Repossession Form Agreement Format India In Wake

Description

Form popularity

FAQ

However, the lender has absolutely no obligation to do so. Even though you want to surrender the vehicle the lender won't pick it up.

How to perform a voluntary repossession of your vehicle Proactively inform your lender that you are unable to maintain making timely, monthly payments. Work with the lender to arrange a time and place for dropping the vehicle off.

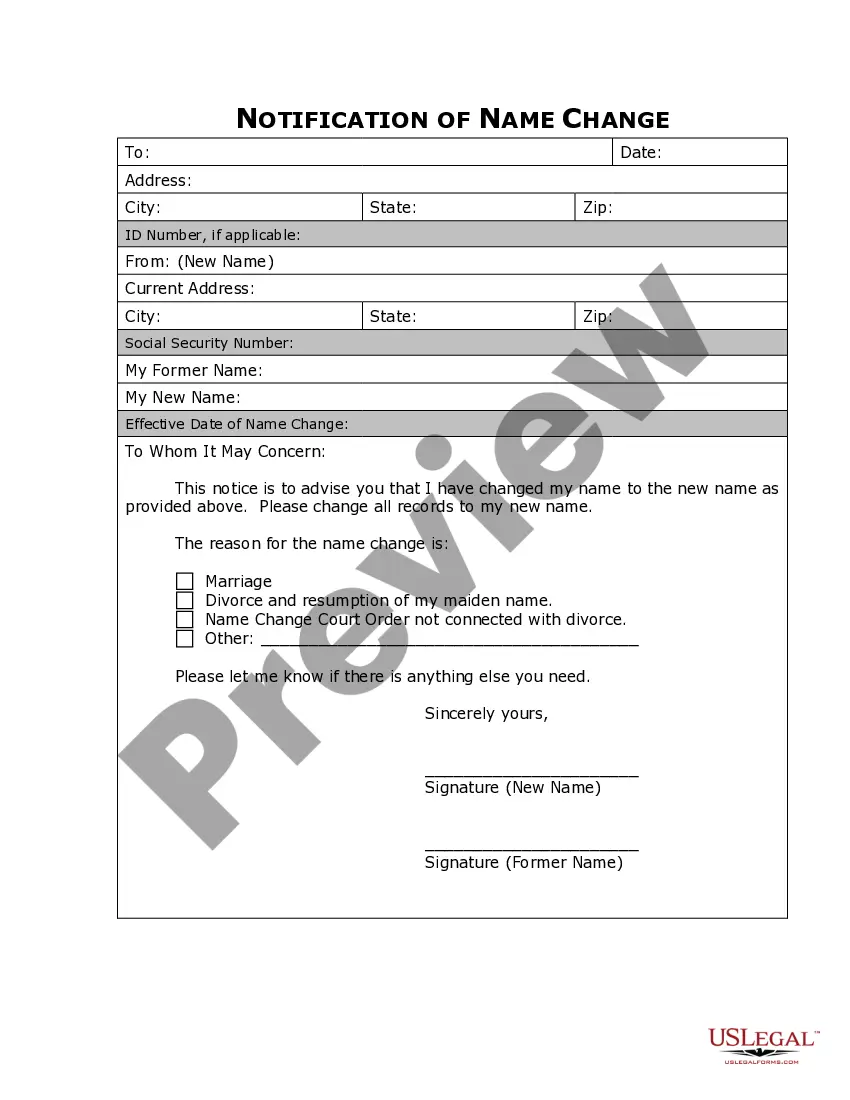

Identify yourself and your vehicle. Be sure to include an account number so that your lender can match your letter to your records. Explain that you're unable to make payments and intend to surrender the car. Provide contact information so that your lender can reach you.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

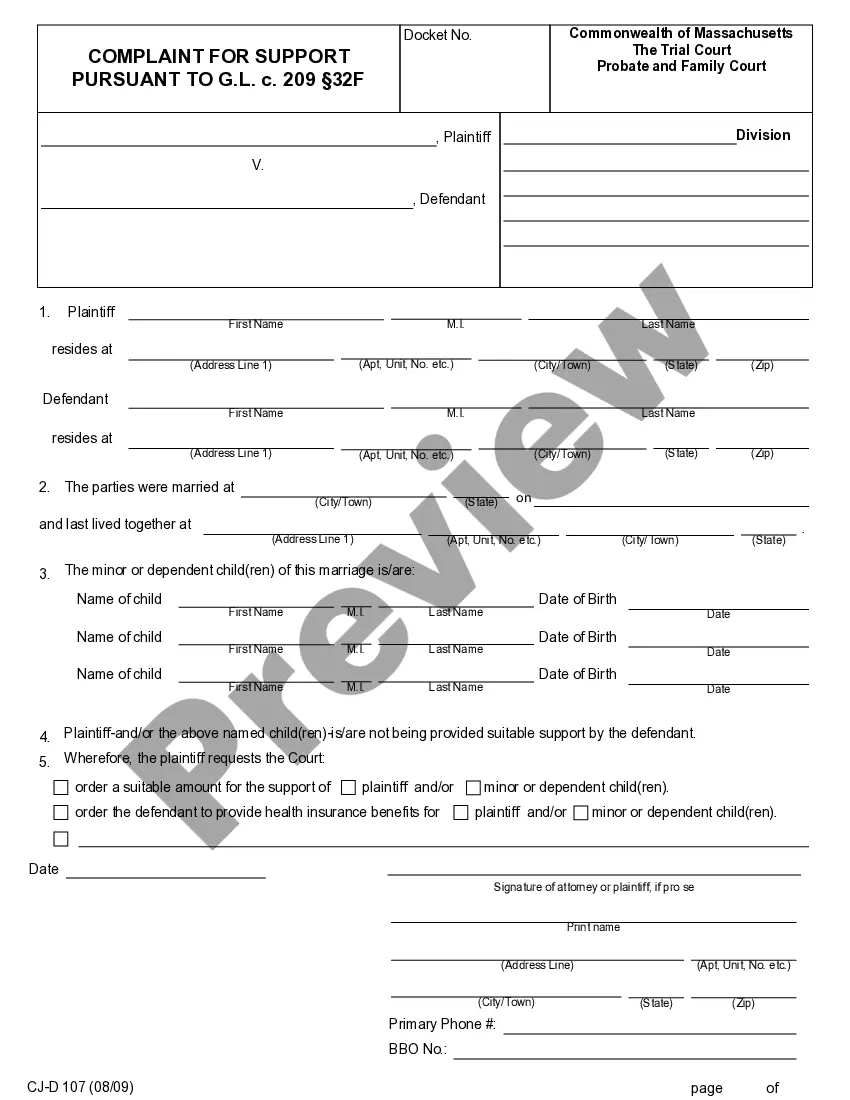

How to fill out repossession order form: Gather all necessary information about the debtor, including their name, contact information, and details about the property involved in the repossession. Clearly state the reason for the repossession and provide any supporting documentation or evidence.

Generally, cars are repossessed once payments are 90 days in default. Just don't expect lenders to give you a heads-up when the Repo Man will come calling. They typically contract that work out to towing services that specialize in snatching cars.

If the owner is an Indiana resident and did not apply for a certificate of title, then the lienholder must present a Court Order. If multiple lienholders are recorded on the title, the first lienholder can repossess the vehicle without proof of lien release from the other lienholders recorded.

How to Repo a Car Know the Repo Laws of Your State. Make Sure the Debtor Is in Default. Locate and Verify the Car. Choose the Method to Repossess. Do Not Breach the Peace.