Good Faith Estimate Template Excel Format In Bexar

Description

Form popularity

FAQ

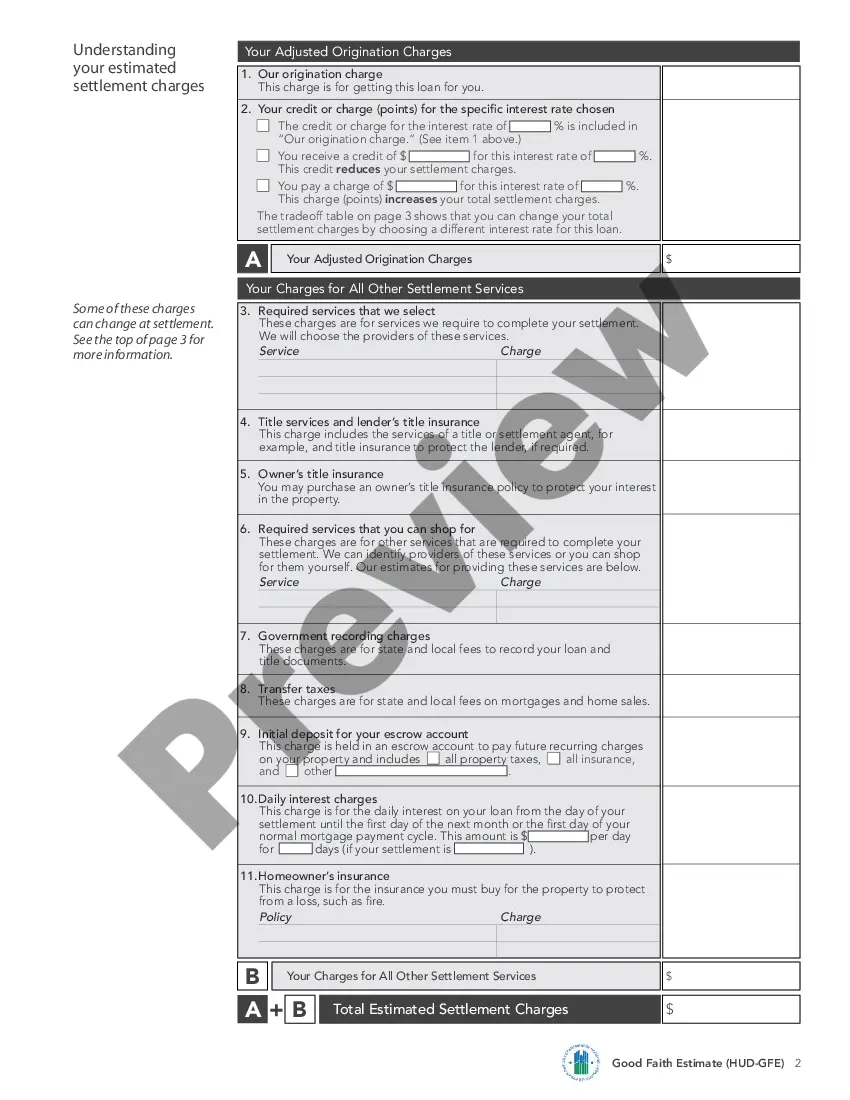

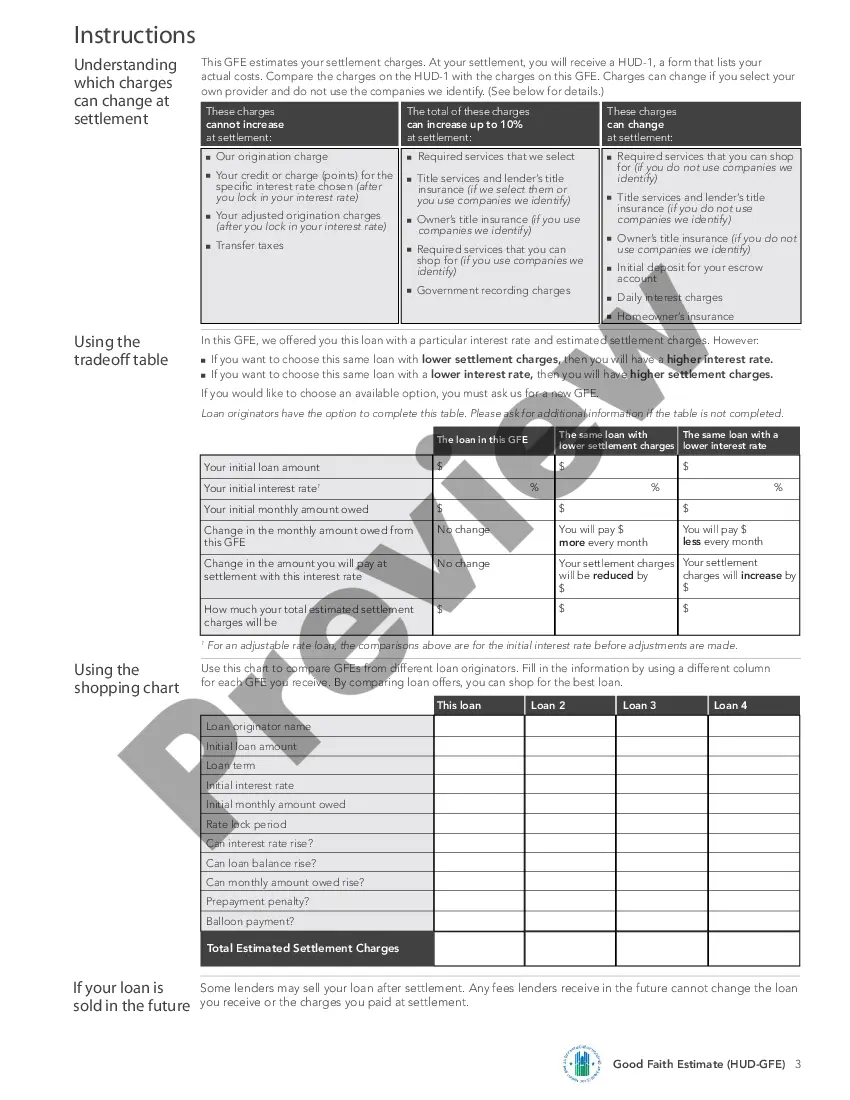

The good faith estimate must include a number of disclaimers. For example, it must state that the estimate is based on information known at the time it was created. Therefore, it won't include any costs for unanticipated items or services that are not reasonably expected and that could occur due to unforeseen events.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

A good faith estimate isn't a bill Generally, the good faith estimate must include expected charges for: The primary item or service • Any other items or services you're reasonably expected to get as part of the primary item or service for that period of care.

IMPORTANT: You aren't required to sign this form and shouldn't sign it if you didn't have a choice of health care provider before scheduling care.

Good Faith Disclosure means a disclosure concerning suspected Improper Activity that is determined to be based on reasonable belief and is not malicious, frivolous, or vexatious.

Implied covenant of good faith and fair dealing (often simplified to good faith) is a rule used by most courts in the United States that requires every party in a contract to implement the agreement as intended, not using means to undercut the purpose of the transaction.

“In all matters relating to this agreement the parties will act with the utmost good faith towards one another and will act reasonably and prudently at all times.”

Good faith estimates only list expected charges for a single provider or facility. You may get an estimate from both your provider and facility, or from multiple providers. The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care.

Make sure your health care provider gives you a Good Faith Estimate in writing at least 1 business day before your medical service or item. You can also ask your health care provider, and any other provider you choose, for a Good Faith Estimate before you schedule an item or service.

A diagnosis is required on the Good Faith Estimate once it's saved to the client's Overview page. There isn't a way to remove it from this document.