Replevin Foreclosure In Dallas

Description

Form popularity

FAQ

The process involves: Filing a Complaint: The plaintiff must file a detailed complaint, specifying the property and asserting their ownership or right to possession. Notice and Hearing: The defendant is given notice, and a hearing is scheduled. The plaintiff must prove their claim to the property.

The Complaint: The complaint in replevin typically must include: (i) a description of the property to be replevied; (ii) its value; (iii) its location if known; and (iv) the material facts upon which the claim is based – in other words, why the filing party is entitled to seize the property that has been taken.

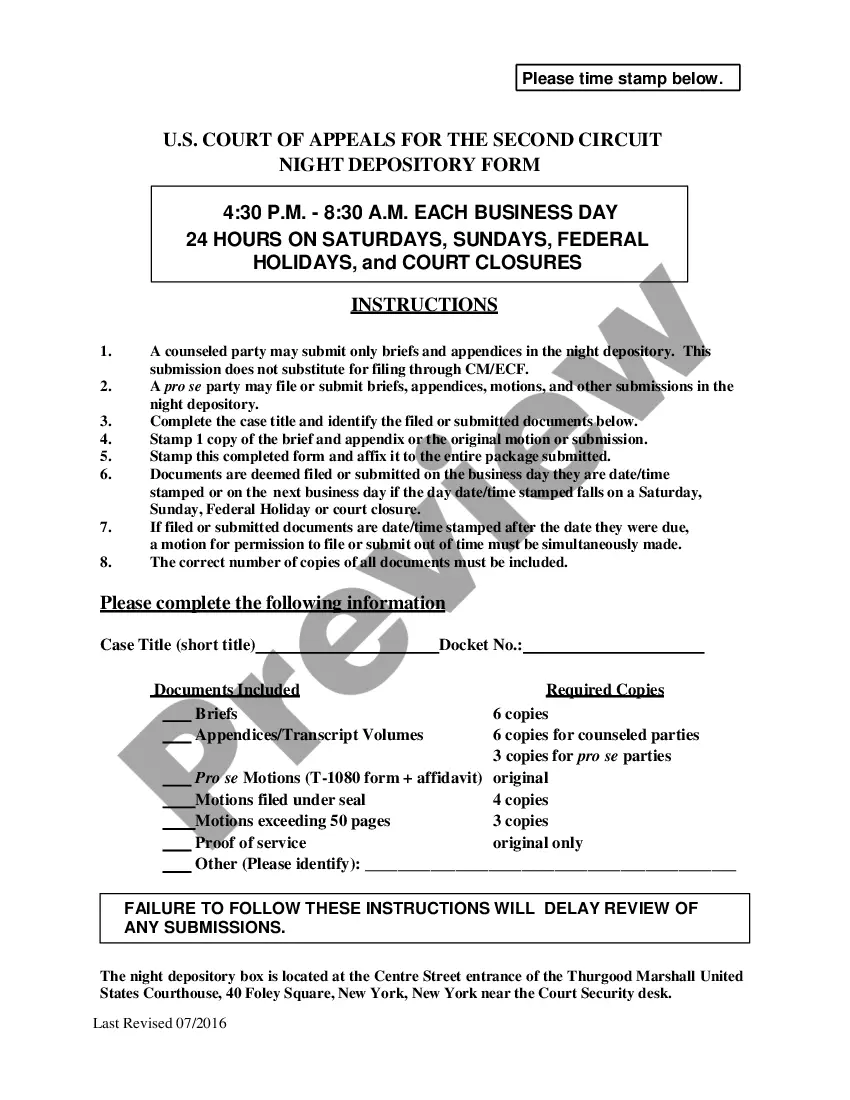

File a motion for a writ of replevin. The motion must be accompanied by an affidavit or verified complaint that supports the allegations in your complaint. The affidavit must also state that you will post a replevin bond with the court. The amount of the bond will be set by the court.

In order to qualify for a non-judicial foreclosure, the lienholder must have a deed of trust with a "power of sale" clause, giving them the authority to sell the property. These foreclosures are governed by Section 51.002 of the Texas Property Code as well as the contractual documents.

The former owner will have to petition the county to turn over the surplus funds. If no one petitions to recover them, the surplus funds generally can be held by the county for two years before they are distributed to the taxing bodies that foreclosed on the property.

For example, a bank might file a replevin action against a borrower to repossess the borrower's car after he missed too many payments. Replevin can also refer to a writ authorizing the retaking of property by its rightful owner (i.e., the remedy sought by replevin actions).

Section 34.04 - Claims for Excess Proceeds (a) A person, including a taxing unit and the Title IV-D agency, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

One way to attack a foreclosure is to argue that the foreclosing party does not have standing to foreclose. If the foreclosing party cannot produce the promissory note on which the loan is based, the court likely will dismiss the case.

A servicer that receives a complete loss mitigation application more than 37 days before a foreclosure sale must take two steps within 30 days: • First, the servicer must evaluate the borrower for all loss mitigation options available to the borrower from the owner or investor of the borrower's mortgage loan.

The process of starting a replevin action usually begins with filing a complaint. It also requires filing an affidavit in the county or district court where the property is. The affidavit: States that the plaintiff claims rightful ownership or entitlement to possession of the property.