Verified Repossession Editable Form 2-t In New York

Description

Form popularity

FAQ

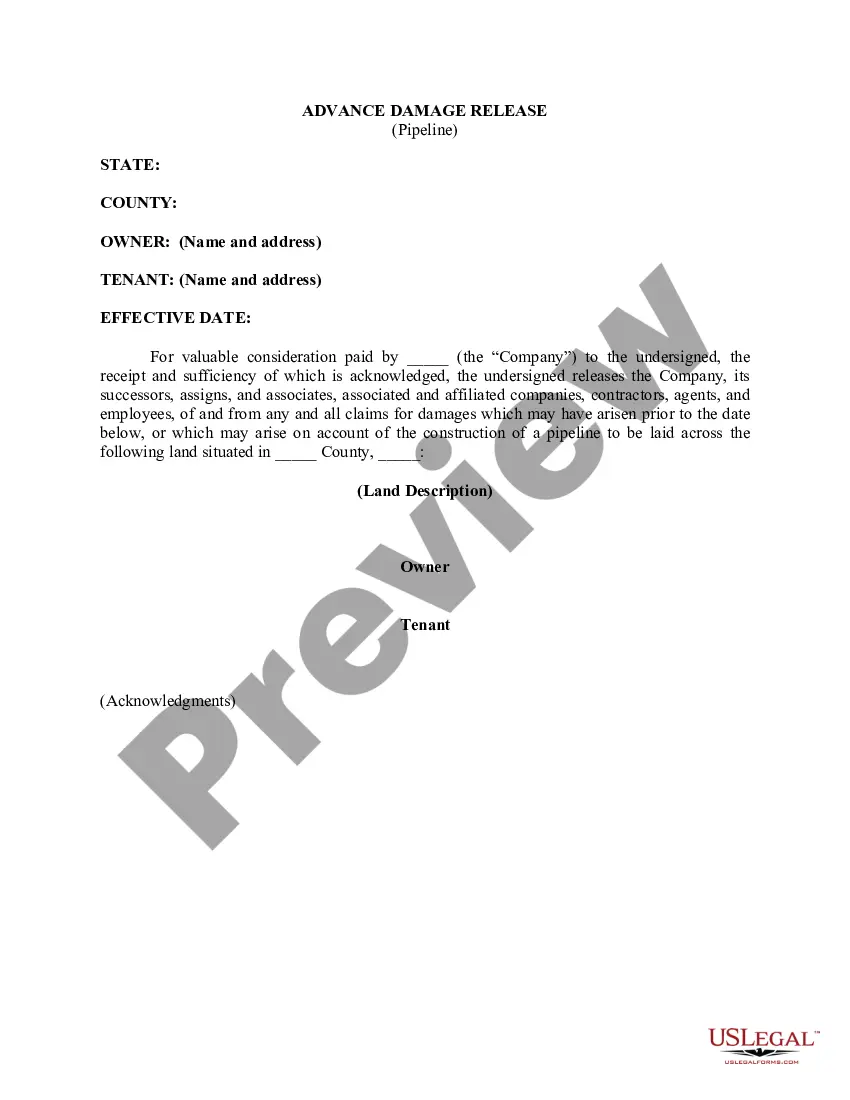

New York gives you the right to redeem or get back your repossessed vehicle by reinstating the contract. You reinstate your contract by paying any late/missing payments plus repo expenses such as towing, storage, and legal fees. But you must act quickly to do this.

Though repossession isn't a situation you want to encounter, engaging in the process voluntarily has some advantages, helping you to mitigate the stress, inconvenience, and financial impacts of a sticky situation. Some important benefits include: You avoid the stress and embarrassment of an involuntary repossession.

You would call the lender and make arrangements. They would tell you the place to go and you would make an appointment. It might be a nearby bank branch or it might be a dealership they have an arrangement with.

How to perform a voluntary repossession of your vehicle Proactively inform your lender that you are unable to maintain making timely, monthly payments. Work with the lender to arrange a time and place for dropping the vehicle off.

