Share Agreement Contract For Car In Allegheny

Description

Form popularity

FAQ

How to Lease a Car Review your credit. Check your credit score to make sure you qualify to lease a new car. Assess your budget. Calculate your mileage limit. Choose a car. Compare prices and terms. Negotiate the car lease. Sign the car lease.

State laws on leases and rental agreements can vary, but a landlord or property management company should provide you with a copy of your signed lease upon request. You should make your request in writing, so you have proof if there is a dispute later.

Select Your Carsharing Model. Establish the Business Model and Revenue Plan. Procure Vehicles. Secure Carsharing Insurance. Develop an Operations and Staffing Plan. Public or Private? ... Identify Host Site(s) and Serviced City(ies) ... Grow Marketing and Measure Success (KPIs)

How to Lease a Car Review your credit. Check your credit score to make sure you qualify to lease a new car. Assess your budget. Calculate your mileage limit. Choose a car. Compare prices and terms. Negotiate the car lease. Sign the car lease.

It is possible to draft your own lease agreement, but you are leaving yourself open to issues.

Contact The Number Provided on Your Monthly Statement. This will be the first place to contact when trying to track down a copy of your automobile lease agreement. Whether it is a dealer owned financier, or a third party bank, they will be the ones that technically own the lease.

To transfer a vehicle title in Pennsylvania, you'll need the signed title, a bill of sale, the application for title (Form MV-1), proof of identity, and proof of residency. Ensuring all documents are complete and accurate is essential for a smooth transfer.

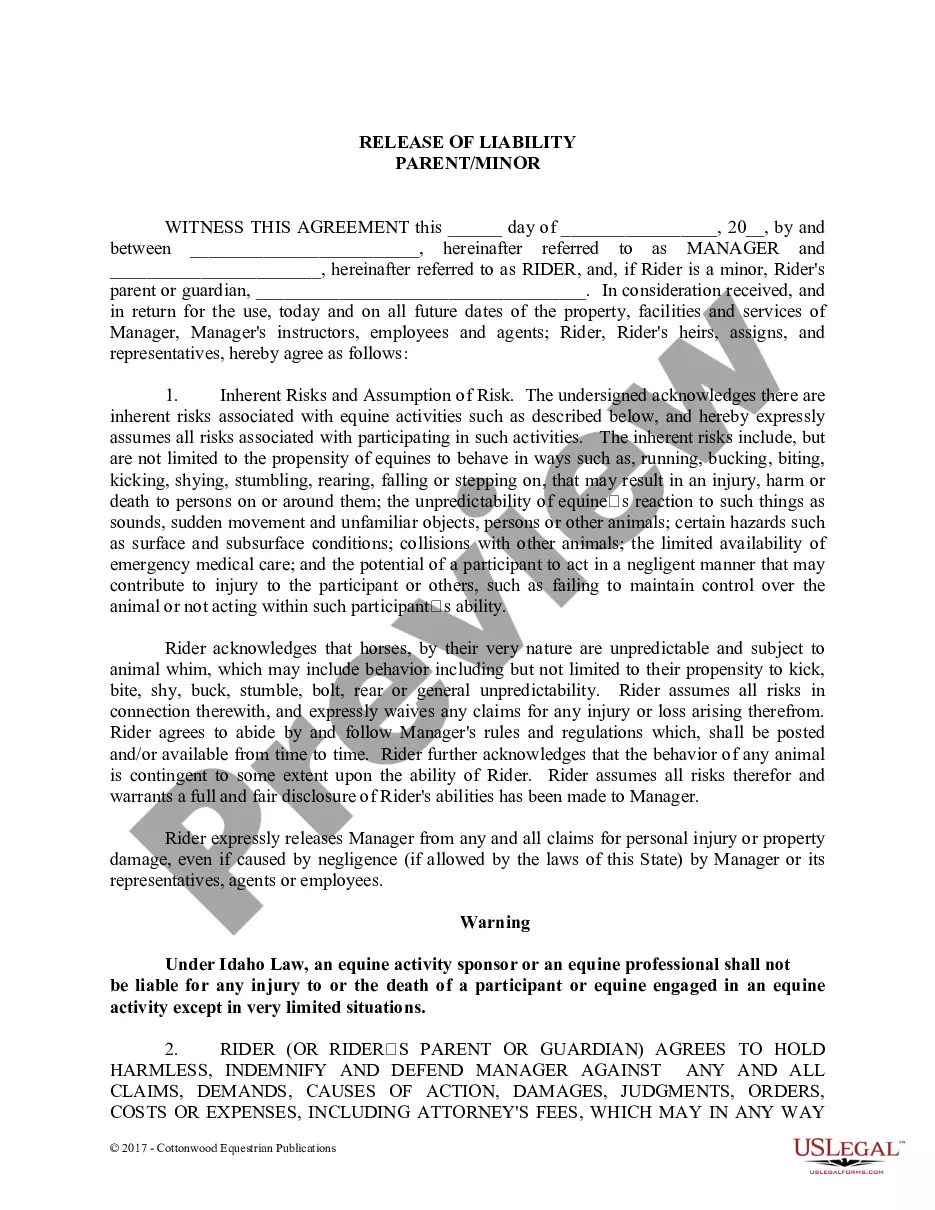

This document outlines the terms and conditions for borrowing a vehicle. It covers responsibilities, insurance requirements, and vehicle return procedures. Ideal for borrowers and dealers to ensure clarity in vehicle lending.

Call for the finance department. They can email it to you or you can go in and get it.