Petition Filing Fee In Pima

Description

Form popularity

FAQ

How to Start Probate for an Estate Open the Decedent's Last Will and Testament. Determine Who Will be the Personal Representative. Compile a List of the Estate's Interested Parties. Take an Inventory of the Decedent's Assets. Calculate the Decedent's Liabilities. Determine if Probate is Necessary. Seek a Waiver of Bond.

If you're wondering how long probate takes in Arizona, the timeline varies depending on several factors. Simple cases with no disputes or complex assets can take as little as six months, while more complicated cases can extend over a year or more.

Informal probate is the process of submitting the paperwork to the probate court registrar who may appoint the personal representative and admit a will to probate or that the person died intestate (without a will). All without a court hearing before a judge. But informal probate is not available in all cases.

You will not have a trial immediately. A few things will occur before the trial. The IRS attorney will file an “Answer” with the Court and serve a copy on you by mail if you are not yet registered for electronic filing. In the Answer, the IRS will generally admit or deny the statements made in your petition.

Advantages of U.S. Tax Court Taxpayers who sue the IRS in U.S. Tax Court can expect a very high probability of at least partial success. Approximately 80% of tax court cases reach a settlement before even going to trial.

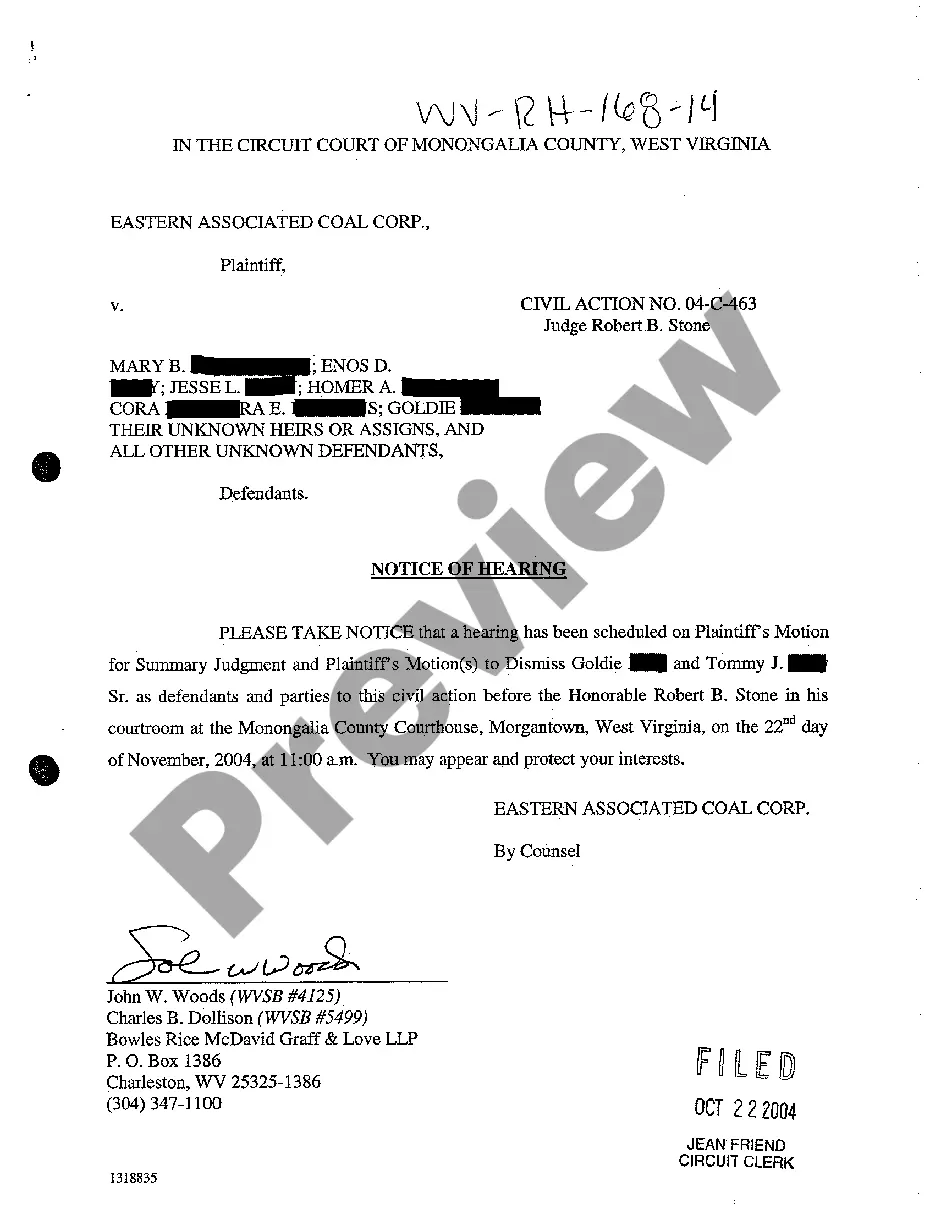

A civil action filed in a limited jurisdiction court is a claim against another party for damages of an amount up to $10,000.00. These lawsuits are designed to resolve civil disputes before a justice of the peace. Parties in a civil lawsuit may be represented by attorneys and appeal their case to a higher court.