Repossession Form Template With Credit Card In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-000265

Format:

Word;

Rich Text

Instant download

Description

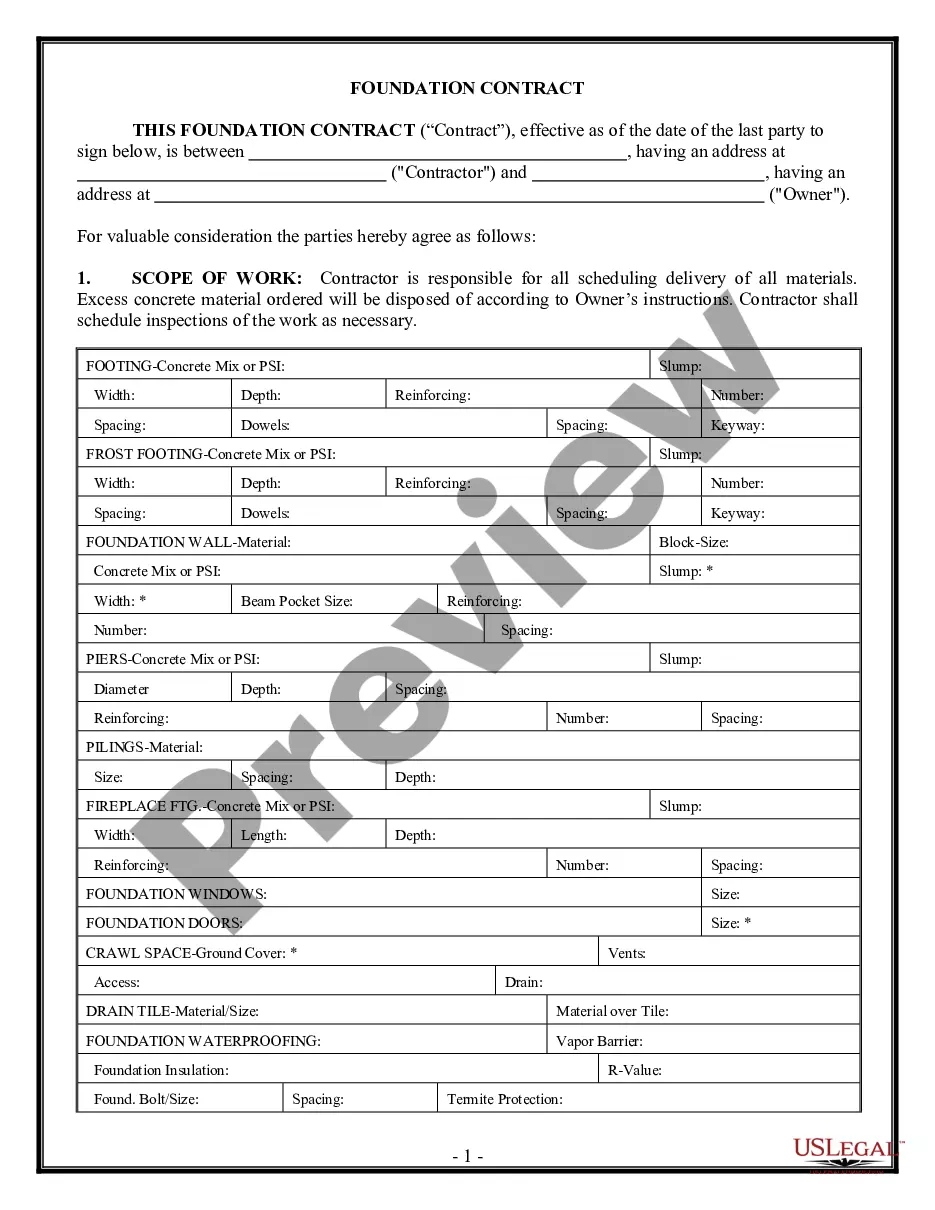

The Repossession Form Template with Credit Card in Phoenix is designed for use in legal proceedings related to the repossession of property, specifically secured vehicles under loan agreements. This form provides a structured framework for filing a Verified Complaint for Replevin, allowing creditors to reclaim vehicles in their possession due to default payments. Key features of the form include sections for parties involved, jurisdiction, and a detailed listing of contracts and corresponding properties, enriched by attached exhibits that serve as supporting documentation. Filling out the form requires clear designation of the debts owed, including principal amounts, interest, and associated fees. Legal professionals, such as attorneys, paralegals, and legal assistants, may find this form particularly useful during the process of initiating repossession actions, enabling them to streamline the filing process and ensure compliance with legal standards. The form's clarity in outlining legal rights and conditions for repossession is invaluable for partners and owners who might be facing collection challenges. Additionally, specific use cases include successful recovery of assets during bankruptcy proceedings or enforcing contractual conditions following tenant defaults. Thus, this template not only facilitates effective legal action but also aids in maintaining transparency in creditor-debtor relationships.

Free preview

Form popularity

FAQ

A repo stays on your credit report for seven years.

How many payments you can miss before you can expect car repossession depends entirely on your lender and their leniency. Most lenders won't begin repossession until you've missed three or more payments.

Creditors in Arizona are not required to send a pre-repossession notice before they conduct a repossession. However, the consumer must be in default and they must have a valid security interest in the vehicle in order for the repossession to be lawful.