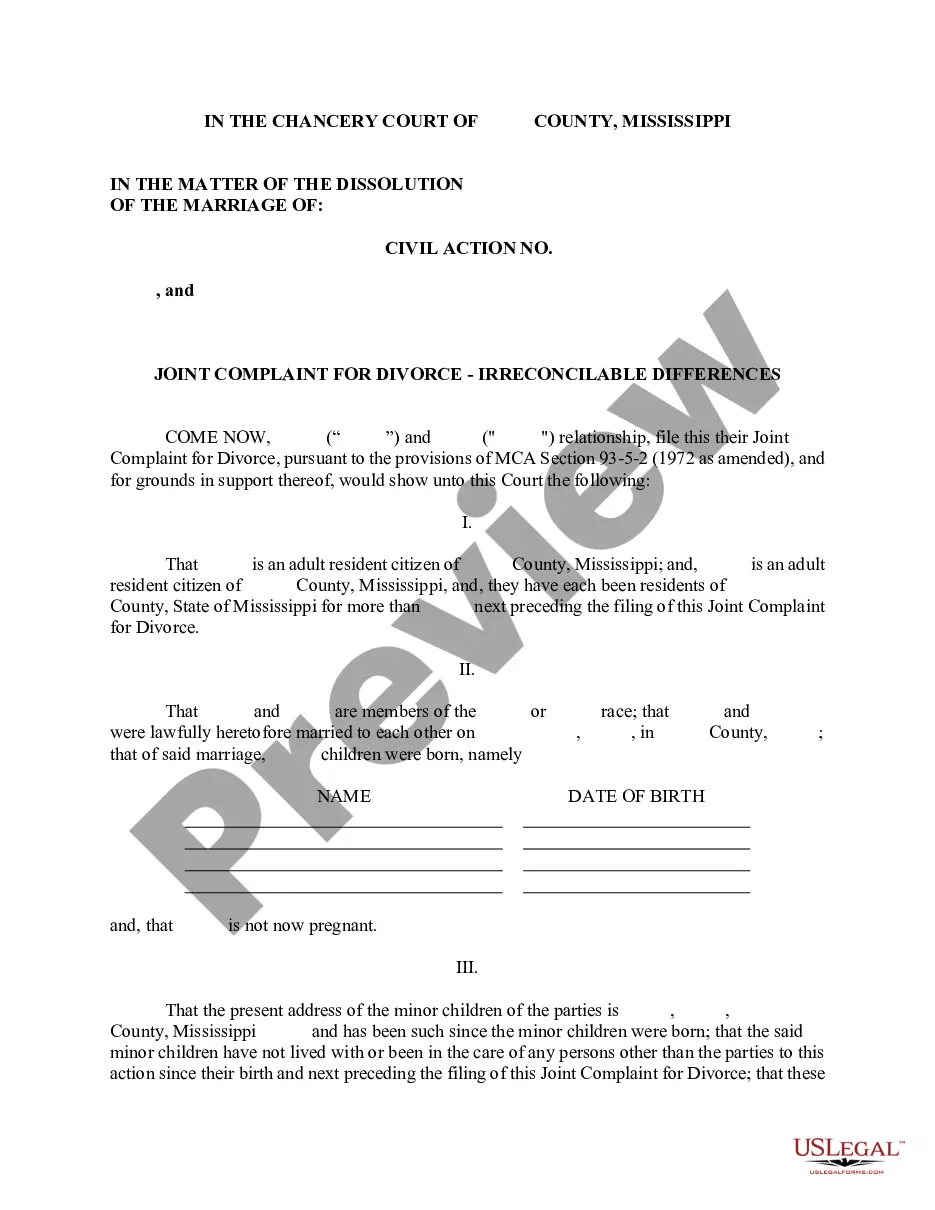

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

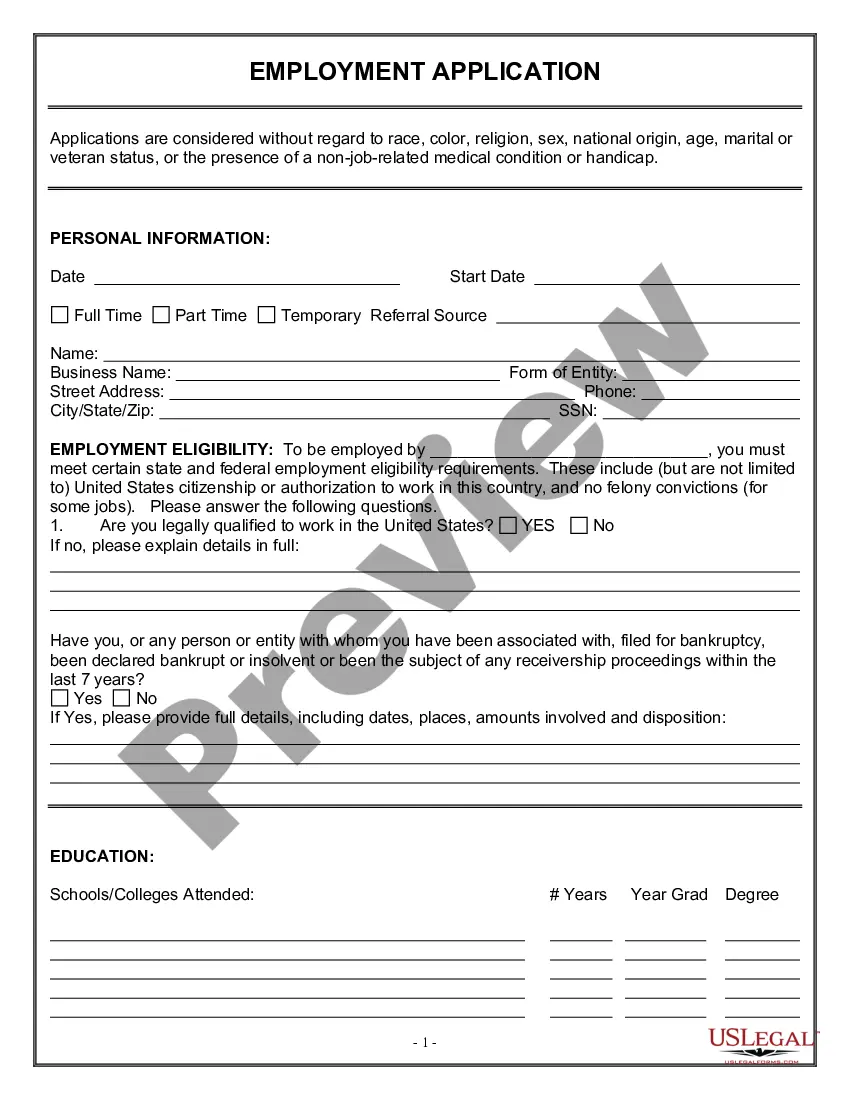

Although court judgments no longer appear on credit reports or factor into credit scores, they're still part of the public record. If a lender looks up your public records, this could make it harder to qualify for future loans.

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

Repossession happens when a lender takes back a car because the borrower has fallen