Good Faith Estimate Template Excel With Payment Plans In Queens

Description

Form popularity

FAQ

A diagnosis is required on the Good Faith Estimate once it's saved to the client's Overview page. There isn't a way to remove it from this document.

The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care. For example: you're scheduled for surgery. You should request 2 good faith estimates: one from the surgeon, and one from the hospital.

What's included in a good faith estimate? A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility.

The good faith estimate must include a number of disclaimers. For example, it must state that the estimate is based on information known at the time it was created. Therefore, it won't include any costs for unanticipated items or services that are not reasonably expected and that could occur due to unforeseen events.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

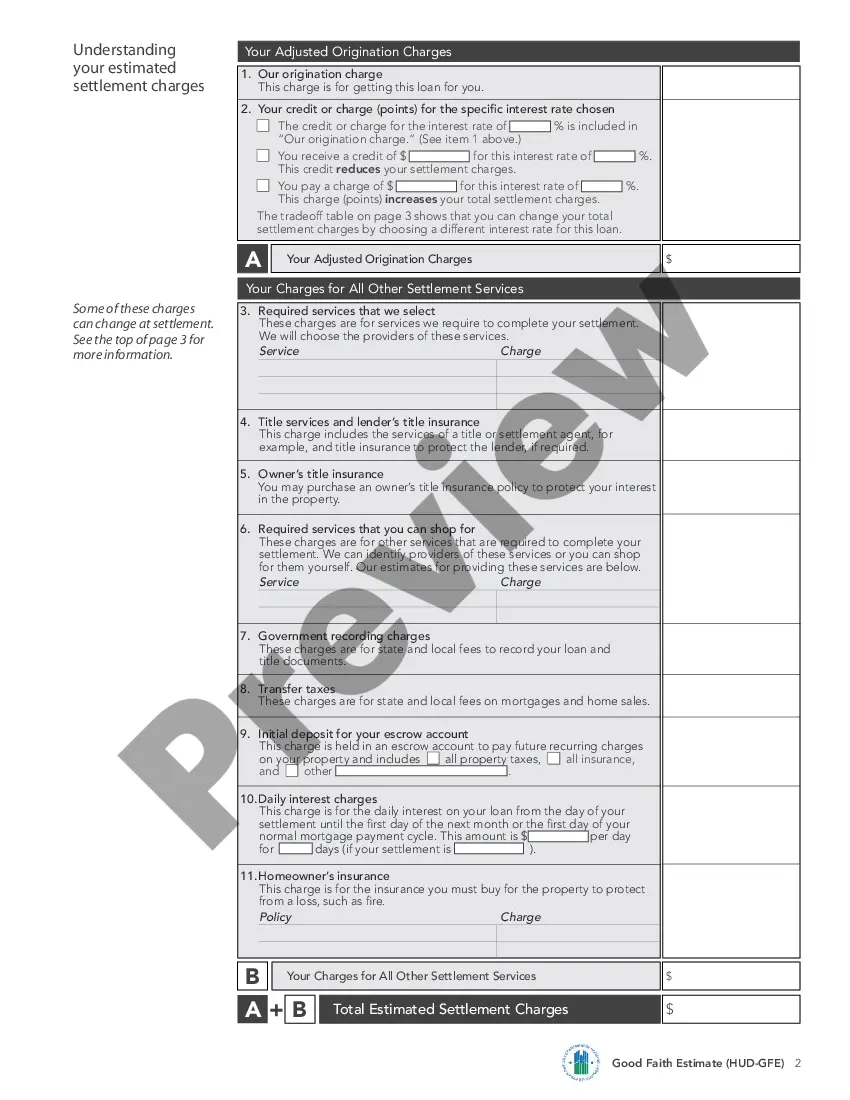

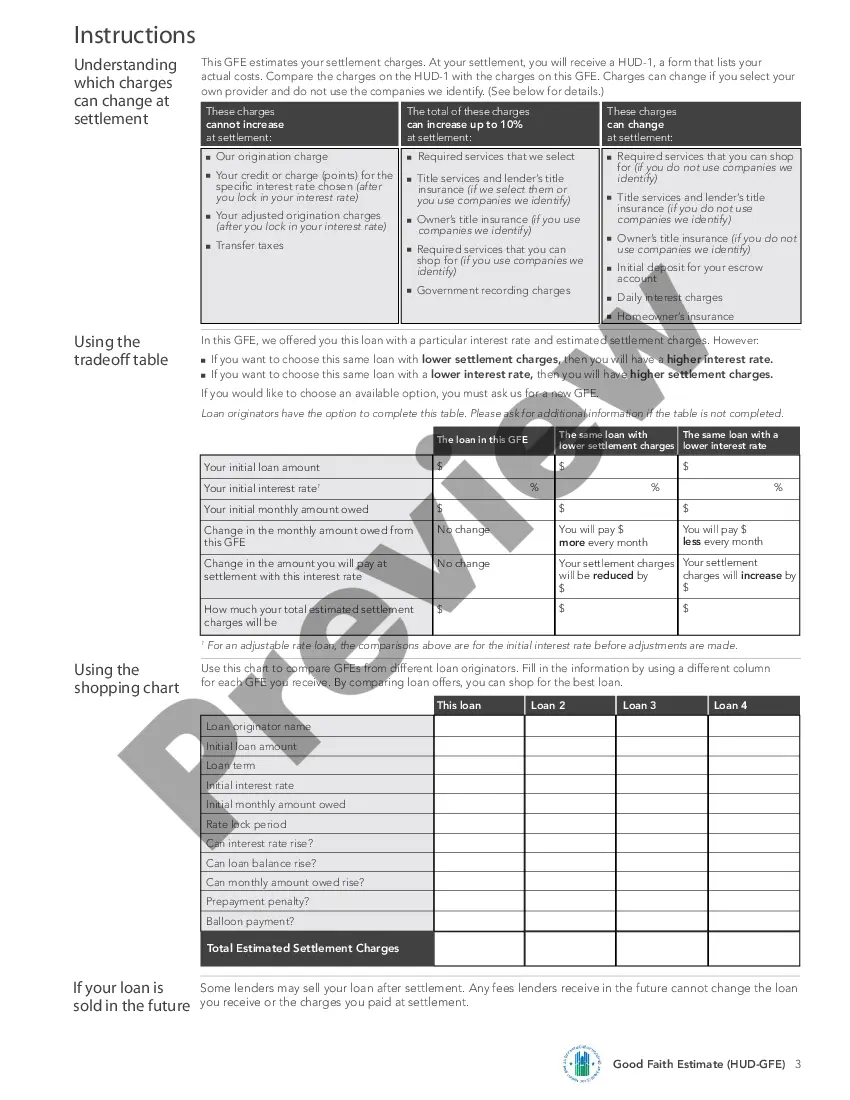

The Good Faith Estimate (GFE) and the HUD-1 Settlement Statement are the primary disclosure documents lenders provide to mortgage applicants. As its name implies, the GFE lists the lender or mortgage broker's best estimate, in "good faith," of closing costs.

A good faith estimate isn't a bill Generally, the good faith estimate must include expected charges for: The primary item or service • Any other items or services you're reasonably expected to get as part of the primary item or service for that period of care.

Good faith estimates only list expected charges for a single provider or facility. You may get an estimate from both your provider and facility, or from multiple providers. The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.