Equity Agreement Document For Payment Agreement In Arizona

Description

Form popularity

FAQ

Unlike HELs and HELOCs, home equity agreements aren't loans. That means there are no monthly payments or interest charges..

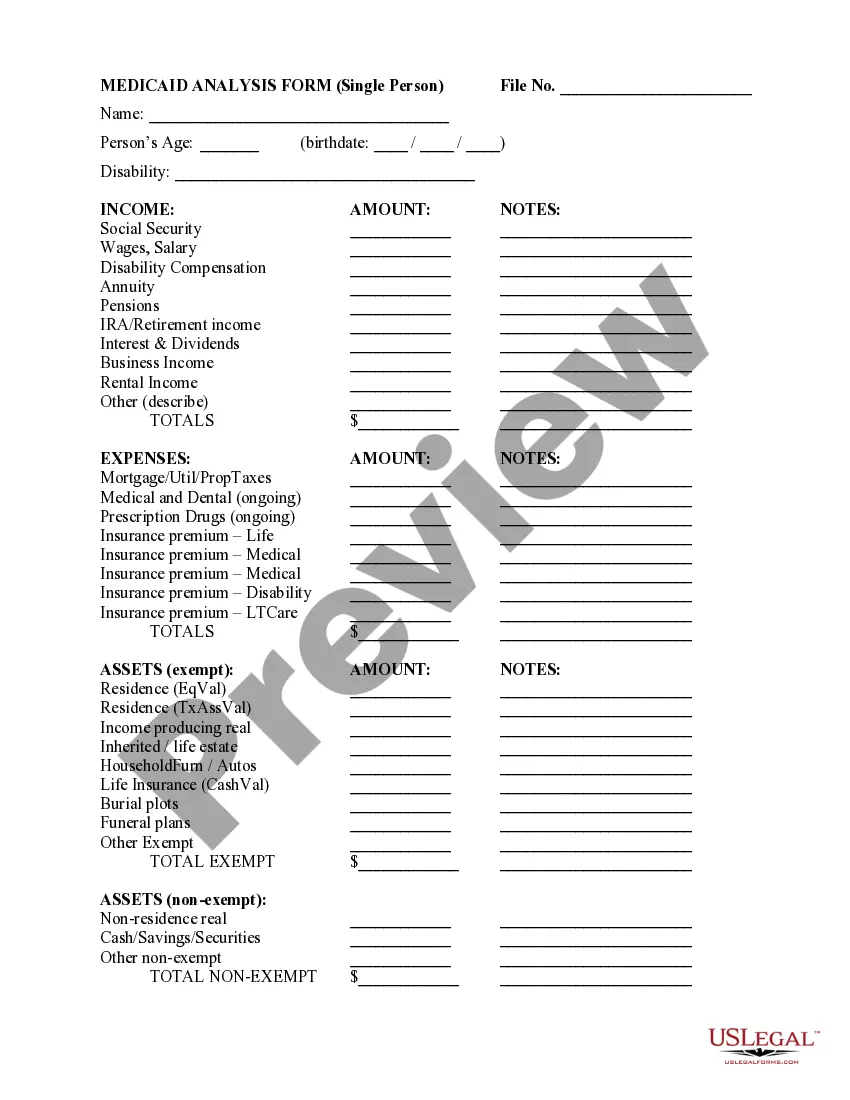

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

The main purpose of an equity agreement is to provide a clear framework for the company's operations and the involvement of shareholders. This agreement is designed to minimize potential disputes and maintain a smooth relationship between all parties involved.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Arizona has a 4.9 percent corporate income tax rate. Arizona also has a 5.6 percent state sales tax rate and an average combined state and local sales tax rate of 8.38 percent.

TPT License Number A eight-digit number issued to the business when approved for a transaction privilege tax license. It is located on the physical TPT license certificate in the upper, right section or on the AZTaxes account under Business Details.