Foreclosure Letter Format In Sacramento

Description

Form popularity

FAQ

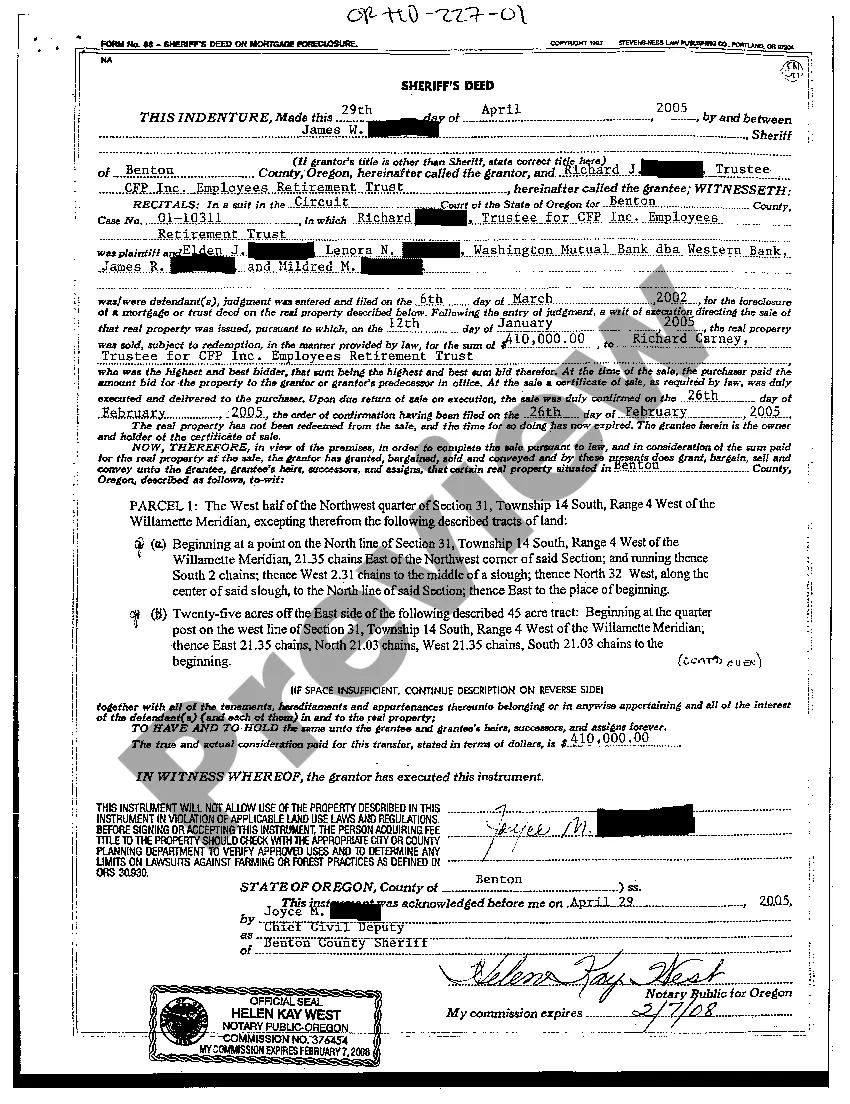

It will take at least 75-95 days, and usually longer, before your home is sold at a foreclosure sale.

Lender asks court for a judgment on default and to appoint a Referee to decide the amount you owe and write a report. Lender asks court to accept the Referee's findings. Judge orders sale of your home. Lender and Referee choose date for auction at the courthouse.

Salutation: Use a formal greeting (eg, ``Dear (Recipient's Name),''). Introduction: State your purpose for writing. Body: Provide details about your loan request (amount, purpose, repayment terms, etc.). Conclusion: Thank the recipient and express your hope for a positive response.

How to write a formal letter in block style Step 1: Write the contact information and date. All formal letters start with the contact information and date. Step 2: Write the salutation. Step 3: Write the body of the letter. Step 4: Write the complimentary close. Step 5: Mention enclosed materials.

While the content of the letter will change depending on your situation, there are a few important aspects to include: Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. Detail why problems won't happen again.

A Notice of Intention to Foreclose is your lender telling you that they are planning to foreclose on your property because you are behind on your mortgage payments.

Reinstating the Mortgage Loan Reinstating a loan (bringing it current by paying all past-due amounts) stops a foreclosure because the borrower catches up on the defaulted payments. Some states have a law permitting a delinquent borrower to reinstate the loan by a specific deadline.

For homeowners facing immediate foreclosure, filing for bankruptcy or obtaining a temporary restraining order (TRO) can be effective solutions. Chapter 7 or Chapter 13 bankruptcy creates an “automatic stay,” which temporarily halts all collection activities, including foreclosure auctions.

When Does Foreclosure Start in Washington? If the property is your principal residence, in most cases, federal law requires the servicer to wait until the loan is more than 120 days overdue before officially starting the foreclosure. This preforeclosure period gives you some breathing room before a foreclosure starts.

Just go to your nearest home loan branch and ask them to apply for foreclosure letter which they will provide to after 7--8 days. Then you can see the outstanding amount in foreclosure letter and give the cheque of same amount to them.