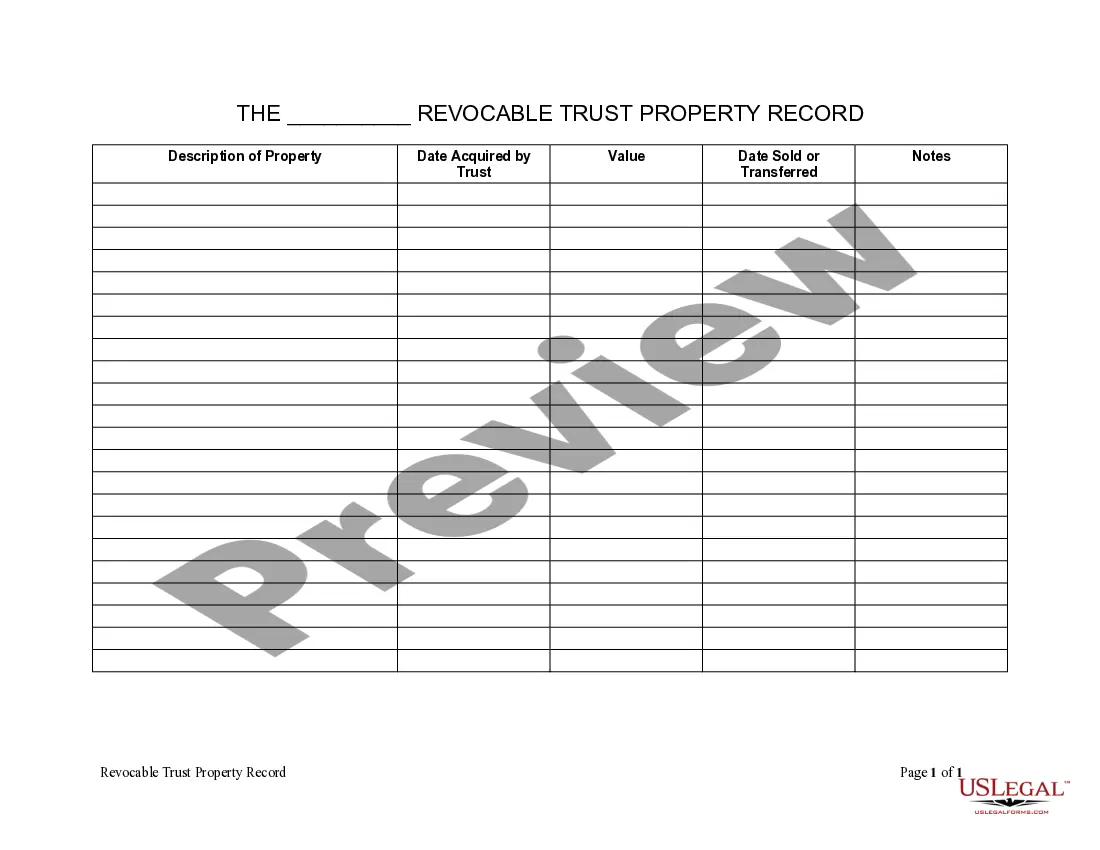

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.