Wrongful Possession Of Property Ipc In Maricopa

Description

Form popularity

FAQ

Collect Evidence: Gather evidence that supports your argument that the property's value is inflated. This could include data relating to recent property sales issues, the condition of your property, or other economic factors impacting property values.

If you want to appeal the Assessor's Valuation of your BPP you can do so by filing a Personal Property Petition for Review of Valuation (AZDOR Form 82530) available for download. You can submit the completed petition to our office in person, by US Mail, or via email to ASRAppeals@maricopa by the deadline.

Planning and Development Department Contact NamePhone Building and/or Code Questions and Complaints 602-506-3301

Fortunately, property tax appeals are a lifeline for homeowners grappling with inflated assessments. A property tax appeal can lower your bill if you're facing an overwhelming rate hike from your city or county.

Step 1 - File a Petition for Review with the County Assessor. Step 2 – Further the Appeal to the Board of Equalization. Step 3 – File an Appeal in Tax Court.

Qualifications. Age: At least one property owner must be the minimum qualifying age of 65 at the time of application. Residence: The property must be the owner(s) primary residence. A "primary" residence is that residence which is occupied by the property owner(s) for an aggregate of nine months of the calendar year.

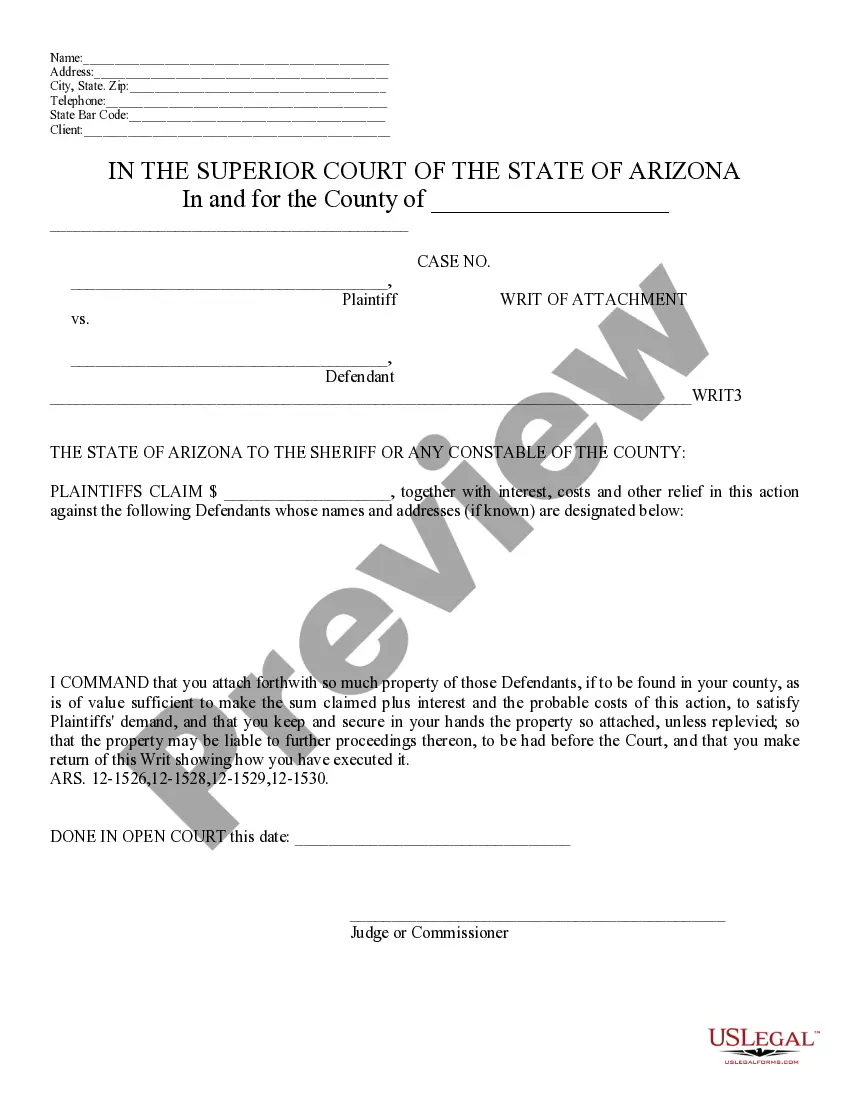

A plaintiff representing herself may obtain and fill out a prepared Complaint form from the Clerk of the Court at the courthouse or online at each county court website or by visiting . The Complaint must be filed with the Clerk of the appropriate court.

The plaintiff files a document (complaint) with the clerk of the court stating the reasons why the plaintiff is suing the defendant, and what action the plaintiff wants the court to take. A copy of the complaint and a summons are delivered to (served on) the defendant.

A Writ of Execution allows the Constable to seize the judgment debtor's non-exempt PERSONAL PROPERTY and hold it for sale at public auction, for the purpose of satisfying the judgment. There are issuance fees and constable fees associated with a writ of execution.

A civil action filed in a limited jurisdiction court is a claim against another party for damages of an amount up to $10,000.00. These lawsuits are designed to resolve civil disputes before a justice of the peace. Parties in a civil lawsuit may be represented by attorneys and appeal their case to a higher court.