behind on payments. Repo agents use personal details, social media, and tools like GPS trackers and license plate scanners to find vehicles.

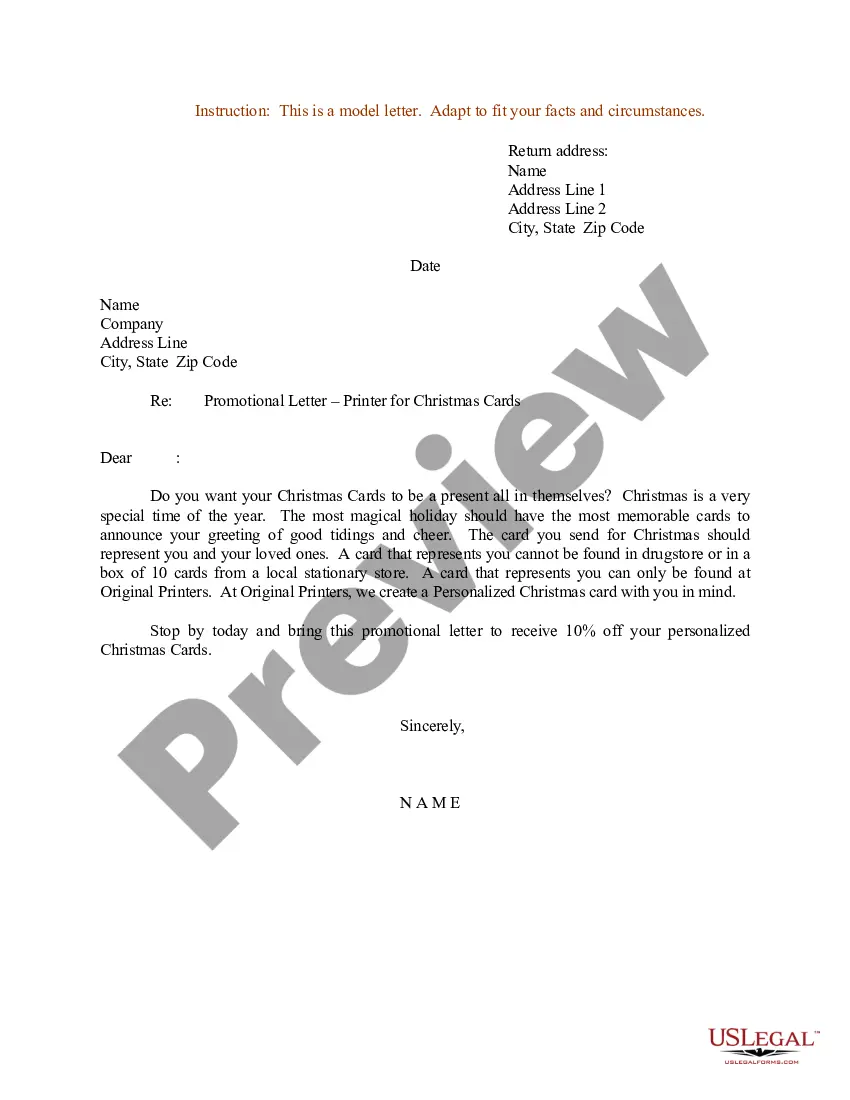

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

Identify yourself and your vehicle. Be sure to include an account number so that your lender can match your letter to your records. Explain that you're unable to make payments and intend to surrender the car. Provide contact information so that your lender can reach you.