Equity Agreement Form For 501 In Allegheny

Description

Form popularity

FAQ

How to File a Petition for Change of Name Get Sample Forms PDF Format Fill out an IFP with the IFP Order, and a Petition for Change of Name. File the original IFP and Petition for Change of Name in the Prothonotary's office. Take all copies of the Order for Publication and Notice to the Court Administrator.

Call the Allegheny County Department of Court Records at (412) 350-4201 and tell them you're looking for information on a legal name change. They will describe the entire process to you, including estimated costs, and mail you the necessary forms. As of September 2017, these are the name change petition forms.

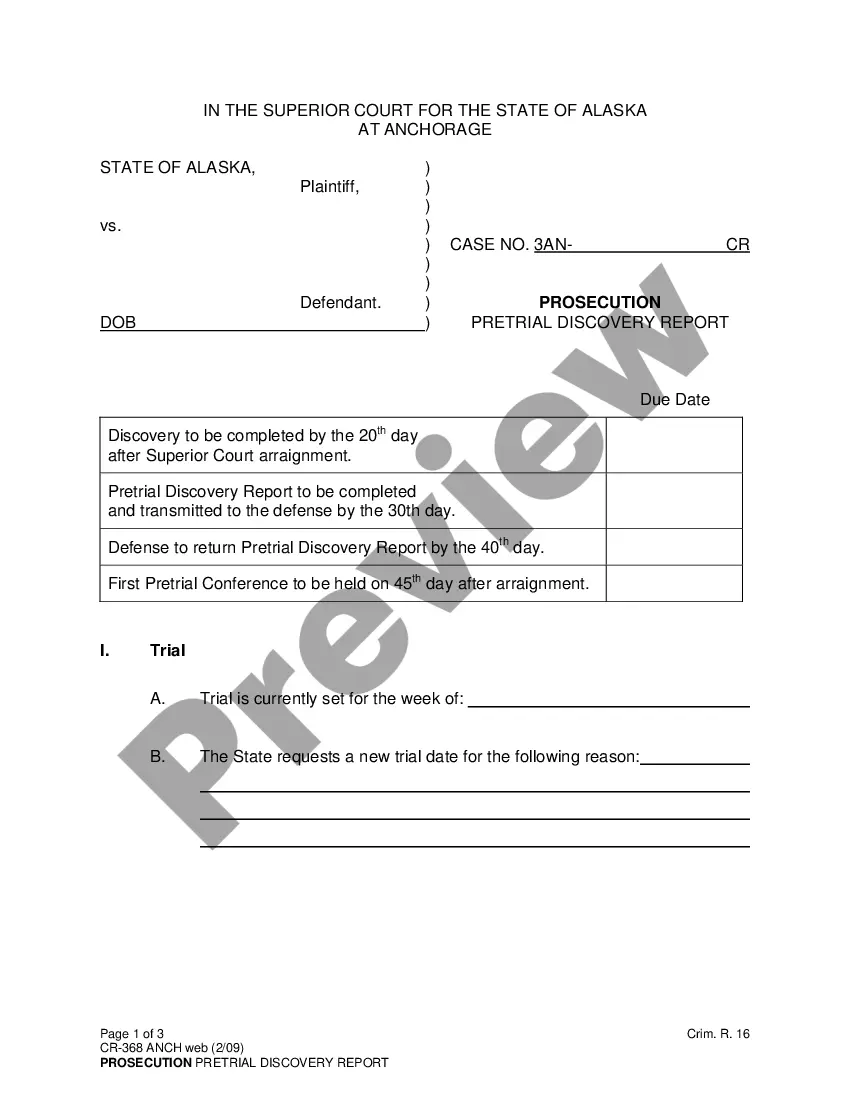

Rule 1301.1 - Discovery in Compulsory Arbitration Proceedings (Except Small Claims) (1) For any personal injury claim filed in Compulsory Arbitration, the plaintiff may serve arbitration discovery requests (see FORM 1301.1A) (see subsection (8)(a) below) either together with the copy of the Complaint served on the ...

If you file Form 1023, the average IRS processing time is 6 months. Processing times of 9 or 12 months are not unheard of. The IRS closely scrutinizes these applications, as the applicants are typically large or complex organizations.

Most organizations described in Section 501(c)(4) are required to notify the IRS that they are operating under Section 501(c)(4) within 60 days of formation by filing Form 8976, Notice of Intent to Operate Under Section 501(c)(4). If an organization doesn't submit a timely notification, a penalty will be assessed.

In order to become a tax-exempt nonprofit, one must file for tax-exempt status. This is a difficult process and professional help is often recommended. The most common way to become a tax-exempt nonprofit is by establishing the organization as a section 501(c)(3) entity with the IRS.