Complaint Repossession Document With Lien Release In Houston

Description

Form popularity

FAQ

Good afternoon. If the bank does not have a lien on your car, then even if you are in default, the bank cannot simply repossess your car. The bank has to first file suit against you for your loan default.

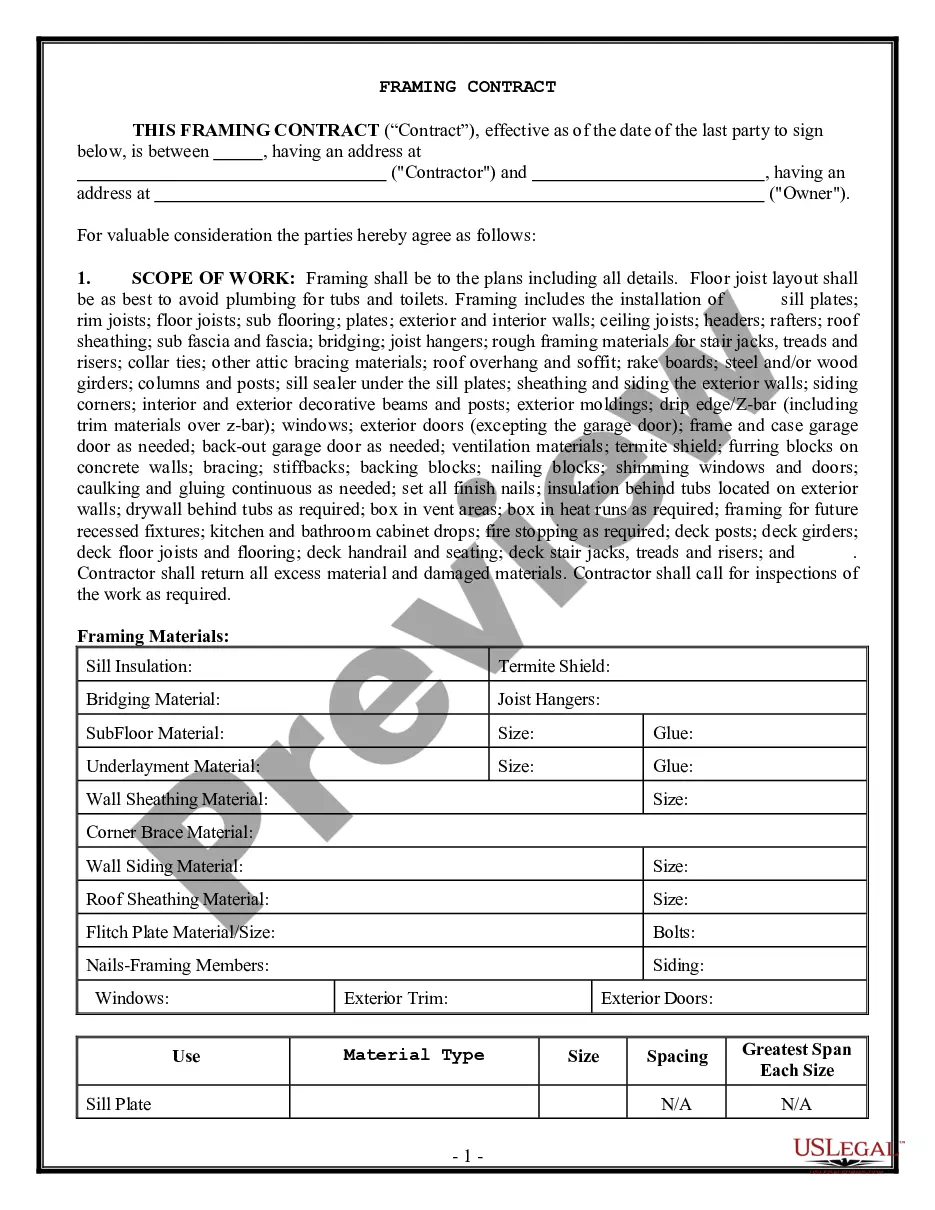

Sign the release document in front of a notary public. File the notarized release with the county clerk's office where the original lien was filed. Pay any required filing fees. Provide a copy of the filed release to the property owner.

The lender is the institution that made the loan. The lender will record the mortgage or deed of trust document in the public records with the appropriate agency in the county where the property is located. Once the loan is repaid, the lender should provide a recordable lien release document.

The document is usually called a Release of Lien, Lien Release, or a Deed of Reconveyance. It can be prepared by the owner or the Lien Claimant, but it must be signed by the Lien Claimant in front of a notary public and filed in the property records in the county where the property is located.

Your loan contract may authorize the lender or repo agent to take your personal belongings with the car and dispose of them.

Repossession rights in Texas are governed by the Texas Business & Commerce Code §9.609. ing to this code section, a lender has the right to repossess a vehicle without filing a lawsuit if the repossession can be accomplished without a “breach of the peace.”

Repo men may seek police support during a repossession, but it's crucial to recognize that law enforcement's role is primarily to maintain the peace.

Illegal access by repo agents, such as entering closed garages or locked gates without permission, is a breach of peace and a violation of the property owner's rights.

To file a release of lien on Texas property, follow these steps: Prepare the release document, ensuring it includes all necessary information. Sign the release document in front of a notary public. File the notarized release with the county clerk's office where the original lien was filed. Pay any required filing fees.