Repossession Form Contract With Dealership In Minnesota

Description

Form popularity

FAQ

Statute of limitations. In most Minnesota debt collection cases, such as credit cards, the statute of limitations is six years. However, the statute of limitations for a repossession deficiency claim is likely four years.

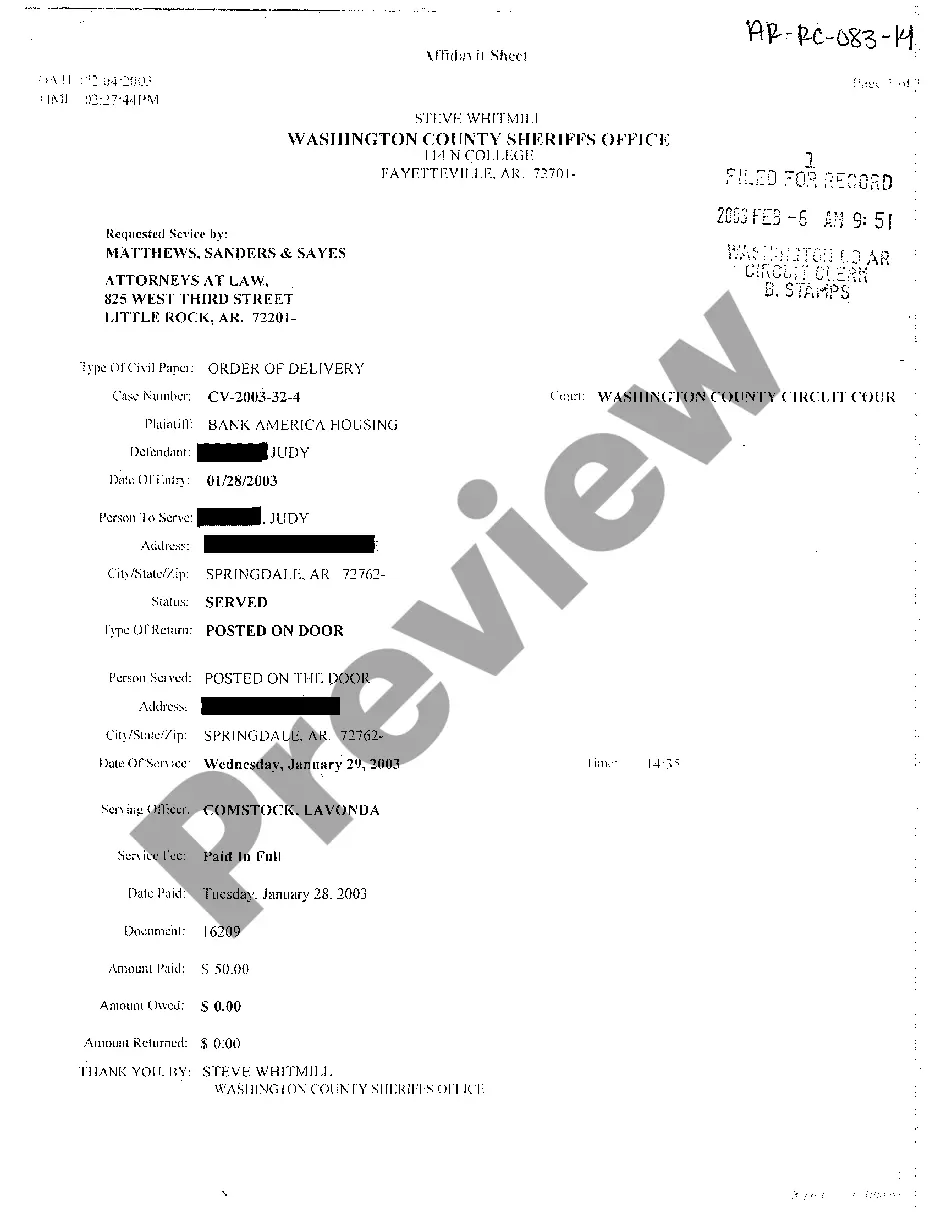

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

You will receive the repossession title once your application is approved and the necessary checks are completed. This title will officially establish your ownership rights to the repossessed vehicle. Keeping this title in a safe and secure location is crucial, as it serves as legal proof of ownership.

Your creditor can try to repossess the vehicle another time or can ask a court for an order to get the vehicle. But you can't get physical with the person trying to repossess your car or interfere with the repossessor's own vehicle or equipment.

The notice must tell you the name and contact information for both the lender (the legal owner of the vehicle) and the repossession agency. The notice must also disclose the charges for storing the car and any personal effects. Don't Lose Your Car to Repossession in the First Place.

How to Get Started With Repo Contracts Table of Contents. Starting Your Brand Awareness as a Repo Agent. Start Reaching Out. Make phone calls to potential clients once a month or so. Scatter Business Cards. Give Away Gifts. Contacting Companies for Contracts. Working at a Repo Company. Freelancing Your Services.

In the easiest cases, the defaulted-on car will be parked in plain sight in the debtor's driveway. If such is the case, you can simply tow away the vehicle right then and there and return it to the lender. Alternately, you could enter the vehicle with a secondary key and drive it to the impound lot.