Second Amended Print Withholding In Dallas

Description

Form popularity

FAQ

The state shall promptly serve on the employer a notice terminating the withholding order for taxes if the state tax liability for which the withholding order for taxes was issued is satisfied before the employer has withheld the full amount specified in the order, and the employer shall discontinue withholding in ...

Withholding orders are legal orders we issue to collect past due income taxes or a bill owed to local or state agencies. There are different types of withholding orders we issue: Earnings withholding order for taxes (EWOT) Earnings withholding order (EWO)

The state shall promptly serve on the employer a notice terminating the withholding order for taxes if the state tax liability for which the withholding order for taxes was issued is satisfied before the employer has withheld the full amount specified in the order, and the employer shall discontinue withholding in ...

Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Learn how to make sure the correct amount is being withheld and how to change it.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages.

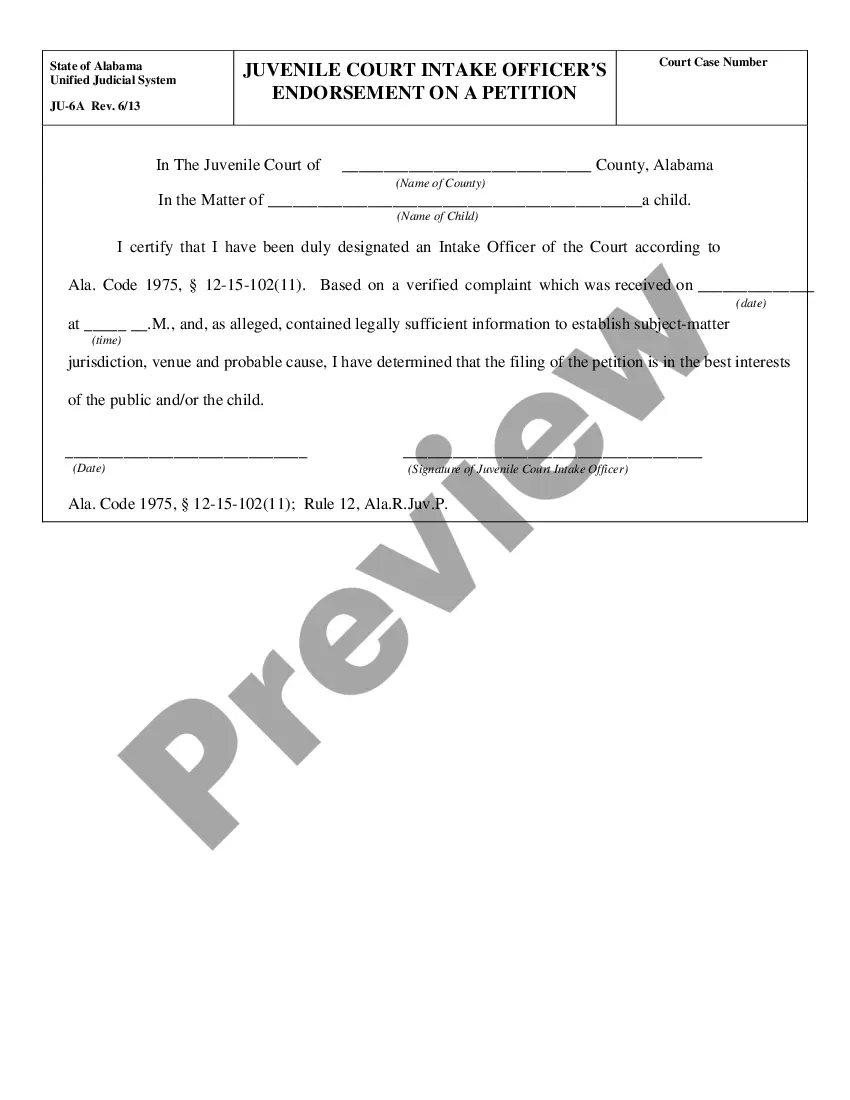

Termination of IWO. Check the box to stop income withholding on a child support order. Complete all applicable identifying information to aid the employer/income withholder in terminating the correct IWO.

Under state law, a court will not issue a child support income withholding order if “ good cause is shown” or there has been an “agreement of the parties.” Texas law limits income withholding at 50 percent of a parent's disposable income for domestic obligations, including child support.

Take advantage of the line for extra withholding. If you want to have a specific number of extra dollars withheld from each check for taxes, you can put that on line 4(c).

How Often Can I Revise My Withholding? You can submit a revised Form W-4 at any time during the year. If your circumstances change—for instance, if you get married, have a child, or start a second job—you can adjust your withholding as needed.

To amend a return that's already been amended, complete the following steps. Open the previously amended return. Verify that the information on Form 1040 matches the information reported on the previous amended return. Open the. Select. If you're amending an amended state return, perform the previous steps for each state.