Complaint Repossession Document With Lien In Wake

Description

Form popularity

FAQ

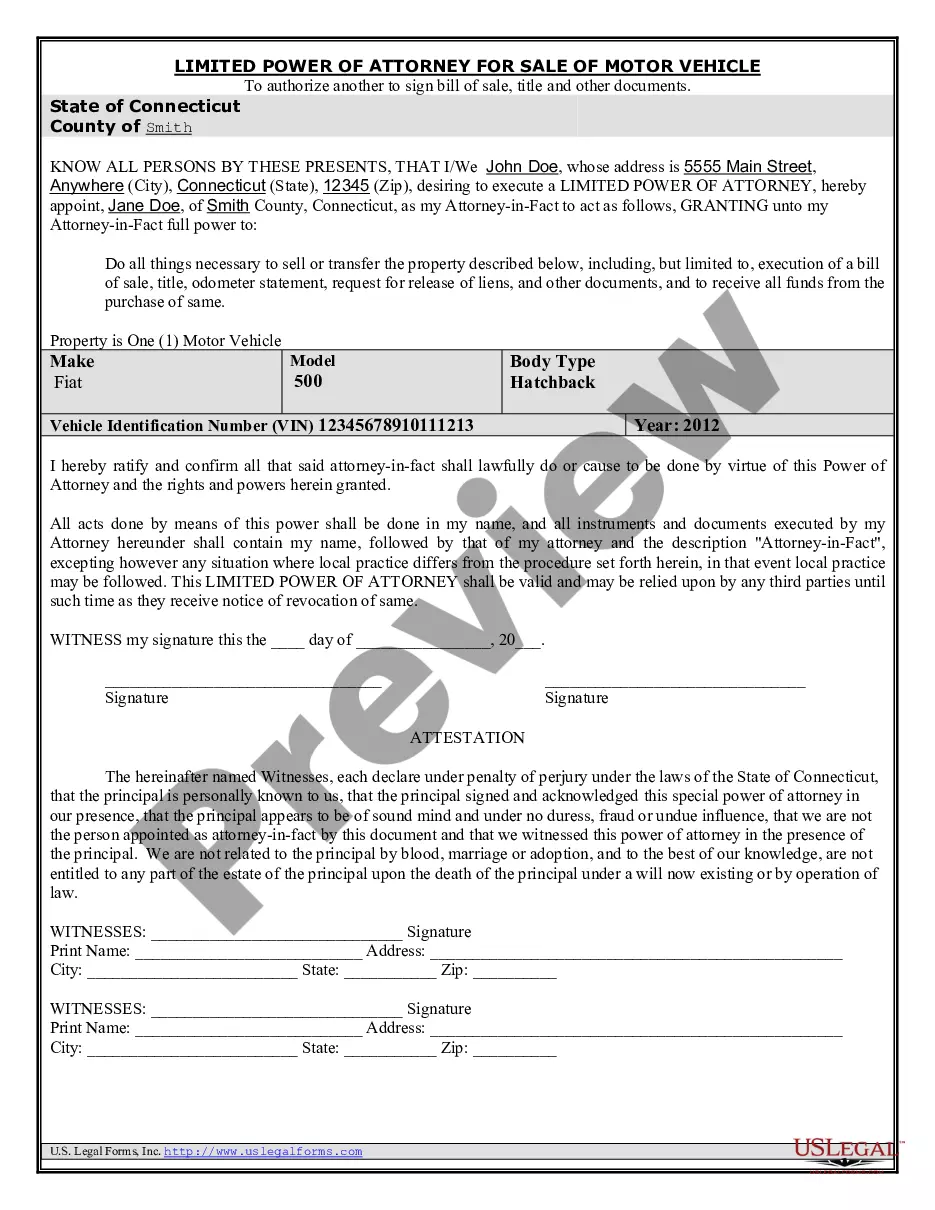

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

If the repo company can't repossess the car without breaching the peace, then the lender can go to court and go through the replevin process. The lender is basically taking you to court to make you hand over the car. If you lose the court case, then you have to return the car by the scheduled date.

Even if it was a voluntary repossession, they can still sue. The thing is that NC law has a three year statute of limitations. This means you should consider making a motion to the court to dismiss on those grounds (NCGS 1-52(1).)

Obtaining a repossession title involves completing specific paperwork to transfer ownership from the previous owner to the lienholder. This paperwork often includes an application for a repossession title, a bill of sale, and a certificate of repossession.

Direct Dispute with the Lienholder: Even though the lienholder has refused to remove the repossession, consider sending them a formal dispute letter. In the letter, outline the timeline of events, provide evidence of the insurance payout, and explain why the repossession should not be considered a default on your part.

In North Carolina, a lien claimant has 120 days from the date of last furnishing to complete these 3 steps: Fill out a mechanics lien form that meets NC requirements. File the lien with the county recorder's office. Serve a copy of the lien on the property owner.

Interested persons can search records of UCC liens filings maintained by the N.C. Secretary of State office through the NC SOS UCC search portal. On the portal, inquirers can search for UCC liens filings by file number, filing date, lapse date, and a subject's or organization name, amongst other search criteria.

Under North Carolina law judgment liens expire ten years from entry of the judgement.